In the dynamic world of trading, complexity often poses a significant challenge. Traders frequently grapple with a multitude of indicators, intricate charts, and the steep learning curves associated with mastering technical analysis. However, there exists a simpler, more effective way to navigate the trading landscape: price action trading. This strategy, designed to revolutionize your trading game, focuses on the price changes of a security, offering a streamlined approach to trading.

Embracing the Power of Simplicity

Price action trading is a testament to the power of simplicity. It’s a form of technical analysis that zeroes in on past prices that have traded in the market. This method does not rely on indicators or any other factors. Instead, it allows traders to make informed decisions with ease, eliminating the need for juggling multiple indicators or spending years mastering technical analysis. Imagine the thrill of spotting market opportunities with precision and accuracy, effortlessly capitalizing on the ebb and flow of the market.

The All-In-One Premium Indicator: A Game Changer

At the heart of this strategy is a remarkable all-in-one premium indicator. This tool eliminates the need for multiple indicators, providing a comprehensive analysis in one place. But what makes this indicator so special?

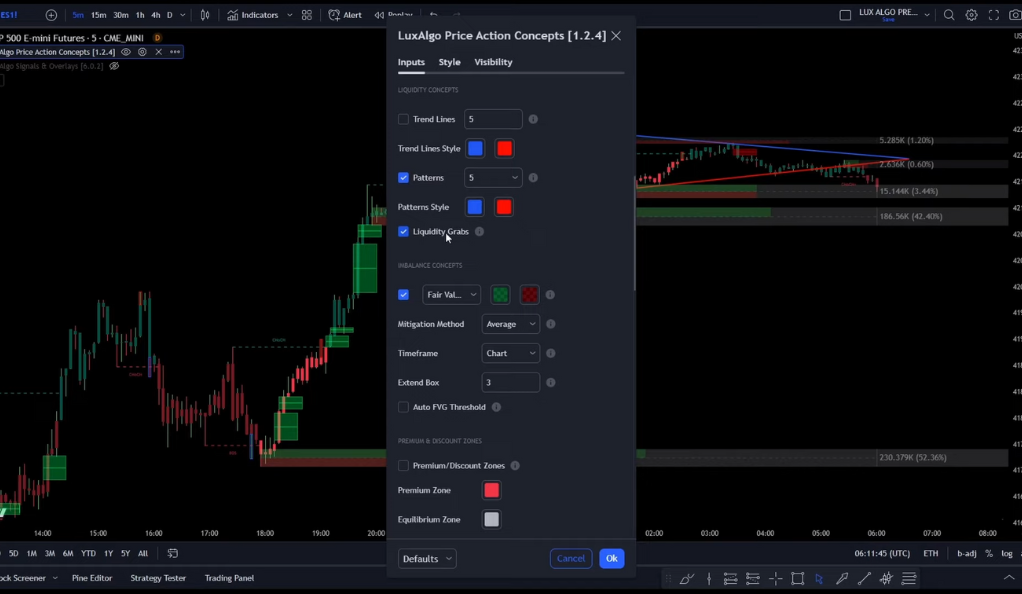

Unpacking the Features of the Premium Indicator

The premium indicator is made up of more than 20 features, primarily focused on generating useful signals and overlays. It’s designed to fulfill any trader’s technical analysis needs with relevant data. This tool is trusted by over 50,000 traders worldwide and can function on any market available on TradingView, such as stocks, crypto, forex, futures, and commodities.

The Power of Community Feedback

The premium indicator is built from community feedback, ensuring that it meets the needs of real traders. It’s continuously updated and improved, providing traders with the most accurate and relevant information. This community-driven approach ensures that the tool remains relevant and effective in the ever-changing trading landscape.

The Core Trading Rules: Paving the Path to Trading Success

The heart of this trading strategy lies in a set of fundamental trading rules. These rules serve as a compass, guiding traders through the often turbulent waters of the market. They are meticulously designed to delineate clear entry and exit points for trades, thereby minimizing risk and amplifying the potential for profit. Let’s delve deeper into these rules and understand how they can shape your trading journey.

The Significance of Trading Rules

Trading rules are akin to a roadmap for traders. They provide a structured approach to making trading decisions, offering clear guidelines that help traders navigate the market. The core trading rules in this strategy are rooted in two key concepts: the Fair Value Gap (FVG) and the Liquidity Grab.

Decoding the Fair Value Gap (FVG)

The Fair Value Gap (FVG) is a price range where the market has barely lingered. It represents an area where price has ‘jumped’ over, leaving a gap in its wake. This concept is pivotal in pinpointing potential trading opportunities. When a FVG is identified, it signals a potential market imbalance, which could precipitate a significant price movement.

Understanding the Liquidity Grab

In contrast, the Liquidity Grab is a scenario where the price ‘snatches’ the liquidity that has accumulated at a certain level before making a U-turn. This is often manifested as a sharp spike in price that quickly reverses. It’s an indication that large market players are maneuvering the price to fill their orders at the most favorable prices.

Short Entry Signals: Perfecting Your Timing

For a valid short entry signal, traders need to identify a Fair Value Gap (FVG) and wait for a Liquidity Grab to be printed. If both conditions are met, a short trade can be initiated. The subsequent order block below is targeted for the take profit. This rule set offers a clear strategy for traders aiming to short a security, providing a systematic and methodical approach to trading.

Long Entry Signals: Capitalizing on Opportunities

The rules for a valid long entry signal mirror their short entry counterparts. Traders need to identify a Fair Value Gap (FVG) and wait for a Liquidity Grab to be printed. If both conditions are met, a long trade can be initiated. The subsequent order block above is targeted for the take profit. These rules provide a lucid strategy for traders aiming to go long on a security, mitigating the uncertainty often associated with trading.

The Virtue of Consistency

One of the key advantages of adhering to these core trading rules is the consistency they offer. By sticking to a clear set of rules, traders can eliminate much of the ambiguity and emotion that often lead to suboptimal trading decisions. This consistency can lead to more successful trades and a more profitable trading strategy.

The Crucial Role of Confluence and Market Conditions in Trading

While the core trading rules form a robust foundation for trading, it’s essential to take into account the overarching market conditions and seek confluence before initiating a trade. This involves comprehending the wider trends and patterns in the market and ensuring that multiple indicators coincide before executing a trade. Let’s delve deeper into these aspects and understand their significance in successful trading.

Understanding Confluence in Trading

In the context of trading, confluence refers to the alignment of multiple trading signals or indicators that point towards a common trading direction. It’s like having several different sources all confirming the same thing. The more confluence factors you have lining up for a trade, the stronger the trade setup becomes.

The Power of Multiple Confirmations

When multiple indicators or tools provide the same signal, it can increase the probability of a successful trade. For instance, if a Fair Value Gap (FVG), a Liquidity Grab, and a trend line all indicate a potential upward movement, it provides a stronger case for entering a long trade. This convergence of signals can significantly enhance the effectiveness of your trading strategy.

The Significance of Market Conditions

Market conditions refer to the overall state of the market, including factors such as market trends, volatility, and liquidity. Understanding market conditions is crucial as it can influence the effectiveness of your trading strategy.

Navigating Market Trends

Market trends, whether upward, downward, or sideways, can provide valuable context for your trades. For instance, in an upward trend, long trades may have a higher probability of success. Recognizing and understanding these trends can help you align your trades with the market momentum, increasing your chances of a profitable trade.

The Role of Volatility and Liquidity

Volatility and liquidity are other key market conditions to consider. High volatility markets can offer more trading opportunities, but they also come with increased risk. Similarly, markets with high liquidity can provide more opportunities for entry and exit but can also be influenced by large market players. Understanding these conditions can help you tailor your trading strategy to the market environment.

The Lux Algo Premium Indicator: A Powerful Ally

The Lux Algo premium indicator is a powerful tool that can help traders implement this strategy effectively. It offers advanced signals and overlays, institutional volume estimations, and 20 plus more premium features.

A Worthwhile Investment

While the Lux Algo premium indicator is a paid tool, it’s a worthwhile investment for serious traders. It’s designed to take your trading skills to the next level and help you build a sustainable career in the trading industry.

The Benefits of Lux Algo Premium Indicator

The Lux Algo premium indicator provides real-time alerts and non-repaint signals, making it a reliable tool for traders. It also includes community access with scanners and bots, providing a comprehensive trading solution. This tool is designed to provide traders with a competitive edge, offering a wealth of information at their fingertips.

Conclusion

In conclusion, price action trading using the all-in-one premium indicator is a strategy that brings simplicity and effectiveness to the forefront of trading. It allows traders to make informed decisions with ease, capitalizing on market opportunities with precision and accuracy. Whether you’re a seasoned trader or just starting out, this strategy can transform your trading game forever. So why not give it a try? After all, in the world of trading, knowledge is power, and the right strategy can make all the difference. Embrace the power of simplicity and revolutionize your trading game today.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)