In the world of trading, market reversals stand out as one of the most profitable strategies. The ability to pinpoint the exact moment when a price changes direction offers traders incredible opportunities for substantial profits. This versatile strategy can be applied to various financial markets, including stocks, forex, and cryptocurrencies, and can be implemented across different time frames. In this comprehensive guide, we will delve into the specifics of market reversals, exploring the concept of liquidity grabs, analyzing backtesting results, discussing entry points and risk-reward ratios, providing techniques to enhance the strategy’s effectiveness, highlighting the importance of psychology and risk management in successful trading, and concluding with practical tips for implementing the strategy in real-world trading scenarios. By mastering market reversals, traders can gain a significant edge in the market and potentially boost their trading profits.

Understanding Liquidity Grabs

At the heart of the market reversal strategy lies the concept of a liquidity grab. A liquidity grab occurs when the price breaks through a support or resistance level, only to swiftly reverse its direction, catching traders off guard. This reversal creates a surge in market activity and sets the stage for potential profits. By identifying and capitalizing on liquidity grabs, traders can take advantage of the subsequent impulsive price movements.

To understand the dynamics of a liquidity grab, let’s visualize a resistance level scenario. When the price surpasses this resistance, many traders enter long positions, anticipating a continuation of the upward trend. These traders typically set their stop losses around the resistance area to protect themselves from potential losses. However, if the breakout turns out to be a liquidity grab and the price quickly reverses, triggering the stop losses, a cascade of selling pressure intensifies the downward momentum. Skilled traders who correctly identify this liquidity grab and enter short positions can benefit from this strong impulsive movement, leading to potentially lucrative trades.

Backtesting Results

To evaluate the effectiveness of the market reversal strategy, renowned trader Thomas Boca conducted an extensive backtesting analysis consisting of 14,000 trades. The results revealed that liquidity grabs consistently outperformed other patterns, providing empirical evidence of the strategy’s viability. This finding emphasizes the importance of identifying liquidity grabs and incorporating them into trading decisions when implementing this strategy.

Backtesting involves testing a trading strategy against historical market data to assess its performance and profitability. By analyzing a large sample of trades, Boca was able to ascertain the statistical significance of liquidity grabs in the context of market reversals. These results provide traders with valuable insights into the potential success of the strategy and serve as a foundation for building confidence in its application.

Entry Points and Risk-Reward Ratios

Once a liquidity grab has been identified, the next crucial step is to determine the optimal entry point. This entry point is marked at the candle that created the liquidity grab, serving as a reference for initiating trades. The success of the market reversal strategy lies in its ability to offer exceptional risk-reward ratios, making it an attractive approach for traders seeking high-reward opportunities with limited downside risk.

For example, when a long position is entered at the point where the liquidity grab occurred, the stop loss is placed just below the liquidity grab to minimize potential losses. At the same time, the take profit level is set at a recent high to capture potential substantial gains. Even if the trade results in a loss, the predetermined stop loss helps keep it small. However, if the trade turns out to be successful, the profits can be significant, often outweighing the potential losses.

Enhancing the Strategy

While the market reversal strategy is already highly effective, there are additional techniques that can be employed to further enhance its performance. Traders can consider incorporating the following techniques:

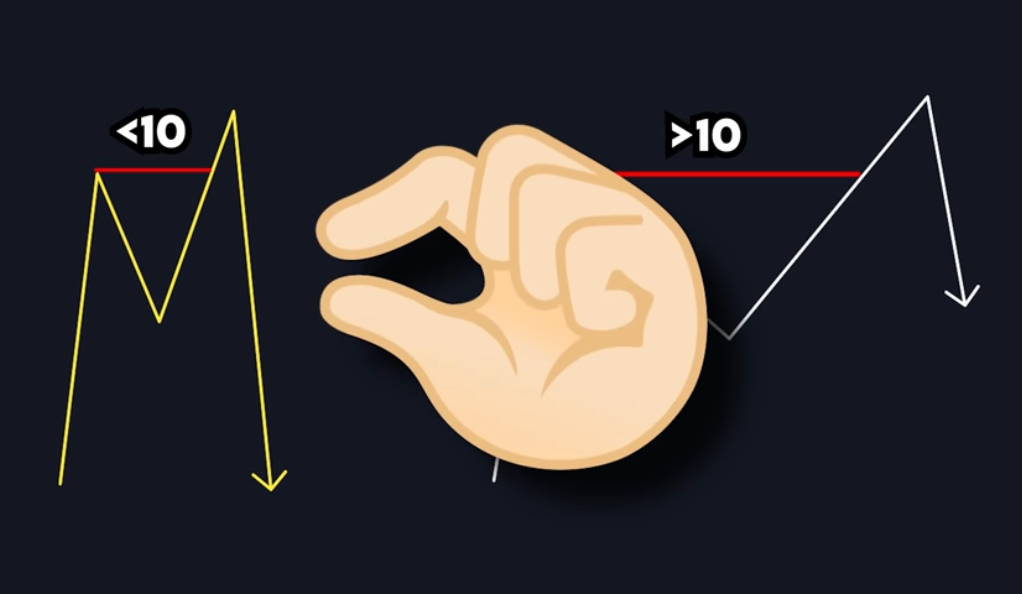

Closer Peaks: One method involves looking for liquidity grabs where the peaks are closer together. In-depth backtesting analysis on various time frames has shown that peaks closer than 10 days apart tend to result in slightly larger price drops compared to those occurring farther apart. This observation suggests that liquidity grabs with closer peaks may indicate stronger reversals, providing traders with an added edge in identifying potentially more profitable opportunities.

Confluences and Divergences: Adding confluences, such as divergences, can enhance the market reversal strategy’s success rate. Divergence occurs when the price action makes lower lows (a liquidity grab), while the momentum oscillator shows higher highs or vice versa. This discrepancy signals a potential reversal in price direction. Combining the identification of liquidity grabs with divergences increases the probability of a successful trade. By incorporating additional indicators, oscillators, or technical analysis tools, traders can strengthen their confidence in the identified market reversal signals.

Timing the Reversals: Market reversals tend to be most effective when identified at the tops or bottoms of significant price moves. Trying to find liquidity grabs in the middle of ongoing trends or consolidations may not yield the same level of success. Traders should focus their attention on spotting reversals during key market turning points to optimize the strategy’s effectiveness.

Psychology and Risk Management

Apart from technical analysis and timing, understanding the psychological aspects of trading and implementing effective risk management strategies are vital for long-term success in mastering market reversals.

Emotional control plays a significant role in trading decisions. Traders need to be disciplined and avoid making impulsive decisions based on fear or greed. Following a well-defined trading plan and sticking to predetermined entry and exit points can help mitigate emotional biases.

Risk management is another critical aspect of successful trading. Traders should determine their risk tolerance and set appropriate stop-loss levels for each trade. By managing risk effectively, traders can limit potential losses and protect their trading capital, ensuring longevity in the markets.

Practical Tips for Implementing the Strategy

Implementing the market reversal strategy in real-world trading requires careful consideration of several practical factors. Here are some tips to help traders make the most of this strategy:

Develop a systematic approach: Establish clear rules for identifying liquidity grabs, determining entry and exit points, and managing risk. This systematic approach will help traders maintain consistency in their trading decisions and reduce the impact of emotional biases.

Utilize multiple time frames: Analyzing multiple time frames can provide a more comprehensive picture of market conditions and increase the accuracy of identifying liquidity grabs. Combining the signals from different time frames can offer valuable confirmation for entering or exiting trades.

Stay informed: Keep abreast of market news, economic events, and other factors that may impact price movements. Fundamental analysis can complement technical analysis in identifying potential market reversals and enhancing the accuracy of trade decisions.

Continuously learn and adapt: The financial markets are ever-evolving, and successful traders must adapt to changing market conditions. Stay updated with new trading techniques, market indicators, and strategies to refine and improve the market reversal approach.

Practice risk management: Implement effective risk management techniques, such as setting appropriate stop-loss levels, using position sizing techniques, and diversifying your portfolio. By managing risk effectively, traders can protect their capital and navigate through market uncertainties.

Keep a trading journal: Maintain a trading journal to record your trades, including entry and exit points, reasons for taking the trade, and emotions experienced during the process. Regularly reviewing your journal can provide valuable insights into your trading performance and help identify areas for improvement.

Conclusion

Mastering market reversals can be a game-changer for traders, providing them with a significant advantage in the dynamic world of trading. By understanding the concept of liquidity grabs, identifying optimal entry points, employing additional techniques to enhance the strategy’s effectiveness, integrating sound psychological and risk management principles, and implementing practical tips for real-world trading scenarios, traders can significantly increase their potential for profits.

It is important to emphasize that thorough research, continuous learning, and diligent risk management are essential components of successful trading. Traders must adapt the strategies discussed in this guide to their individual trading styles and preferences. Regular practice, refinement of skills, and adaptation to evolving market conditions will contribute to long-term success.

Moreover, traders should be aware that no strategy is foolproof and that losses are an inherent part of trading. It is crucial to set realistic expectations and manage emotions during both winning and losing trades. A disciplined and patient approach is key to navigating the ups and downs of the market.

By applying the knowledge gained from this comprehensive guide, traders can embark on their journey towards mastering market reversals and potentially transforming their trading results. The market offers endless opportunities, and with the right tools and mindset, traders can capitalize on them.

So why wait? Start exploring the market reversal strategy today and unlock the potential for greater trading success. Remember, patience, discipline, and perseverance are key virtues in the pursuit of profitable market reversals. Continuously refine your skills, adapt to market dynamics, and never stop learning. With dedication and practice, you can become a proficient trader capable of identifying high-reward opportunities in market reversals.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)