In the dynamic world of cryptocurrency trading, the use of automated trading algorithms has become a game-changer. These algorithms, powered by advanced technologies like GPT, are revolutionizing the way we trade, offering high returns and a level of customization that was previously unimaginable. The traditional methods of trading, which required constant monitoring and quick decision-making, are being replaced by these smart, automated systems. They not only save time and reduce the stress associated with trading but also bring in a level of precision and efficiency that human traders often find challenging to achieve. This article will delve into the intricacies of one such algorithm, designed specifically for Bitcoin trading, and explore its unique features and benefits. We will discuss how it works, its exclusive access, the indicators it uses, its risk management strategies, and the impressive results it has shown in backtesting.

The Magic of GPT-Coded Trading Algorithms

The algorithm in focus has been coded using GPT, a powerful language model developed by OpenAI. This automated trading strategy is not just a tool but a full-fledged trading companion. It’s designed to generate high returns on Bitcoin, but its versatility doesn’t stop there. It’s highly customizable, capable of working on all time frames, and adaptable to multiple assets, including cryptocurrencies, stocks, and Forex. The use of GPT in coding this algorithm brings in a level of sophistication and intelligence that sets it apart. GPT, with its ability to understand and generate human-like text, allows the algorithm to analyze market trends and make trading decisions that are not just based on numbers but also on the context and subtleties of market behavior.

In the second paragraph, we delve deeper into the magic of GPT-coded trading algorithms. The beauty of these algorithms lies in their ability to learn and adapt. As the algorithm interacts with the market data, it learns from it, improving its trading decisions over time. This learning capability, combined with the algorithm’s ability to analyze and understand market trends in a human-like way, makes it highly effective and reliable. Furthermore, the algorithm’s high level of customization allows it to be tailored to the specific needs and trading style of the user. Whether you are a day trader looking for quick profits or a long-term investor seeking steady growth, this GPT-coded trading algorithm can be customized to meet your needs, making it a truly magical tool for any trader.

The Indicators: Key to Customization

The power of this trading algorithm lies in its indicators. It uses three technical indicators and the Average True Range (ATR) to determine where to place a stop loss and take profit targets. These indicators are not just random choices; they have been carefully selected and fine-tuned to work together and provide accurate trading signals. The first of these is the Exponential Moving Average (EMA), set to a length of 100. This indicator helps identify the broader market trend while still being responsive to recent changes. If the price action is located above, the algorithm looks for a long entry, and if it’s below the EMA, a short entry is sought.

In the second paragraph, we delve into the other two indicators, the QQE Mod and the Water Adder Explosion V2. The QQE Mod serves as the entry confirmation. A blue histogram higher than the MA line signals a long entry confirmation, while the opposite scenario confirms a short entry. This indicator provides a comprehensive view of the market, taking into account both price and volume data, making it a reliable confirmation tool. The Water Adder Explosion V2 provides a second entry confirmation. It helps the algorithm identify explosive moves in the market, which often lead to profitable trading opportunities. A green histogram, higher than the MA line and the explosion line, confirms a long entry, while a red histogram signals a short entry confirmation. These indicators, working in harmony, allow the algorithm to generate accurate and profitable trading signals, making customization the key to its success.

Exponential Moving Average (EMA)

The EMA is set to a length of 100. If the price action is located above, the algorithm looks for a long entry. Conversely, if it’s below the EMA, a short entry is sought. The EMA is a popular technical indicator used by traders worldwide. It gives more weight to recent data and is therefore more responsive to new price changes. By setting the length to 100, the algorithm ensures that it captures the broader market trend while still being responsive to recent changes. This balance makes the EMA a reliable indicator for both long-term and short-term trading strategies.

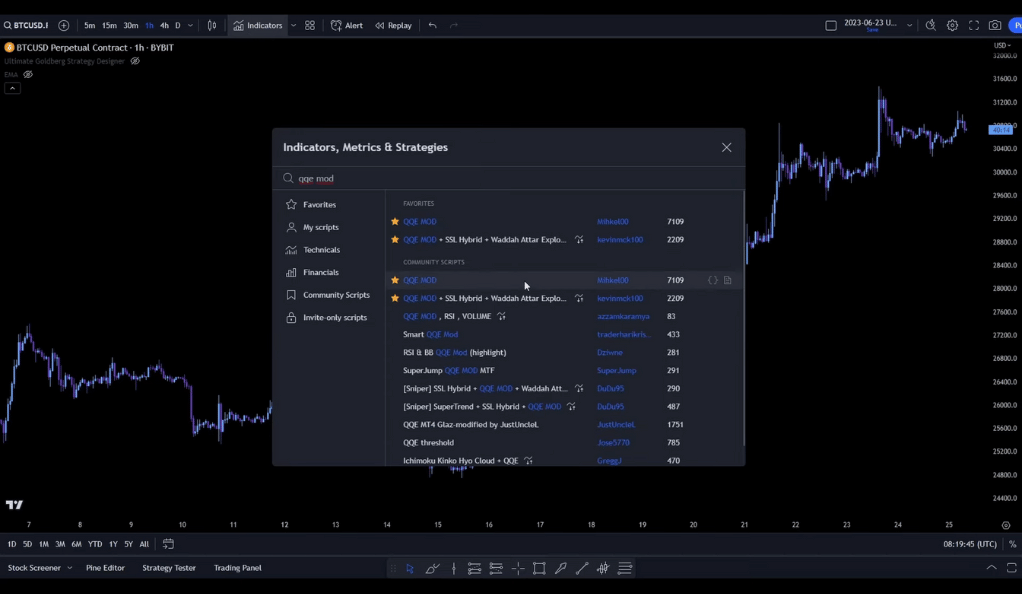

QQE Mod

The QQE Mod serves as the entry confirmation. A blue histogram higher than the MA line signals a long entry confirmation. The opposite scenario confirms a short entry. The QQE Mod is a complex indicator that combines several technical analysis tools. It provides a comprehensive view of the market, taking into account both price and volume data. This comprehensive analysis makes the QQE Mod a reliable confirmation tool, ensuring that the trading signals generated by the algorithm are based on a thorough understanding of the market.

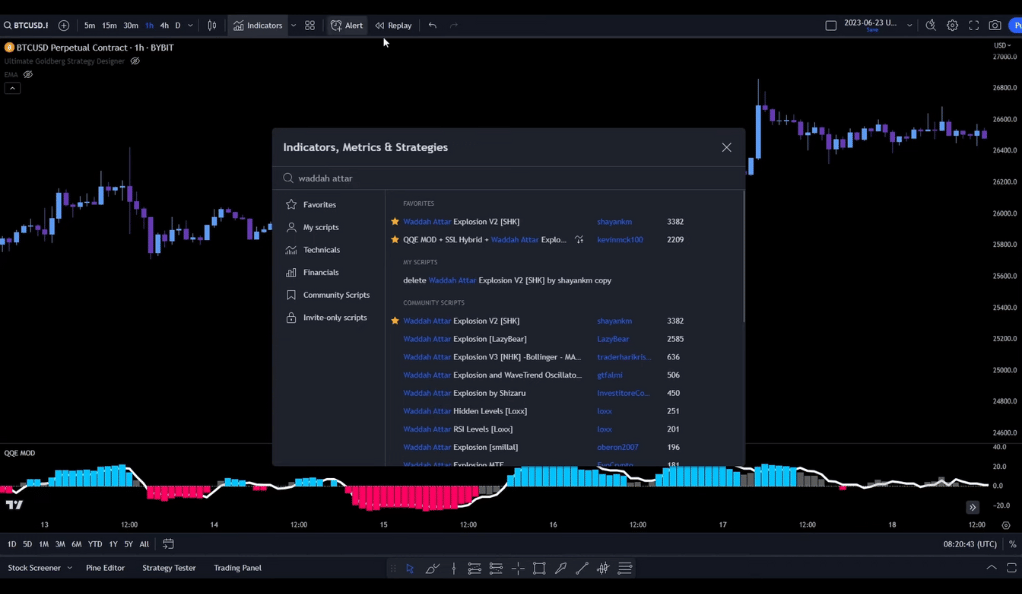

Water Adder Explosion V2

This indicator provides a second entry confirmation. A green histogram, higher than the MA line and the explosion line, confirms a long entry. A red histogram signals a short entry confirmation. The Water Adder Explosion V2 is a volatility-based indicator. It helps the algorithm identify explosive moves in the market, which often lead to profitable trading opportunities. By using this indicator, the algorithm ensures that it doesn’t just follow the market trend but also capitalizes on high-volatility moves, which are often where the big profits lie.

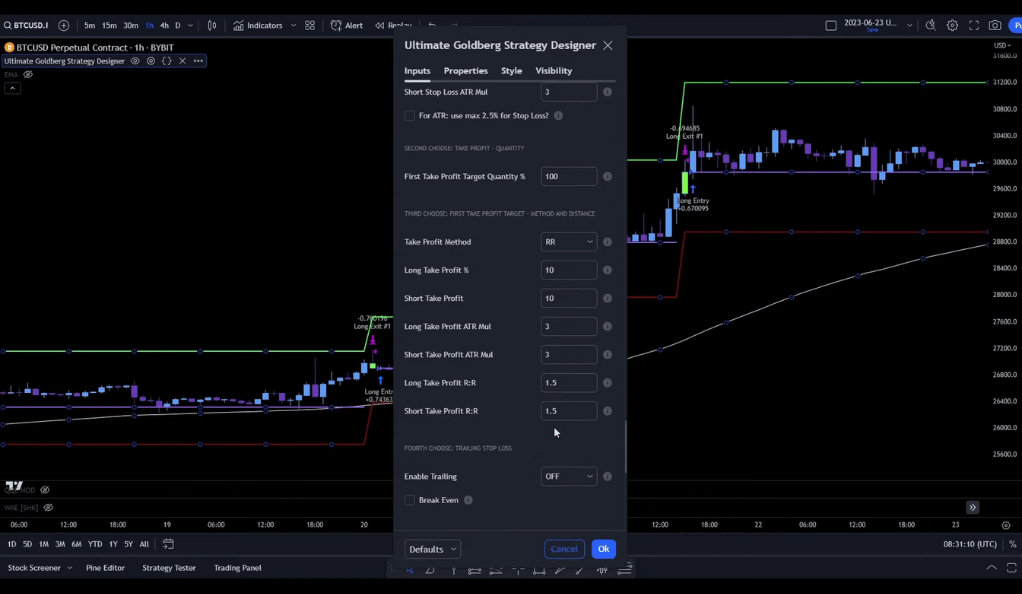

Risk Management: The Balancing Act

The algorithm also incorporates robust risk management settings. It uses an ATR stop loss multiplier of three and a 1 to 1.5 risk-reward ratio. These settings ensure that while the algorithm seeks high returns, it doesn’t do so recklessly, maintaining a balance between risk and reward. Risk management is a crucial aspect of any trading strategy. No matter how accurate the trading signals are, there will always be losing trades. The key to long-term success in trading is to manage these losses so that they don’t wipe out the profits from the winning trades. The use of an ATR stop loss multiplier of three ensures that the stop loss is set at a level that gives the trade enough room to move while still protecting the trader from large losses. The 1 to 1.5 risk-reward ratio ensures that the potential profit on each trade is higher than the potential loss, which is key to maintaining profitability in the long run.

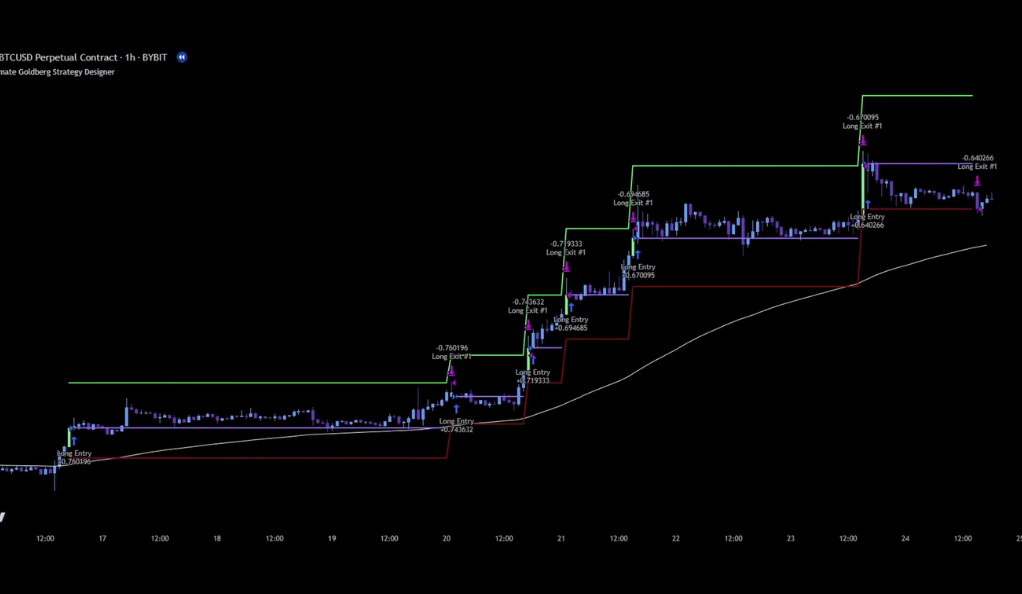

Backtesting: The Proof of the Pudding

The algorithm has been backtested extensively, and the results are impressive. Backtesting is an essential step in the development of any trading algorithm. It involves running the algorithm on historical data to see how it would have performed in the past. While past performance is not a guarantee of future results, a successful backtest does provide confidence in the algorithm’s effectiveness. The backtesting shows a win rate of 43 percent with a leverage of 20x. It has demonstrated the potential to grow an account size from 1,000 to 46,466 US dollars with a max drawdown of less than 23 percent.

In the second paragraph, we delve deeper into the significance of these backtesting results. A win rate of 43 percent, combined with a 20x leverage, has resulted in significant account growth with a reasonable drawdown. These results are a testament to the algorithm’s robustness and profitability. They show that the algorithm can consistently generate profitable trades while keeping losses to a minimum. Furthermore, the ability to grow an account size from 1,000 to 46,466 US dollars demonstrates the algorithm’s potential for high returns. These impressive backtesting results provide solid proof of the algorithm’s effectiveness, making it a reliable tool for any trader looking to maximize their profits in the cryptocurrency market.

Conclusion

In conclusion, this GPT-coded trading algorithm is a powerful tool for traders. Its high returns, customization capabilities, and robust risk management make it a valuable asset in any trader’s arsenal. However, it’s not just about the algorithm; it’s about how you use it. The best trading tools can lead to losses if not used correctly. Therefore, it’s crucial to understand the algorithm, its indicators, and its risk management strategies thoroughly before using it. So, are you ready to harness the power of automated trading algorithms and take your trading game to the next level? The world of automated trading is here, and it’s time to embrace it.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)