Bitcoin, the world’s pioneering and widely adopted cryptocurrency, has attracted numerous traders seeking rapid profit opportunities. However, maximizing returns and minimizing risks in Bitcoin trading necessitates the implementation of a well-designed and extensively backtested day trading strategy. This article aims to explore a specific 15-minute Bitcoin day trading approach that leverages three robust indicators to inform and guide trading decisions.

An effective 15-minute Bitcoin day trading strategy involves carefully selecting indicators like MACD, RSI, and Bollinger Bands to gain insights into market trends and price movements. The MACD identifies potential trend reversals, RSI indicates overbought/oversold conditions, and Bollinger Bands highlight price volatility. Traders monitor these indicators on 15-minute Bitcoin price charts. For instance, if MACD shows a bullish crossover and RSI suggests the market is not overbought, it may be a good time to consider buying Bitcoin. Conversely, a bearish MACD crossover and an overbought RSI could signal selling or shorting. However, trading cryptocurrencies, including Bitcoin, carries inherent risks due to market volatility, liquidity, and regulatory changes. Thorough research, updated knowledge, and risk assessment are essential before engaging in day trading or any cryptocurrency trading.

The Importance of Backtesting

Before we delve into the details of the strategy, it is essential to highlight the significance of backtesting. Backtesting plays a crucial role in assessing the performance and reliability of a trading strategy. It entails simulating trades using historical market data, providing traders with valuable insights into the potential outcomes of implementing the strategy in live trading. By conducting backtesting, traders can identify strengths and weaknesses, make necessary adjustments, and refine their strategy before risking their actual capital.

The process of backtesting allows traders to evaluate how a strategy would have performed in different market conditions and periods of time. It helps uncover potential flaws, such as high-risk areas or poor performance during certain market trends. Through this evaluation, traders gain a better understanding of the strategy’s effectiveness, enabling them to optimize and fine-tune their approach. Ultimately, backtesting acts as a vital tool for traders to gain confidence in their strategy and make informed decisions when it comes to real-time trading.

The Three Pillars of Our Strategy: Indicators

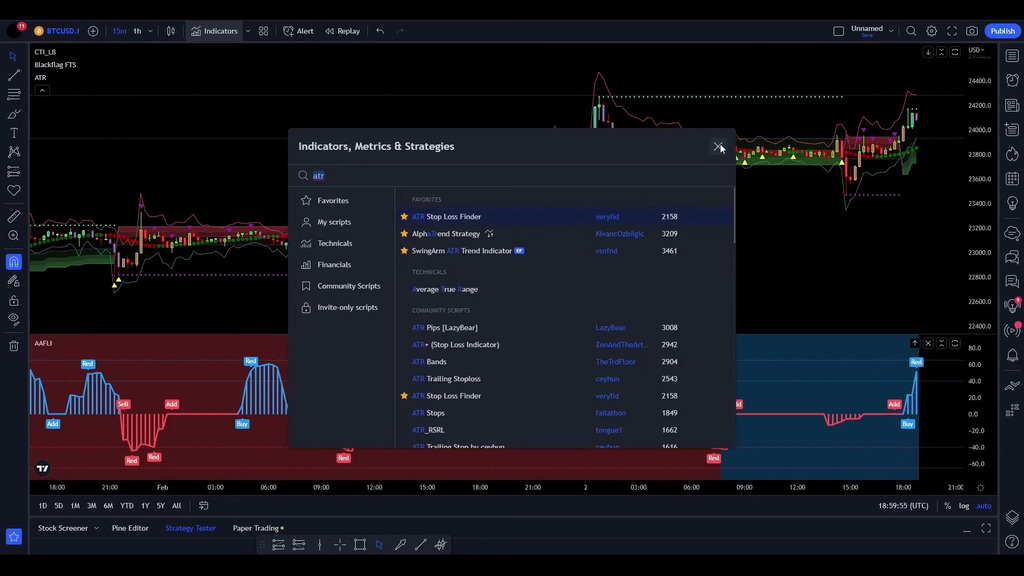

Our Bitcoin day trading strategy is anchored on three essential indicators: the Coral Trend indicator, the Swing Arm ATR, and the Angle Attack indicator. These indicators serve as the pillars of our strategy, providing valuable insights into market trends and generating signals for optimal entry and exit points.

By incorporating these three indicators into our strategy, traders can gain a comprehensive understanding of the market dynamics, identify favorable trading opportunities, and make informed decisions based on the signals generated. However, it is important to note that no strategy guarantees success in trading, and thorough analysis, risk management, and continuous monitoring are essential for effective implementation.

Coral Trend Indicator

The Coral Trend indicator serves as a valuable tool for identifying entry signals in our Bitcoin day trading strategy. This indicator utilizes a color-coded system to indicate potential trading opportunities. When the candle color is blue, it suggests that traders should consider looking for long entries, indicating a favorable time to enter a buy position. Conversely, when the candle color is violet, it suggests that traders should focus on short entries, signaling a potential opportunity to enter a sell or short position. This color-coded system simplifies the process of spotting potential trades, allowing traders to quickly identify favorable entry points.

Angle Attack Indicator

The Angle Attack indicator serves as a valuable confirmation tool for the entry signals generated by the Coral Trend indicator in our Bitcoin day trading strategy. This indicator provides additional validation by employing a dual-check system. When the Angle Attack indicator displays a blue color, it confirms the entry of a long position, further supporting the indication provided by the Coral Trend indicator. On the other hand, when the Angle Attack indicator shows a red color, it confirms the entry of a short position, reinforcing the signal provided by the Coral Trend indicator. This dual-check system helps traders ensure that they are making trading decisions based on strong and aligned signals, enhancing the overall reliability of the strategy.

Swing Arm ATR Trend Indicator

The Swing Arm ATR Trend indicator plays a vital role in our Bitcoin day trading strategy by helping traders identify the overall market trend. This indicator utilizes color-coded bands to provide insights into the prevailing market sentiment. When the band is green, it suggests that traders should consider looking for long positions, indicating a favorable environment for entering buy positions. Conversely, when the band is red, it suggests that traders should focus on short positions, signaling an opportune time to enter sell or short positions. By aligning their trades with the broader market trend identified by the Swing Arm ATR Trend indicator, traders can increase their chances of success and capitalize on the overall market direction.

The Art of Setting Stop Loss and Targeting Risk-Reward Ratio

In our Bitcoin day trading strategy, the art of setting stop loss and targeting a risk-reward ratio is crucial for effective risk management. Once an entry point is identified using the indicators, we set the stop loss at the recent swing low or high, depending on whether it is a long or short position. By placing the stop loss at these levels, we aim to limit potential losses if the market moves against our trade. This approach helps protect our capital and prevents excessive losses in case the trade does not go as expected.

Alongside the stop loss, we also target a risk-reward ratio ranging from 1 to 1.5. This means that for every unit of risk (potential loss) we are willing to take, we aim to achieve a reward (potential profit) that is one to one-and-a-half times the risk. By targeting a favorable risk-reward ratio, we aim to ensure that the potential profits outweigh the potential losses. This helps to increase the overall profitability of our trades and improve the likelihood of achieving positive returns over time.

It is important to note that setting stop loss and targeting a risk-reward ratio are subjective decisions that may vary based on individual trading preferences and risk tolerance. Traders should carefully consider their own risk management strategy, taking into account factors such as market conditions, volatility, and the specific characteristics of each trade. Continuous monitoring and adjustment of stop loss and risk-reward ratios as the trade progresses can also be essential for adapting to changing market dynamics and optimizing trade outcomes.

Backtesting Results: Proof of the Pudding

The backtesting results of this strategy provide compelling evidence of its potential effectiveness. With a win rate of nearly 61 percent, it indicates that the strategy generated profitable trades more often than not. The profit achieved during the backtesting period amounted to an impressive 120 percent, showcasing the strategy’s ability to capitalize on market opportunities and generate substantial returns.

To put these results into perspective, starting with an initial account balance of $1,000, the strategy’s performance led to a significant account growth. After executing 100 trades, the account balance reached $2,192, indicating a substantial increase of 119.2 percent. These results underscore the potential profitability of the strategy when implemented correctly and highlight its ability to generate positive returns over time.

However, it is important to remember that backtesting results are based on historical data and do not guarantee future performance. Market conditions can change, and the strategy’s efficacy may vary in live trading. Traders should exercise caution, continually monitor market conditions, and adapt their approach as necessary. Additionally, risk management practices, such as proper position sizing and the use of stop-loss orders, are essential to mitigate potential losses and protect capital.

The ATR Stop Loss Finder: An Additional Tool

The ATR Stop Loss Finder is a valuable tool that can enhance the risk management aspect of our Bitcoin day trading strategy. This tool utilizes the Average True Range (ATR) indicator to calculate the potential volatility of the market. By considering the ATR value, traders can determine an appropriate stop loss level that accounts for the expected price fluctuations.

Implementing the ATR Stop Loss Finder allows traders to set stop loss levels that are dynamically adjusted based on the market conditions. This tool takes into account the current market volatility, ensuring that the stop loss is placed at a suitable distance from the entry point to accommodate potential price swings. By utilizing the ATR Stop Loss Finder, traders can enhance their risk management practices and optimize their stop loss settings to align with the specific characteristics of each trade. This additional layer of risk management helps to protect capital and minimize potential losses in volatile market conditions.

Conclusion

In conclusion, Bitcoin day trading can be a lucrative venture if approached with a well-planned strategy. The 15-minute Bitcoin day trading strategy discussed in this article, with its use of the Coral Trend, Angle Attack, and Swing Arm ATR Trend indicators, provides a robust framework for making informed trading decisions. Remember, the key to successful trading lies in diligent backtesting, effective risk management, and continuous learning. Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)