The world of trading is a complex and challenging landscape. Traders are always on the lookout for strategies that can give them an edge, and one such strategy that has gained popularity in the Forex market is the 1 Minute Scalping Strategy. This strategy has a high win rate of 75% and a Profit and Loss (PnL) ratio of 453%, making it a potentially lucrative option for traders. However, the question remains: how does this strategy perform when applied to Bitcoin trading? This article aims to answer that question by backtesting the 1 Minute Scalping Strategy on Bitcoin trades and providing a detailed analysis of the results.

The 1 Minute Scalping Strategy

The 1 Minute Scalping Strategy is a trading methodology that has gained significant popularity among Forex traders due to its high win rate and impressive Profit and Loss (PnL) ratio. This strategy is designed to capitalize on small price changes in the market, making it an ideal choice for traders who prefer quick trades and frequent entry and exit points.

The core of this strategy lies in its utilization of a 1-minute timeframe. This short timeframe allows traders to make numerous trades within a single trading session, thereby increasing the potential for profit. However, it’s worth noting that this approach requires a high level of concentration and quick decision-making skills, as market conditions can change rapidly within this short timeframe.

The 1 Minute Scalping Strategy employs three specific indicators to guide its trading decisions. These are:

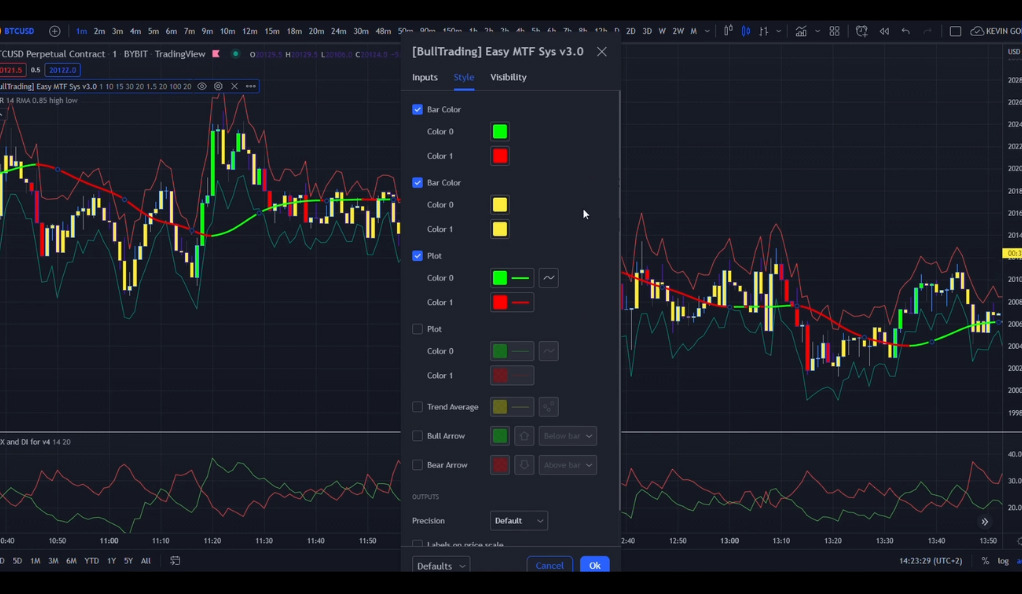

[BullTrading] 1 minute Easy Scalping Sys v3.0 from GustavoRubi

This indicator is designed to identify potential entry and exit points for trades. It uses a combination of moving averages and price action to determine the optimal points for entering and exiting trades. This indicator is particularly useful in a scalping strategy as it helps traders identify short-term trends and capitalize on small price movements.

ATR Stop Loss Finder from veryfid

The Average True Range (ATR) Stop Loss Finder is a crucial tool for managing risk in the 1 Minute Scalping Strategy. It helps traders set a stop loss level that is proportional to the market’s volatility. By setting a stop loss level based on the ATR, traders can ensure that they are not prematurely stopped out of their trades due to normal market volatility.

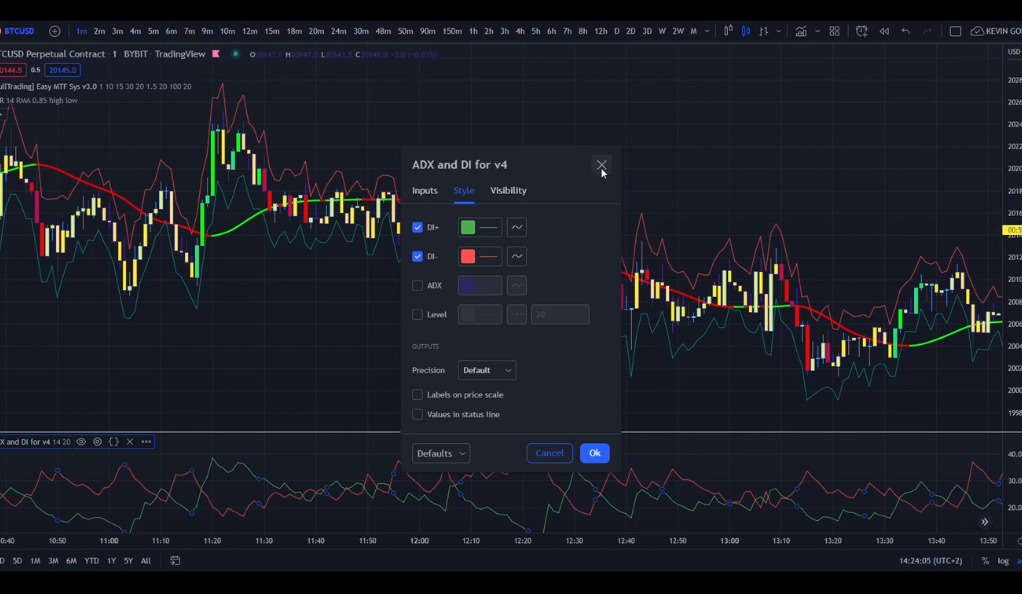

ADX and DI from BeikabuOyaji

The Average Directional Index (ADX) and Directional Indicator (DI) are used to assess the strength of the prevailing market trend. The ADX measures the strength of a trend, while the DI indicates the direction of the trend. When used together, these indicators can provide valuable insights into whether the market is trending or ranging, thereby helping traders make informed trading decisions.

Setting Up the Indicators

Setting up and customizing these indicators is a crucial step in implementing the 1 Minute Scalping Strategy. The BullTrading indicator’s Trend Length Period, for instance, is adjusted to 88 for optimal performance. This setting helps the indicator better capture the market’s short-term fluctuations, which are critical for a scalping strategy. The ATR Stop Loss Finder’s multiplier is set to 0.85, which helps set a stop loss level that is not too close to the entry point to avoid premature exits, and not too far to limit potential losses. The ADX and DI indicator’s settings are also customized to better capture the market’s trend strength. These adjustments help fine-tune the indicators to the specific requirements of the 1 Minute Scalping Strategy, thereby increasing its effectiveness.

Entering Long and Short Positions

The 1 Minute Scalping Strategy provides clear and concise rules for entering both long and short positions. These rules are designed to help traders identify potential trading opportunities and make informed trading decisions. Here’s a detailed look at how to enter long and short positions using this strategy.

Entering Long Positions

A long position is a scenario where a trader buys a financial instrument with the expectation that its price will rise. In the context of the 1 Minute Scalping Strategy, there are several conditions that must be met before entering a long position:

- Green Line Below the Candles: The first condition for entering a long position is the presence of a green line below the candles on the chart. This green line is generated by the BullTrading indicator and signifies a potential upward trend in the market.

- Green Candle Above the Green Line: The second condition is the presence of a green candle whose entire body is above the green line. This suggests that the market’s upward momentum is strong, making it a good time to enter a long position.

- Fresh Cross of the ADX and DI Lines: The third condition is a fresh cross of the ADX and DI lines, with the green line (DI+) above the red line (DI-). This indicates that the upward trend is gaining strength, further reinforcing the decision to enter a long position.

- Wait for the Green Candle to Close: The final condition is to wait for the green candle to close. Your entry point is the closing price of the green candle. This ensures that you enter the trade based on confirmed market conditions rather than transient price movements.

Entering Short Positions

A short position is a scenario where a trader sells a financial instrument with the expectation that its price will fall. Similar to long positions, there are several conditions that must be met before entering a short position:

- Red Line Above the Candles: The first condition for entering a short position is the presence of a red line above the candles on the chart. This red line, generated by the BullTrading indicator, signifies a potential downward trend in the market.

- Red Candle Below the Red Line: The second condition is the presence of a red candle whose entire body is below the red line. This suggests that the market’s downward momentum is strong, making it a good time to enter a short position.

- Fresh Cross of the ADX and DI Lines: The third condition is a fresh cross of the ADX and DI lines, with the red line (DI-) above the green line (DI+). This indicates that the downward trend is gaining strength, further reinforcing the decision to enter a short position.

- Wait for the Red Candle to Close: The final condition is to wait for the red candle to close. Your entry point is the closing price of the red candle. This ensures that you enter the trade based on confirmed market conditions rather than transient price movements.

Backtesting the Strategy

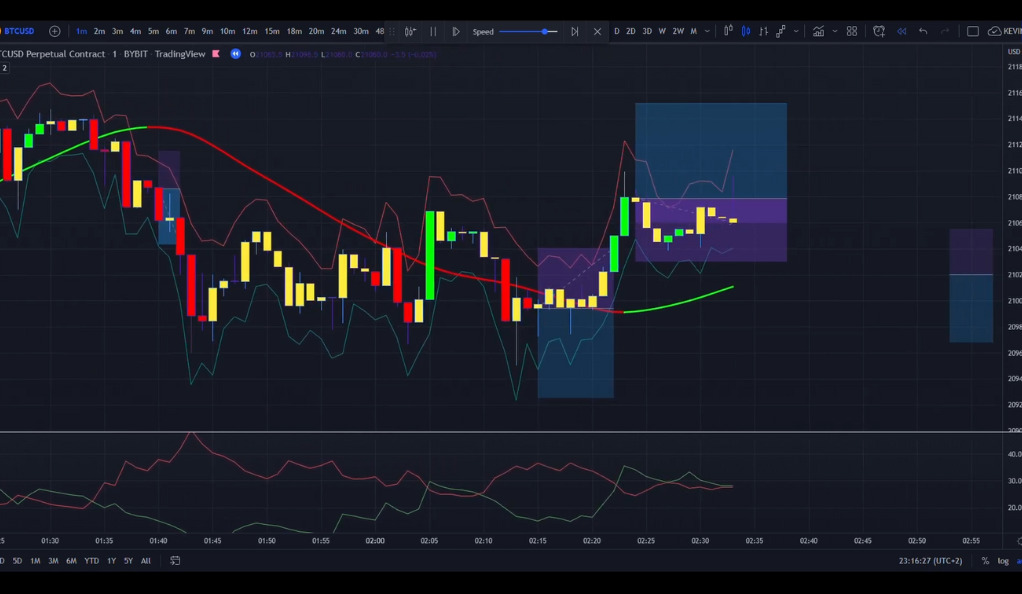

Backtesting is a critical component of any trading strategy. It involves applying the strategy to historical data to evaluate its performance and identify potential issues. For the 1 Minute Scalping Strategy, backtesting provides valuable insights into how the strategy performs under different market conditions and helps fine-tune its parameters for optimal performance. Here’s a detailed look at how to backtest this strategy.

The 1 Minute Scalping Strategy was backtested 100 times on Bitcoin trades over a period of three days, from June 26 to June 28, 2022. This short timeframe was chosen to reflect the high-frequency nature of the strategy, which involves making numerous trades within a single trading session.

The trades were categorized into four groups: long wins, long losses, short wins, and short losses. This categorization helps analyze the strategy’s performance in different market conditions and identify areas for improvement. For example, if the strategy has a high number of long losses, it may indicate that the strategy’s parameters for entering long positions need to be adjusted.

The backtesting process also involves analyzing the strategy’s risk-to-reward ratio. This ratio is a measure of the potential profit of a trade compared to its potential loss. For the 1 Minute Scalping Strategy, the risk-to-reward ratio is 1 to 1.5, meaning that for every dollar risked, the potential profit is $1.5. This ratio is a crucial factor in determining the strategy’s profitability over the long term.

In addition to evaluating the strategy’s performance, backtesting also provides an opportunity to test the effectiveness of the strategy’s risk management measures. This includes the use of the ATR Stop Loss Finder to set stop loss levels and the ADX and DI indicator to determine the strength of the prevailing trend.

Reality Check: The Results

Assuming a $100 investment per trade with a leverage of 25x, the results were surprising. Despite a win rate of 59%, the strategy resulted in a loss of -0.0037308205 Bitcoin, or -149 USD with an average Bitcoin price of 40K, after 100 trades. This reality check underscores the importance of thorough backtesting before implementing any trading strategy. It also highlights the fact that a strategy that works well in one market (Forex, in this case) may not necessarily perform as well in another market (Bitcoin, in this case). Therefore, traders should always be cautious when applying a strategy to a different market and should conduct thorough backtesting before doing so.

Conclusion

The 1 Minute Scalping Strategy, while highly effective in Forex trading, did not yield the same results when backtested on Bitcoin. This highlights the importance of adapting and testing strategies across different markets. Trading, after all, is not a one-size-fits-all endeavor. It requires continuous learning, testing, and adapting to succeed in the ever-changing market landscape. Remember, the key to successful trading lies not just in finding a high win-rate strategy, but in understanding its nuances, adapting it to your trading style, and applying it judiciously.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)