Welcome to the evolving world of finance where Decentralized Finance, commonly known as DeFi, stands at the cutting edge of innovation. The emergence of blockchain technology has given birth to DeFi, fundamentally challenging and reshaping the traditional financial frameworks by offering greater autonomy and flexibility. Now, we enter a new chapter: DeFi 2.0.

DeFi 2.0 isn’t merely an upgrade; it’s a groundbreaking redevelopment that seeks to address the shortcomings of its predecessor, DeFi 1.0. This advanced version focuses on enhancing user experiences, bolstering security measures, and resolving crucial issues like liquidity – the ease with which assets can be transformed into cash.

This latest wave of DeFi protocols is designed to make financial services more accessible and efficient for everyone. Building on the lessons learned from the initial DeFi applications, DeFi 2.0 integrates innovative ideas and cutting-edge technologies. The result is a more robust, user-friendly financial ecosystem that stands ready to meet modern financial demands.

Our guide will explore the essence of DeFi 2.0, its distinctions from the earlier DeFi version, and its significance in the current financial era. It’s tailored for both beginners and those already versed in blockchain and DeFi basics, aiming to clarify the advancements and potential of this significant financial evolution. Let’s explore what DeFi 2.0 brings to the future of finance and uncover its transformative potential.

Early Developments in DeFi

The journey of Decentralized Finance (DeFi) began with a simple yet powerful idea: to democratize the financial sector. The early developments in DeFi laid the groundwork for a system where financial transactions could be executed without the need for traditional banking institutions. This was a big step towards giving people more control over their financial dealings.

Pioneers of DeFi

Several key players emerged in the early days of DeFi, each contributing to the foundational aspects of this new financial landscape. The pioneers of DeFi include:

- Uniswap: Revolutionized the way users exchange cryptocurrencies by introducing an automated liquidity protocol.

- Aave: Brought forth the concept of decentralized lending, allowing users to earn interest on deposits and borrow assets.

- Compound: Similar to Aave, Compound focused on the lending and borrowing of assets, but with a slightly different approach in its protocol.

- MakerDAO: Introduced a decentralized stablecoin, DAI, which provided stability in the otherwise volatile cryptocurrency market.

Impact of Early DeFi Developments

The early stages of DeFi were marked by significant milestones:

- Decentralized Exchanges (DEXs): They allowed users to swap tokens directly with each other, bypassing traditional centralized exchanges.

- Lending and Borrowing Platforms: These platforms enabled users to lend their crypto assets or take loans, creating a whole new avenue for earning interest and accessing funds without banks.

- Stablecoins: By offering price-stable assets like DAI, DeFi made it easier for people to engage in transactions without worrying about the volatility of cryptocurrencies.

These initial developments paved the way for a more inclusive financial ecosystem, where anyone with an internet connection could access financial services without the need for a traditional bank account. However, these early stages also revealed some challenges, such as scalability issues and high transaction costs, which the next wave of DeFi, DeFi 2.0, aims to address.

The Emergence of DeFi 2.0

With the foundation set by its early developments, DeFi was poised for a significant evolution. This led to the emergence of DeFi 2.0, a new phase in decentralized finance that builds on the successes and learns from the challenges of its predecessor. DeFi 2.0 is characterized by its innovative solutions that aim to streamline processes, reduce costs, and enhance the overall user experience.

Advancements in DeFi 2.0

DeFi 2.0 has brought about a host of advancements and improvements:

- Enhanced Liquidity Solutions: One of the critical enhancements in DeFi 2.0 is the focus on solving liquidity issues. New protocols have been developed to ensure more stable and consistent liquidity in the market.

- Improved User Experience: DeFi 2.0 emphasizes user-friendliness with more intuitive interfaces and simpler transaction processes, making DeFi accessible to a broader audience.

- Greater Security Measures: With advancements in technology, DeFi 2.0 offers improved security features to protect users’ investments and personal information.

Key Features of DeFi 2.0

The features that set DeFi 2.0 apart include:

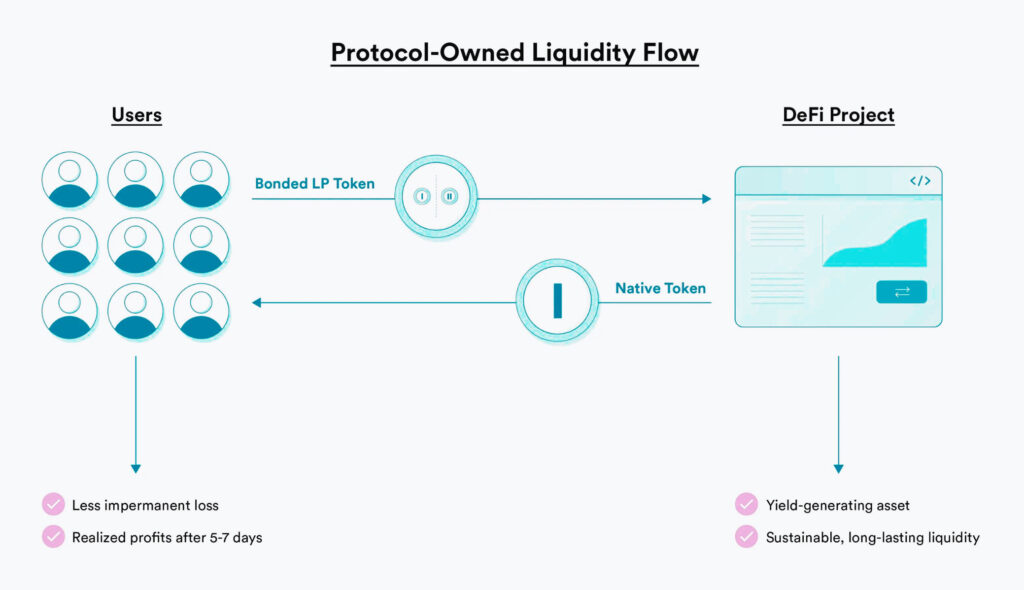

- Protocol-Owned Liquidity: Unlike DeFi 1.0, where liquidity was often provided by users, DeFi 2.0 protocols tend to control their own liquidity, reducing reliance on external liquidity providers.

- Scalability: DeFi 2.0 protocols are designed to handle a higher number of transactions more efficiently, addressing the scalability issues faced by the earlier generation.

- Interoperability: There is a greater emphasis on making DeFi 2.0 protocols interoperable with various blockchains, enhancing the overall functionality and reach.

These developments signify a maturing DeFi landscape, one that is ready to address the needs of a global audience and set the stage for further innovations in the world of decentralized finance.

Addressing Liquidity Challenges

One of the most significant advancements in DeFi 2.0 has been its focus on addressing liquidity challenges. Liquidity, the ease with which assets can be converted into cash, is crucial for the smooth functioning of any financial system. In DeFi 2.0, innovative solutions have been introduced to tackle the liquidity issues that were prevalent in earlier DeFi models.

Solutions to Liquidity Issues in DeFi 2.0

Several strategies and mechanisms have been developed in DeFi 2.0 to enhance liquidity:

- Protocol-Owned Liquidity (POL): DeFi 2.0 introduces the concept of protocols owning their liquidity. This approach reduces the dependency on external providers, leading to more stable and consistent liquidity pools.

- Liquidity Mining and Yield Farming: These practices have been refined in DeFi 2.0. Users are incentivized to provide liquidity through rewards, thus increasing the overall liquidity available in the system.

- Advanced Automated Market Makers (AMMs): Improved AMMs in DeFi 2.0 offer better pricing models and lower slippage, making it easier for users to trade and provide liquidity.

Impact of Improved Liquidity in DeFi 2.0

The focus on liquidity in DeFi 2.0 has several positive impacts:

- Increased Market Stability: With more consistent liquidity, the DeFi market becomes more stable, attracting more users and investments.

- Enhanced User Confidence: As liquidity concerns are addressed, users gain more confidence in using DeFi platforms for their financial transactions.

- Greater Innovation Potential: With the foundational issue of liquidity being tackled, developers can now focus on innovating and adding new features to DeFi platforms.

By addressing the liquidity challenges effectively, DeFi 2.0 marks a significant step forward in making decentralized finance more robust, reliable, and user-friendly.

The Role of Yield Farming

Yield farming, a standout feature in the DeFi world, has played a pivotal role in the evolution of decentralized finance, particularly in DeFi 2.0. It refers to the practice of staking or lending crypto assets in order to generate high returns or rewards in the form of additional cryptocurrency. This innovative approach has significantly contributed to the growth and popularity of DeFi platforms.

How Yield Farming Works in DeFi 2.0

Yield farming in DeFi 2.0 operates on enhanced mechanisms:

- Incentivizing Liquidity Providers: Users are rewarded for contributing to liquidity pools. These rewards are often in the form of the platform’s native tokens.

- Utilizing Various DeFi Protocols: Yield farmers often move their assets around different DeFi protocols to maximize their returns.

- Compound Interest Mechanism: Many DeFi platforms allow farmers to reinvest their earnings, compounding their rewards.

Benefits and Risks of Yield Farming

Yield farming comes with its set of benefits and risks:

- Benefits:

- High Return Potential: Yield farming can offer higher returns compared to traditional banking products.

- Contribution to DeFi Growth: It encourages users to participate actively in the DeFi ecosystem, enhancing overall liquidity and stability.

- Diverse Opportunities: Offers a variety of strategies across different platforms, appealing to a wide range of investors.

- Risks:

- Market Volatility: The value of rewards can fluctuate significantly due to the volatile nature of cryptocurrencies.

- Smart Contract Risks: As yield farming depends on smart contracts, any bugs or vulnerabilities can lead to loss of funds.

- Impermanent Loss: If the price of tokens in a liquidity pool changes after depositing them, it can lead to potential losses when compared to holding the tokens outside the pool.

Yield farming remains a crucial and dynamic component of DeFi 2.0, offering opportunities for users to maximize their earnings while contributing to the vitality of the DeFi ecosystem. However, it is essential for participants to understand the associated risks and conduct thorough research before diving into yield farming strategies.

Innovations in DeFi 2.0

DeFi 2.0 has been marked by a wave of innovations, introducing new technologies and approaches that aim to solve the challenges faced in the initial phase of DeFi. These innovations not only enhance the functionality of DeFi platforms but also significantly improve user experience and security.

Key Technological Advancements in DeFi 2.0

The advancements in DeFi 2.0 are diverse and impactful:

- Cross-Chain Interoperability: One of the most notable innovations in DeFi 2.0 is the ability to operate across different blockchain networks, enhancing the scope and reach of DeFi applications.

- Enhanced Smart Contract Capabilities: The new wave of DeFi has seen smarter and more secure smart contract implementations, reducing the risks of bugs and vulnerabilities.

- Improved Governance Models: DeFi 2.0 introduces more sophisticated governance models, allowing for better community involvement in decision-making processes.

- Scalability Solutions: With innovations like layer-2 scaling solutions, DeFi 2.0 platforms can handle a larger volume of transactions, addressing one of the major limitations of the previous generation.

Impact of DeFi 2.0 Innovations

The innovations in DeFi 2.0 have far-reaching implications:

- Broader Market Access: By enabling cross-chain interoperability, DeFi 2.0 opens up opportunities for a broader audience to participate in the DeFi ecosystem.

- Enhanced User Trust: Improved security measures and smart contract capabilities build more trust among users, essential for the adoption of DeFi.

- Sustainable Growth: With better governance and scalability solutions, DeFi 2.0 is poised for sustainable and long-term growth.

These technological advancements signify a maturing ecosystem that is more aligned with the needs of a global and diverse user base. DeFi 2.0 not only addresses the initial challenges faced by the DeFi sector but also lays the foundation for continuous innovation and expansion in the field of decentralized finance.

Enhancing Security and User Experience

In DeFi 2.0, a significant emphasis has been placed on enhancing both security and user experience. Recognizing the challenges faced by early adopters of DeFi, developers have focused on creating a more secure and user-friendly environment. This is essential for wider adoption and long-term success in the decentralized finance space.

Strengthening Security in DeFi 2.0

DeFi 2.0 has made considerable strides in enhancing security:

- Robust Smart Contract Audits: DeFi 2.0 platforms are investing more in thorough smart contract audits to identify and rectify vulnerabilities before they are exploited.

- Advanced Encryption Techniques: The use of stronger and more sophisticated encryption methods helps safeguard user data and transactions against potential threats.

- Decentralized Security Protocols: By decentralizing security measures, DeFi 2.0 platforms distribute the responsibility of security, making it harder for attacks to succeed.

Improving User Experience in DeFi 2.0

Alongside security, user experience has also been a primary focus:

- Simplified User Interfaces: DeFi 2.0 platforms are designed with more intuitive and user-friendly interfaces, making them more accessible to those new to DeFi.

- Faster and Cheaper Transactions: Through various scalability solutions, DeFi 2.0 offers faster transaction speeds and lower fees, addressing two major pain points from DeFi 1.0.

- Educational Resources and Support: Increased availability of educational materials and responsive support systems helps users navigate and understand the DeFi ecosystem more effectively.

The advancements in security and user experience in DeFi 2.0 are crucial for building trust and encouraging broader participation. By addressing these fundamental aspects, DeFi 2.0 is poised to attract a more diverse range of users, from crypto enthusiasts to those new to digital finance.

DeFi 2.0 Projects and Their Impact

DeFi 2.0 has been marked by the emergence of various innovative projects, each contributing significantly to the evolution of decentralized finance. These projects have not only demonstrated the potential of DeFi 2.0 but have also had a tangible impact on the market, attracting a wider audience and establishing new standards in the industry.

Spotlight on Major DeFi 2.0 Projects

Some notable projects in the DeFi 2.0 space include:

- OlympusDAO: Known for its unique approach to protocol-owned liquidity, OlympusDAO has been a game-changer in how DeFi platforms manage and stabilize their own liquidity.

- Abracadabra.money: A platform that allows users to use interest-bearing tokens as collateral for loans, offering a new way to access liquidity.

- Convex Finance: Focused on enhancing the yield farming experience, Convex Finance allows users to earn more with their staked tokens without locking them up.

- Aave V2: An upgrade from its initial version, Aave V2 offers improved features like collateral swapping and better risk management protocols.

The Impact of These Projects

The influence of these DeFi 2.0 projects is multifaceted:

- Market Innovation: These projects have introduced new concepts and models, pushing the boundaries of what’s possible in DeFi.

- Increased User Participation: By addressing earlier limitations, these projects have made DeFi more accessible, attracting a broader range of participants.

- Setting Industry Standards: The success of these projects sets a high standard for future developments in the DeFi space, encouraging continuous innovation and improvement.

DeFi 2.0 projects have played a critical role in shaping the current landscape of decentralized finance. They not only address the shortcomings of earlier DeFi models but also open up new possibilities for users and developers alike. As these projects continue to evolve, they are expected to further solidify DeFi’s position as a formidable alternative to traditional financial systems.

The Future of DeFi 2.0

As we look ahead, the future of DeFi 2.0 appears bright and full of potential. With its rapid advancements and growing popularity, DeFi 2.0 is poised to continue its trajectory of innovation and expansion. The continuous evolution of technology and the increasing interest from both users and investors suggest a transformative impact on the financial world.

Predictions and Trends in DeFi 2.0

Looking forward, several key trends and predictions can be made about DeFi 2.0:

- Greater Integration with Traditional Finance: DeFi 2.0 is likely to see increased integration with traditional financial systems, leading to a more seamless interaction between decentralized and conventional finance.

- Focus on Regulatory Compliance: As DeFi grows, there will be a greater emphasis on compliance with global financial regulations, which will help in gaining mainstream acceptance.

- Advancements in Technology: Continued technological advancements are expected to solve current challenges in DeFi, such as scalability and interoperability among different blockchains.

- Wider Adoption and User Base: With improvements in user experience and security, DeFi 2.0 is set to attract a wider audience, including those who are new to cryptocurrency and blockchain technology.

The Long-Term Vision for DeFi 2.0

The long-term vision for DeFi 2.0 encompasses:

- Establishing a Decentralized Financial Ecosystem: The ultimate goal is to create a fully functional and autonomous decentralized financial ecosystem that operates efficiently and securely without central authority.

- Empowering Users Globally: DeFi 2.0 aims to empower users worldwide with more control over their financial transactions and opportunities to participate in diverse financial activities.

- Innovation in Financial Products and Services: We can expect to see a range of innovative financial products and services that were not possible in traditional finance, opening up new possibilities for investment, savings, lending, and more.

The future of DeFi 2.0 is not just about technological advancements; it’s about reshaping the financial landscape to be more inclusive, efficient, and user-centric. As DeFi 2.0 continues to grow and evolve, it holds the promise of redefining our understanding and interaction with finance.

Conclusion

As we reflect on the evolution of DeFi 2.0, it’s evident that this new phase in decentralized finance is more than a technological advancement; it’s a paradigm shift in financial interactions and systems. DeFi 2.0 has rapidly evolved from a niche concept to a mainstream phenomenon, underpinned by continuous innovation and a growing, engaged community. Looking ahead, DeFi 2.0 promises to expand its horizons further, embracing challenges such as regulatory compliance and market volatility. It’s not just about enhancing financial transactions; it’s about forging a more equitable, transparent, and accessible financial ecosystem for all. In essence, DeFi 2.0 is not just part of the financial revolution; it’s at the forefront, reshaping and redefining the global financial landscape for the better.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.