In the fast-paced, dynamic world of forex trading, strategies that promise quick returns are often the most attractive. One such approach is the one-minute scalping trading strategy. These strategies have gained significant popularity among traders due to their potential for rapid profit generation. However, the effectiveness of these strategies can vary significantly, and their success often depends on the specific parameters and rules used. This article delves into a specific one-minute scalping trading strategy shared by Trade IQ. We’ll provide a comprehensive review of its performance, effectiveness, and potential pitfalls, offering insights that could help you make informed trading decisions.

Understanding the Strategy

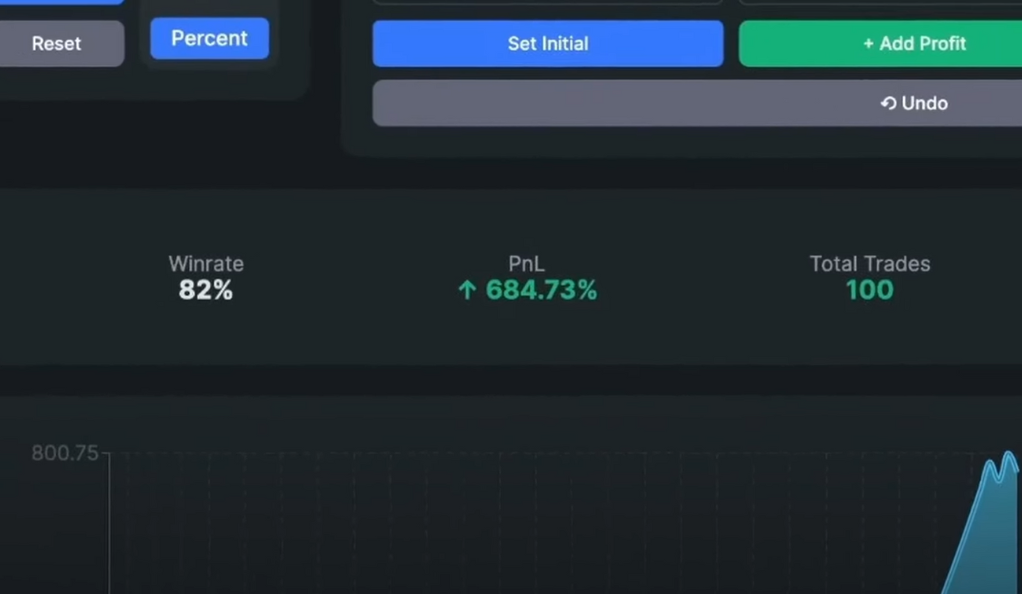

The one-minute scalping trading strategy shared by Trade IQ is an intriguing approach to forex trading. It boldly claims to offer a win rate of 82% and a staggering profit of 684% after 100 trades. These figures are quite impressive and can easily catch the attention of any trader looking for quick and substantial returns. However, as with any trading strategy, it’s important to understand the underlying mechanics and principles before jumping in.

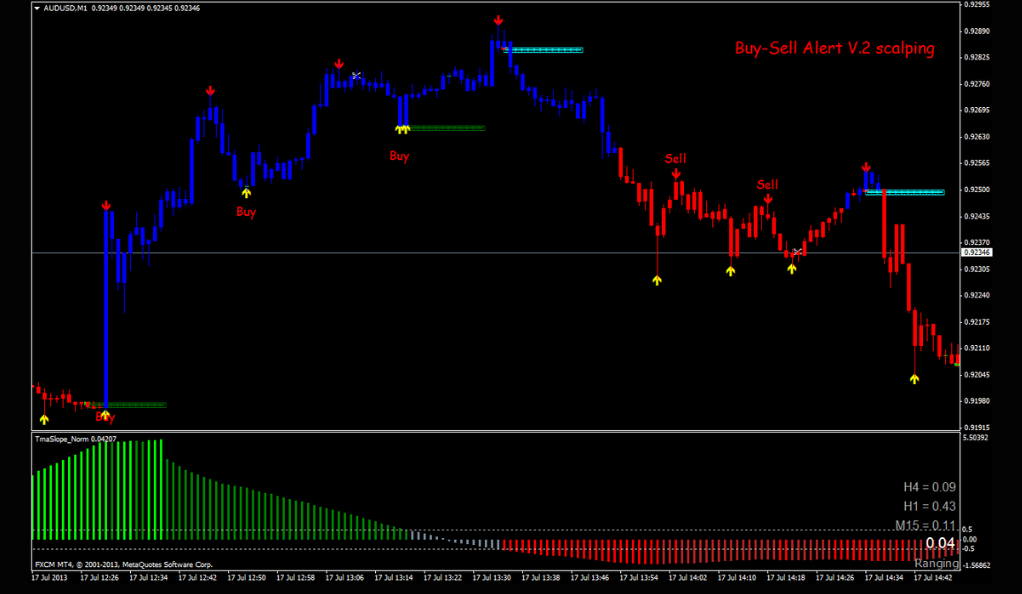

This strategy employs four free trading view indicators. Indicators are statistical tools that traders use to understand current market trends and predict future ones. They can provide insights into things like market volatility, momentum, trend direction, and market strength. The use of four different indicators suggests that the strategy is based on a multi-faceted analysis of the market, which can potentially increase its accuracy and reliability.

What’s more, these indicators are free, making the strategy accessible to traders who may not have the resources for premium tools. This is a significant advantage, as it lowers the barrier to entry and allows more traders to take advantage of the strategy.

The strategy is designed to work on all markets with high daily volume. High volume markets are typically more liquid, meaning there are more participants and more transactions occurring. This can lead to more opportunities for scalping, as price movements can be more predictable and trends can be easier to spot.

However, it’s important to note that while high volume can increase opportunities, it can also increase risk. High volume markets can be more volatile, with prices changing rapidly and unpredictably. Therefore, while the strategy’s applicability to high volume markets is a potential advantage, it also underscores the need for effective risk management.

But does this strategy live up to its hype? Can it deliver the promised results consistently? These are the questions we aim to answer as we delve deeper into the strategy’s mechanics, performance, and potential pitfalls. It’s important to remember that while impressive claims can be enticing, they should always be evaluated critically and objectively. After all, in the world of trading, the proof of the pudding is in the eating.

The Backtesting Process

To evaluate the effectiveness of the one-minute scalping trading strategy, it was subjected to a rigorous backtesting process on the EUR/USD chart. Backtesting is a critical step in assessing any trading strategy. It involves applying the strategy to historical data to see how it would have performed. This process provides traders with a glimpse into the potential success rate of the strategy, offering a form of ‘rehearsal’ before the strategy is used in real-time trading.

In this case, the backtesting process was conducted on the EUR/USD chart, one of the most traded currency pairs in the forex market. This choice of currency pair is significant because it represents a highly liquid and volatile market, which is ideal for a scalping strategy. Scalping strategies thrive on volatility and liquidity, as they rely on making many trades within short time frames to capitalize on small price movements.

The backtesting process involves applying the strategy’s rules to the historical price data of the EUR/USD pair. This includes identifying potential entry and exit points based on the strategy’s criteria and calculating the potential profit or loss for each trade. By doing this for a large number of trades, we can get a sense of how the strategy performs over time and under different market conditions.

However, it’s important to remember that while backtesting provides valuable insights, it’s not foolproof. Market conditions change, and what worked in the past may not necessarily work in the future. Furthermore, backtesting often assumes ideal trading conditions, with no slippage or trading costs, which is rarely the case in real trading. Therefore, while backtesting is a useful tool, its results should be interpreted with caution and supplemented with other forms of analysis and risk management.

In essence, backtesting is like a time machine that allows us to travel back and see how our strategy would have fared in the past. It’s a valuable tool in a trader’s arsenal, but like any tool, it must be used correctly and its limitations understood. As we delve into the backtesting results of the one-minute scalping strategy, we’ll keep these considerations in mind.

The Results of the Backtest

The backtest results of the one-minute scalping trading strategy were quite revealing. The strategy achieved a win rate of 67% and a profit of 6% after 100 trades. While these figures are impressive in their own right, they fall short of the claimed win rate and profit. This discrepancy raises questions about the strategy’s reliability and consistency. It also highlights the importance of conducting independent tests before adopting any trading strategy. After all, in the world of trading, it’s the cold, hard numbers that ultimately matter, not the lofty promises.

A win rate of 67% means that out of every 100 trades, around 67 were profitable. This is a decent win rate, especially for a scalping strategy, which typically involves making many trades with a relatively small profit target for each. However, it’s worth noting that a high win rate doesn’t necessarily guarantee overall profitability. The size of the wins relative to the size of the losses, also known as the risk/reward ratio, is also a crucial factor.

The profit of 6% after 100 trades, while modest, is a positive result. It indicates that the strategy was able to generate a net profit over the course of the 100 trades. However, this figure is significantly lower than the claimed profit of 684%. This discrepancy could be due to a variety of factors, including changes in market conditions, the limitations of backtesting, or overestimation of the strategy’s performance.

These backtest results serve as a reminder that trading strategies should always be evaluated based on their performance, not their promises. While the one-minute scalping strategy showed some potential, its actual performance did not live up to the high expectations set by its claims. This doesn’t necessarily mean that the strategy is ineffective, but it does suggest that traders should approach it with a healthy dose of skepticism and a strong focus on risk management.

Long and Short Positions

One of the strengths of this strategy is its versatility. It includes rules for entering both long and short positions. This flexibility allows traders to capitalize on market movements in either direction, increasing the potential for profits. In a volatile market, the ability to go long or short is a significant advantage. It means that you can profit from both rising and falling markets. However, it’s important to remember that both long and short positions come with their own risks and challenges. Traders must understand these risks and manage them effectively to succeed.

Drawdown: A Critical Consideration

The strategy boasts a “super small” maximum drawdown. Drawdown refers to the reduction in a trading account, which occurs as a result of a series of losing trades. A small drawdown is desirable as it indicates lower risk. However, it’s important to remember that past performance is not always indicative of future results. While a small drawdown in the past is encouraging, it doesn’t guarantee a small drawdown in the future. Traders must always be prepared for the possibility of larger drawdowns and have a solid risk management plan in place.

Is the Strategy Worth It?

The one-minute scalping trading strategy shared by Trade IQ presents an interesting proposition. It promises high returns and low risk, but the backtest results suggest otherwise. While the strategy does offer a decent win rate and profit, it does not match up to the claimed figures. This discrepancy could be due to a number of factors, including changes in market conditions or the inherent limitations of backtesting. Therefore, while the strategy may be worth considering, it’s essential for traders to approach it with a healthy dose of skepticism and a strong focus on risk management.

Conclusion

In conclusion, while the one-minute scalping trading strategy has its merits, it’s essential for traders to approach it with caution. The discrepancy between the claimed and actual results suggests that the strategy may not always deliver as promised. As with any trading strategy, it’s crucial to conduct thorough backtesting and risk management before diving in. Remember, in the world of forex trading, there’s no such thing as a sure win. It’s all about playing the odds, managing your risks effectively, and staying disciplined. The one-minute scalping strategy, like any other, is just a tool. Its success ultimately depends on the skill and discipline of the trader wielding it.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)