In the dynamic world of financial markets, traders are always on the lookout for strategies that can give them an edge. One such approach that has gained popularity among active traders is scalping. This method, characterized by its high-speed and high-volume trading, aims to capitalize on small price changes that occur throughout the day. But what if there was a scalping strategy that boasted a win rate of 96.8%? It sounds almost too good to be true. This article aims to dissect this high win-rate scalping strategy, exploring its mechanics, the indicators used, and the rules for entering and exiting trades. By the end of this guide, you’ll have a comprehensive understanding of this strategy and how it might be applied in your trading activities.

Understanding Scalping

Scalping is a trading strategy used primarily in the forex and stock markets, characterized by its rapid-fire approach to buying and selling. Traders who use the scalping strategy, also known as scalpers, aim to capitalize on small price movements. They typically enter and exit trades within a few minutes or even seconds, making numerous trades within a single day. This strategy hinges on the principle that small but frequent profits can add up to a substantial amount by the end of the trading day. Scalpers often use high leverage to multiply the value of potential gains, but this equally magnifies the risk of losses.

The success of scalping relies on in-depth market knowledge, fast decision-making, and meticulous technical analysis. Scalpers usually employ charts and other trading tools to identify potential trading opportunities based on short-term price movements and trends. Key to this strategy is strict discipline in setting and adhering to stop-loss orders, minimizing the impact of unsuccessful trades. Moreover, because of the high number of trades made, transaction costs can become significant; hence, an understanding of these costs and a broker offering low transaction fees are essential for scalpers. Despite its inherent risks, scalping remains popular due to the potential for fast returns.

The Trading Platform: TradingView

The high win-rate scalping strategy we’re discussing was backtested on TradingView, a renowned trading platform favored by traders worldwide. TradingView offers a wide range of tools for technical analysis, making it an ideal platform for testing and implementing trading strategies. Its user-friendly interface, coupled with powerful charting capabilities, makes it a go-to platform for both novice and experienced traders. For our high win-rate strategy, TradingView provides the perfect environment to apply and monitor the required indicators.

The Indicators: Heikin Ashi Candles, Chandelier Exit, and ZLSMA Zero Lag LSMA

The high win-rate strategy uses three key indicators: Heikin Ashi Candles, Chandelier Exit, and ZLSMA Zero Lag LSMA. Heikin Ashi Candles are a type of candlestick chart that filters out market noise and highlights trend direction. This makes them an excellent tool for a scalping strategy, where recognizing short-term trends quickly is crucial. The Chandelier Exit and ZLSMA Zero Lag LSMA indicators are used to identify potential entry and exit points for trades. These indicators, when used in conjunction, provide a robust framework for the high win-rate scalping strategy.

Heikin Ashi Candles

Heikin Ashi candles are a type of candlestick chart that originated in Japan, designed to help traders more easily identify market trends and forecast future prices. Unlike standard candlestick charts, Heikin Ashi charts average price data, which creates a smoother appearance and can reduce the noise of minor price fluctuations. This makes it easier to spot trends and potential reversal points in the market. Each Heikin Ashi candle is calculated using data from the current open, high, low, and close, as well as the previous candle’s open and close. As such, Heikin Ashi candles can help traders make more informed decisions, particularly in volatile markets.

Chandelier Exit

The Chandelier Exit is a volatility-based indicator designed to set a trailing stop-loss level for both long and short trading positions. It was developed by Chuck LeBeau, who named it “chandelier” because it hangs down from the high point or the ceiling of the trade. The Chandelier Exit formula typically uses a 22-day period as a default (reflecting trading days within a month), and the Average True Range (ATR) to represent volatility. For long trades, it’s calculated by subtracting a multiple of the ATR from the highest high since the trade was entered. For short trades, it’s calculated by adding the same multiple of the ATR to the lowest low since the trade was entered. The Chandelier Exit helps traders determine where to place stop orders by reflecting both the volatility of the market and the trading behavior of the stock.

ZLSMA Zero Lag LSMA

The Zero Lag LSMA (ZLSMA), also known as Zero Lag Least Squares Moving Average, is a technical analysis tool that aims to eliminate the lag associated with traditional moving averages. The “LSMA” stands for Least Squares Moving Average, which is a method of fitting a line to data in a way that minimizes the sum of the squares of the distances from the data points to the line. The zero-lag component is a modification that attempts to offset the inherent lag in moving averages by predicting where the moving average line will be in the future, and then placing it there now. This results in a moving average that is more responsive to current price changes, helping traders to identify market trends and make trading decisions more quickly. However, like all technical indicators, it’s not infallible and should be used in conjunction with other indicators and analysis methods for the most reliable results.

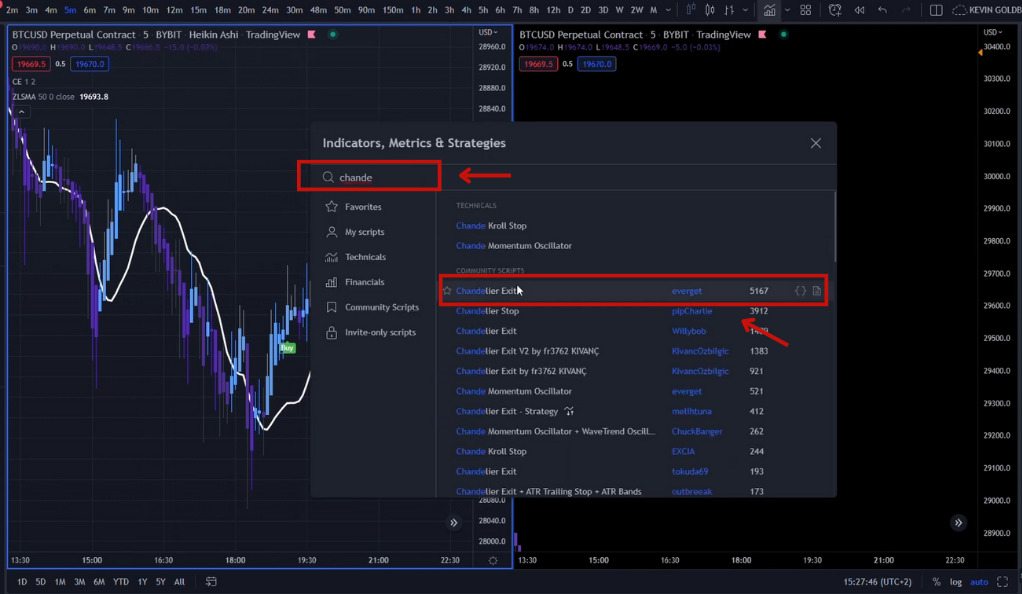

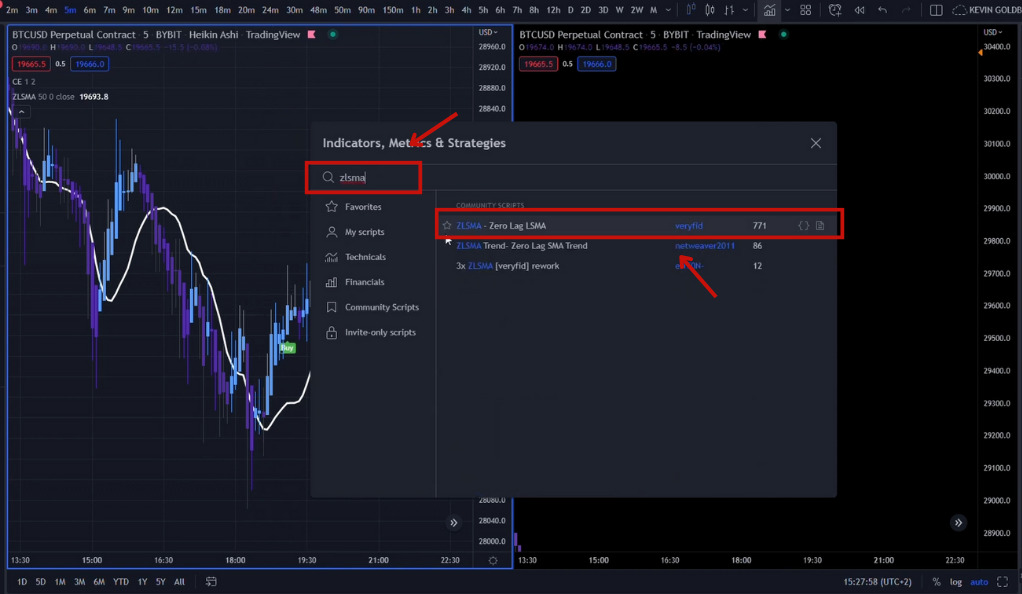

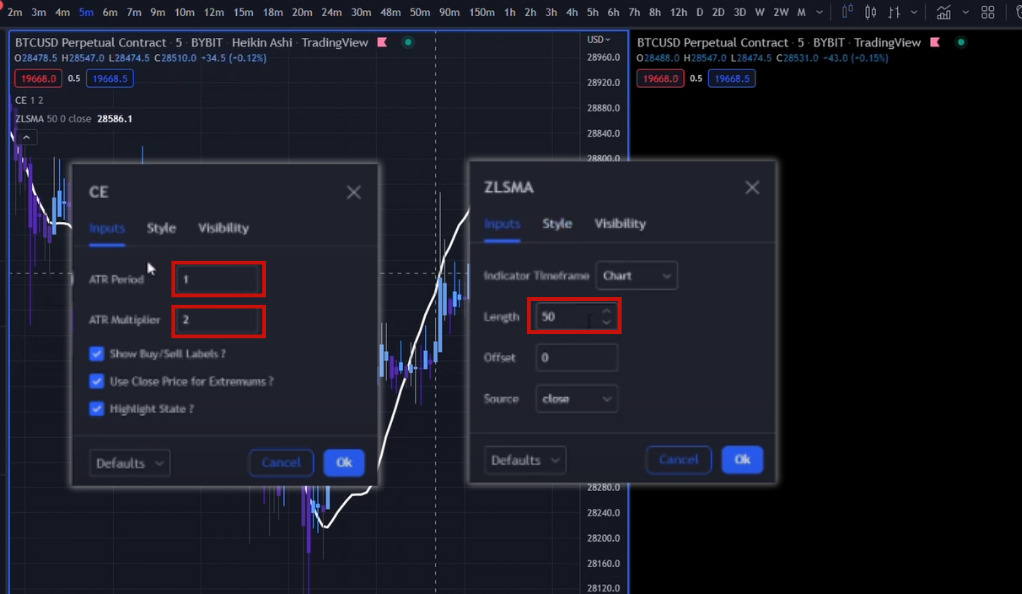

Setting Up the Indicators

Setting up the indicators correctly is crucial to the success of the strategy. For the Chandelier Exit indicator, the ATR Period is set to 1, and the Multiplier is set to 2. In the Styles section, only the Buy Label and Sell Label are activated. This setup helps to clearly identify potential buy and sell signals. For the ZLSMA Zero Lag LSMA, the Length is set to 50, and the color is set to white. This configuration helps to clearly visualize the indicator on the chart and identify potential trading opportunities.

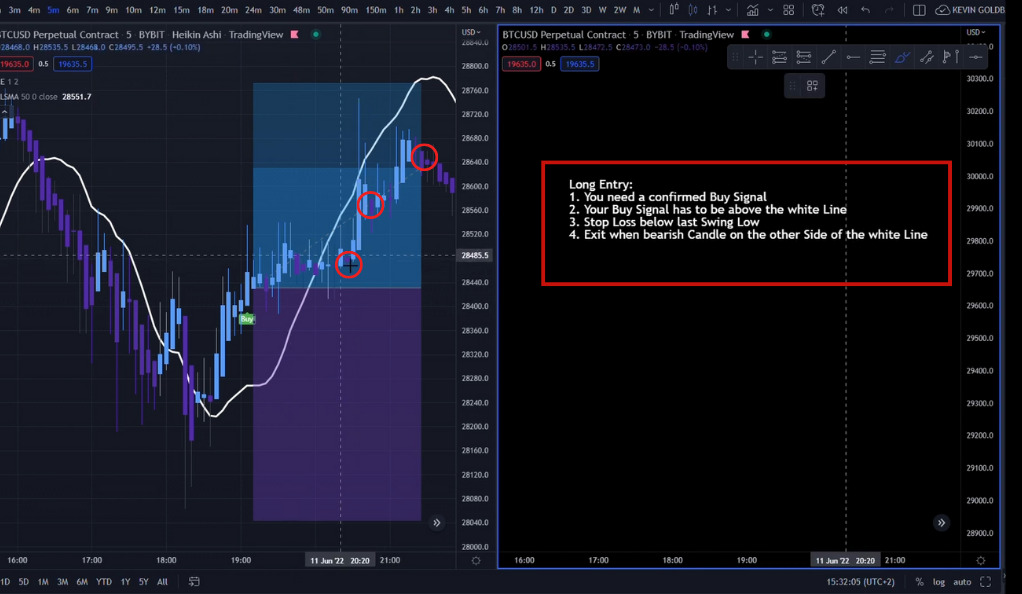

Long Position Rules: The Buy Signal

The rules for entering a long position in this strategy are clear and straightforward. The first requirement is a confirmed Buy Signal from the Chandelier Exit indicator. This signal candle must be above the white line of the ZLSMA Zero Lag LSMA indicator, indicating a potential upward trend. Once this condition is met, a Stop Loss is set below the last Swing Low. This provides a safety net against potential adverse market movements. The position is exited if the candle closes on the other side of the white line, indicating a potential trend reversal.

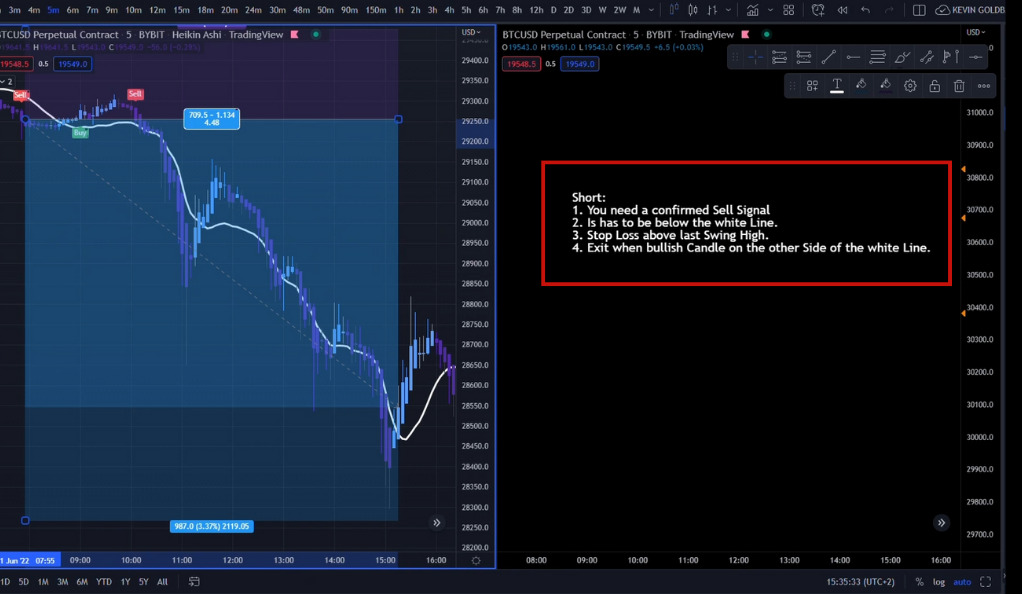

Short Position Rules: The Sell Signal

The rules for entering a short position mirror those for a long position. The strategy begins with a confirmed Sell Signal from the Chandelier Exit indicator. The signal candle must be below the white line of the ZLSMA Zero Lag LSMA indicator, suggesting a potential downward trend. A Stop Loss is set above the last Swing High to protect against potential price increases. The position is exited if the candle closes on the other side of the white line, indicating a potential trend reversal.

Backtesting and Results

The high win-rate scalping strategy was backtested over 100 trades in a 14-day period, from June 11, 2022, to June 24, 2022. The backtesting assumed a $100 investment per trade with 25x leverage, resulting in a position size of $2500 per trade. The results were impressive, with a profit of 0.0283500784 Bitcoin, equivalent to $1134 with an average Bitcoin price of $40,000. The win rate for these trades was 41%, a remarkable figure for a scalping strategy.Backtesting is an essential process in trading strategy development where the strategy is applied to historical data to evaluate its performance. It involves simulating trades based on certain predefined rules and criteria over a specific period in the past, and then analyzing the outcome. The primary purpose of backtesting is to verify whether a strategy has the potential to be profitable under different market conditions. Traders can identify the win/loss ratio, maximum drawdown, risk/reward ratio, and many other parameters that help to estimate the feasibility and reliability of a trading strategy. However, it’s important to use high-quality, accurate data for backtesting to ensure that the results are as reliable as possible.

The results of backtesting provide valuable insights but should be interpreted with caution. One of the key aspects to consider is that past performance does not guarantee future success. Market conditions, volatility levels, and economic indicators can change, affecting the performance of a strategy. Additionally, backtesting can sometimes lead to overfitting, where a strategy performs well on historical data but fails on new data because it’s too tailored to the past data. To mitigate this, traders use out-of-sample testing, where the strategy is tested on a different data set than the one used for backtesting. In conclusion, while backtesting is a vital tool for strategy development, its results are just one piece of the puzzle when it comes to assessing a strategy’s potential effectiveness.

The Reality of Trading

While the backtesting results of this strategy are promising, it’s important to remember that actual trading results may vary. Market conditions can change rapidly, and personal risk tolerance and execution speed can significantly impact trading outcomes. It’s also crucial to remember that scalping is a high-risk strategy that requires a significant time commitment and intense focus. As such, it may not be suitable for all traders.

Conclusion

Scalping can be an exciting and potentially profitable trading strategy for those who have the time and discipline to execute a large number of trades each day. The high win-rate scalping strategy we’ve explored in this article offers a structured approach to scalping, with clear rules for entry and exit points. However, as with all trading strategies, it’s essential to do your own research, understand your risk tolerance, and practice sound money management. Remember, the goal is not just to make profits, but also to protect your trading capital. Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)