The modern stock market is more confusing and contradictory than ever before. Amid the chaos of varying opinions, strange phenomena, and warning signs, investors may feel like they’re navigating a battlefield, where the strategies of yesterday may not apply to the challenges of today. Some herald the massive rise in stocks like NVIDIA and the resurgence of SPACs as exciting opportunities, while others see them as overblown and dangerous bubbles. Extreme put-to-call ratios and macroeconomic data also send mixed signals. Understanding this complex landscape is essential for success, requiring both caution and informed decision-making. This article aims to unravel these perplexing aspects and guide investors through the current financial turmoil.

NVIDIA’s Unprecedented Surge: A Cautionary Tale?

The Rise of NVIDIA

NVIDIA, a leading tech company specializing in graphics processing units (GPUs), has witnessed a breathtaking surge in its stock prices. The growth is attributed to innovative product lines, emerging applications in AI and machine learning, and strong corporate partnerships. The question arises: Is this a solid investment or an overheated hype? Analyzing the company’s core strengths and potential weaknesses is crucial to understanding whether this rise is sustainable.

Potential Risks and Rewards

Every investment carries both risk and reward, and NVIDIA’s case is no different. The rapid growth in stock price has led to fears of a bubble, while others believe that NVIDIA’s innovative edge justifies the surge. It’s essential to balance these opposing views, taking into account the competitive landscape, potential market saturation, and broader economic indicators. Weighing these factors can help investors make an informed decision about NVIDIA’s future trajectory.

IPO Mania and the Return of SPACs: What’s Going On?

IPO Frenzy

The recent explosion of Initial Public Offerings (IPOs) has captured investors’ attention. New companies are entering the stock market at a rapid pace, fueled by an appetite for innovation and growth. While IPOs offer opportunities for significant profits, they also come with inherent risks. Understanding the underlying business models, market demand, and valuation metrics is key to discerning whether this IPO mania is a sign of healthy market expansion or an unsustainable bubble.

The Resurgence of SPACs

Special Purpose Acquisition Companies (SPACs) have made a dramatic comeback. Acting as ‘blank check companies,’ SPACs raise funds through an IPO with the intent to merge with a private company. The resurgence of SPACs has stirred debates about their efficiency, transparency, and ethics. Investigating their structure, advantages, and potential drawbacks can help investors gauge whether SPACs represent a unique opportunity or a risky proposition.

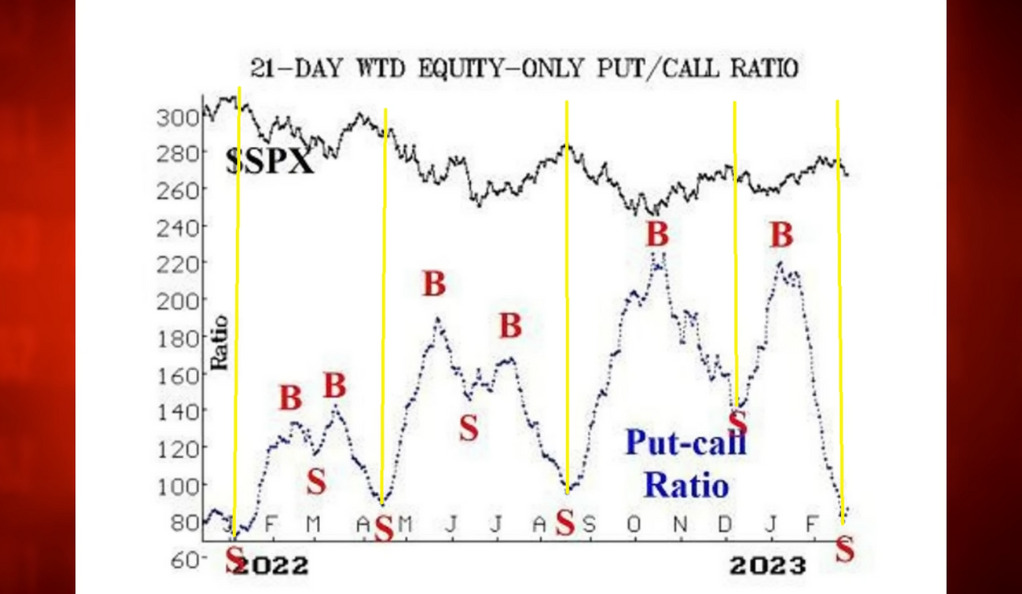

Alarming Signals: The Extreme Put-to-Call Ratio

The current extreme put-to-call ratio, which is the ratio of trading volume of put options to call options, is signaling a potential massive pullback in the market. A high ratio indicates that investors are buying more put options, which are essentially bets against the market. This could be a sign that traders expect a downturn or at least increased volatility. Understanding the underlying causes and historical context of these ratios can help investors prepare for potential market shifts and devise strategies to minimize risk.

Macroeconomic Concerns: Higher Inflation and Slower Growth

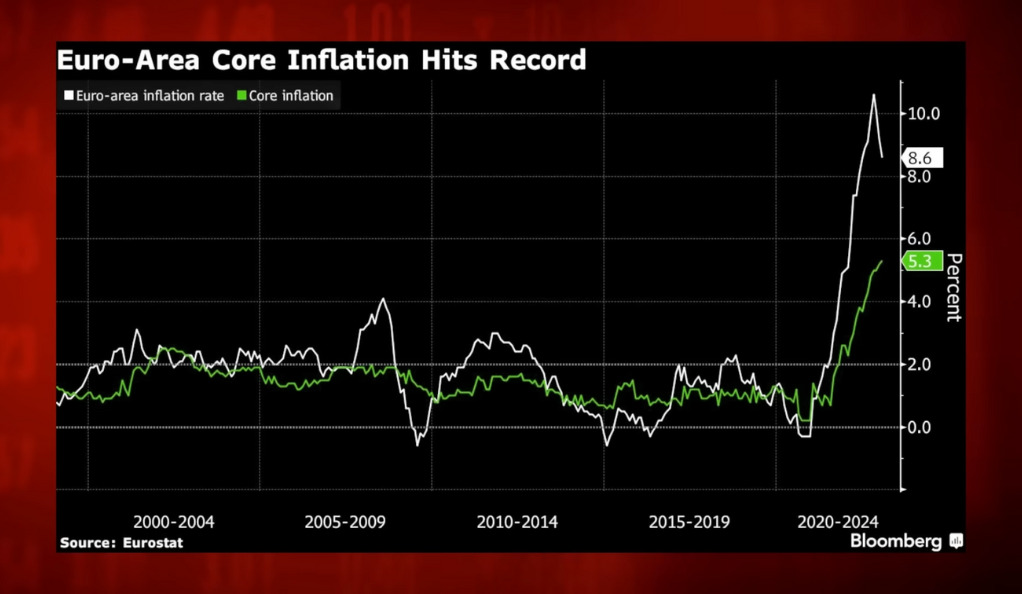

The Inflation Dilemma in the US and Eurozone

Inflation rates are climbing in both the US and the Eurozone, sparking debates and concerns among policymakers and investors. The rise in consumer prices is affecting everything from everyday spending to long-term investment decisions. Analyzing the underlying causes of this inflation, such as supply chain disruptions and fiscal policies, can provide insights into future trends and necessary interventions.

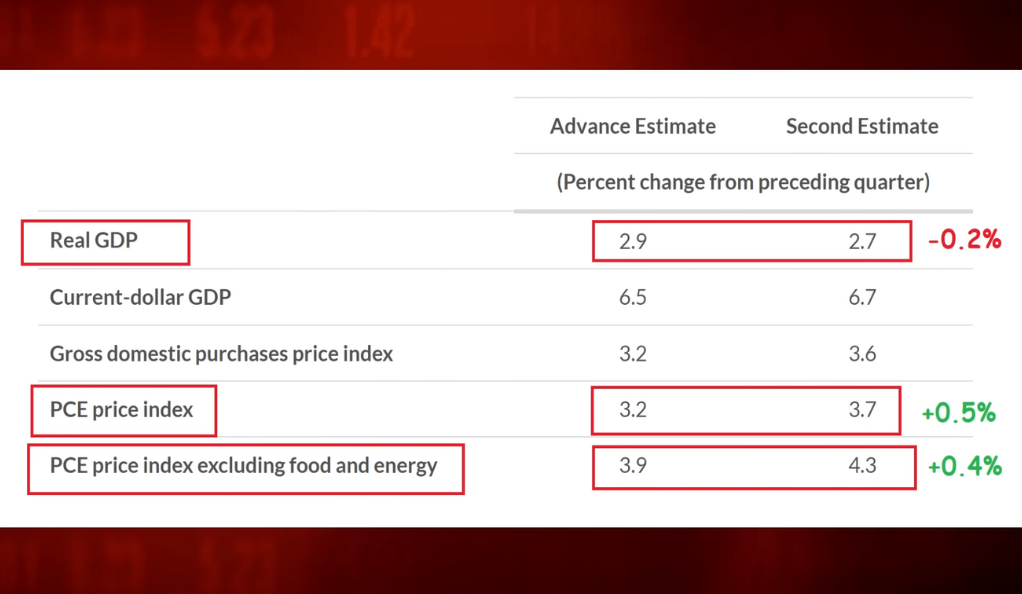

Lower GDP Growth: A Troubling Sign?

Gross Domestic Product (GDP) growth in major economies has shown signs of slowing down. This deceleration may indicate underlying structural issues, such as labor market imbalances or decreased consumer spending. Understanding the factors contributing to this slowdown, along with its potential long-term implications, is vital for both policymakers and investors seeking to navigate these complex economic waters.

The Federal Reserve Under Fire: Handling Inflation Criticisms

The Federal Reserve’s handling of rising inflation has been met with significant criticism. Some argue that the Fed’s monetary policies are exacerbating the problem, while others contend that it’s taking the right steps to control the situation. Examining the Federal Reserve’s actions, its mandate, and the broader economic context can shed light on whether these criticisms are valid. The Fed’s decisions have wide-reaching impacts on the economy and financial markets, so understanding its strategies is key for informed investment decisions.

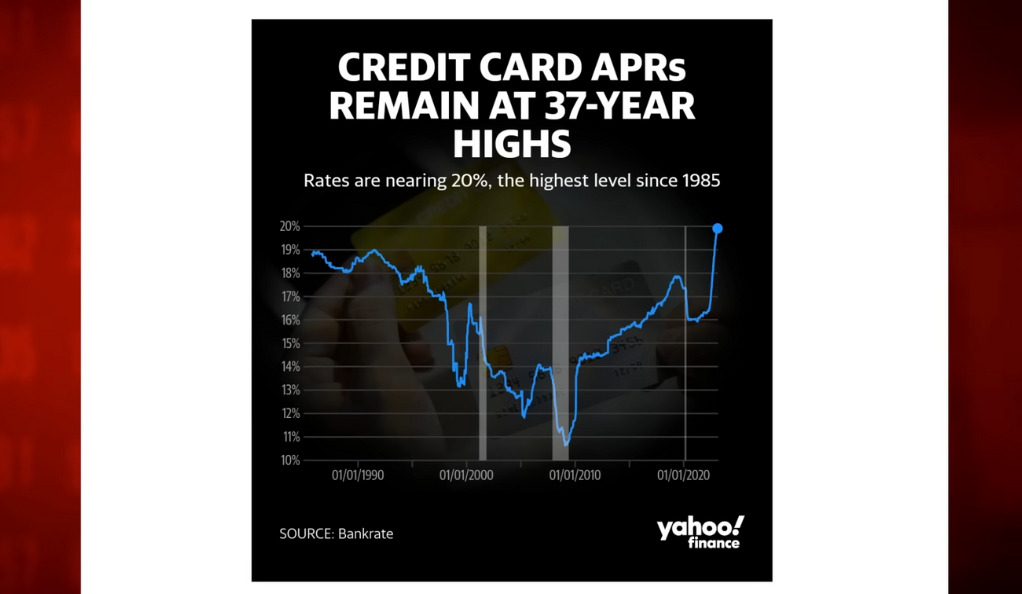

Consumer Credit Card Debt: A Ticking Time Bomb?

Consumer credit card debt in the United States has surpassed the staggering $1 trillion mark. With rising interest rates and the burden of debt weighing on consumers, some fear a looming crisis. Analyzing the growth of credit card debt, its underlying causes, and potential remedies can offer insights into this critical issue. Understanding how this debt level interacts with other economic factors can also provide valuable perspectives on overall financial stability and future economic growth.

Wall Street’s Ominous Warnings: Words from Jamie Dimon and Others

Prominent Wall Street figures, including JPMorgan CEO Jamie Dimon, have voiced concerns about potential economic turmoil. These warnings carry weight due to the vast experience and insight of the individuals behind them. Analyzing their statements in light of current economic indicators, historical trends, and potential future scenarios can help investors decipher the true significance of these warnings. Is this a prudent caution or unnecessary alarmism? Understanding these perspectives can guide investment strategies and risk management.

Strategies for Navigating Uncertainty: Caution and Informed Decision Making

In these turbulent times, investors must tread with caution and make informed decisions. This involves a careful analysis of current trends, understanding potential future scenarios, and developing adaptable strategies. Utilizing tools like diversification, continuous monitoring, and professional advice can help investors weather the storms. Recognizing that there are no foolproof strategies, but rather a continuous process of learning and adaptation, is essential for successful navigation through this uncertainty.

Conclusion

The financial landscape we’re traversing is filled with conflicting signals, unexpected phenomena, and substantial uncertainties. From the remarkable rise in NVIDIA stock to concerns over inflation, consumer debt, and Wall Street warnings, there’s much to understand and even more to prepare for. This complex environment requires a careful balance of enthusiasm and caution, knowledge and adaptability. Investors must be diligent, flexible, and, most importantly, well-informed to make the best decisions in this ever-changing battlefield. Are you equipped with the insights and strategies to face what lies ahead? It’s time to arm yourself with the understanding to navigate the financial storms on the horizon.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)