In the fast-paced and volatile world of cryptocurrency trading, staying one step ahead is not just an advantage, it’s a necessity. One way traders are achieving this is by leveraging the power of artificial intelligence (AI) to enhance their strategies and optimize their trading experience. This article delves into the intricacies of a specific AI trading strategy, providing a comprehensive guide on how it can be used to potentially increase your trading success.

The Revolution of AI in Trading

Artificial Intelligence, a term that once belonged to the realm of science fiction, has now become a reality that is revolutionizing many industries, and trading is no exception. AI, with its ability to analyze vast amounts of data at lightning speed and with pinpoint accuracy, has become an invaluable tool for traders. But how exactly does it work in trading? AI uses complex algorithms and machine learning to analyze market trends, predict future movements, and generate trading signals, all in real-time.

Understanding Artificial Intelligence

At its core, AI is a branch of computer science that aims to create machines that mimic human intelligence. This doesn’t just mean following pre-programmed instructions, but also learning from experience, understanding complex concepts, recognizing patterns, and making decisions based on the data they process. This ability to learn and adapt makes AI particularly useful in fields where large amounts of data need to be analyzed quickly and accurately, such as trading.

AI and Machine Learning: The Dynamic Duo

AI uses complex algorithms and machine learning, a subset of AI, to analyze market trends, predict future movements, and generate trading signals. Machine learning algorithms use statistical techniques to enable AI systems to learn from data. They can identify patterns and make decisions with minimal human intervention. In trading, machine learning algorithms can analyze historical and real-time data to predict market trends and generate trading signals.

Real-Time Analysis and Prediction

One of the most significant advantages of AI in trading is its ability to analyze and process vast amounts of data in real-time. Traditional trading methods often involve manual analysis of market trends, which can be time-consuming and prone to errors. AI, on the other hand, can analyze complex market data instantly, identifying trends and patterns that might be missed by human traders. This real-time analysis allows traders to make more informed decisions, often leading to more profitable trades.

Generating Trading Signals

AI doesn’t just analyze market data; it also generates trading signals. These signals, based on the AI’s analysis of market trends and predictions of future movements, provide traders with recommendations for making trades. For example, an AI trading system might generate a signal to buy a particular cryptocurrency if it predicts that the price of that cryptocurrency will rise. These signals can help traders make more informed decisions, reducing the risk of loss and potentially increasing profits.

The Future of AI in Trading

The use of AI in trading is still in its early stages, but its potential is enormous. As AI technology continues to advance, it’s likely that AI trading systems will become even more accurate and efficient, further revolutionizing the trading industry. We can expect AI to become an increasingly common tool in the trader’s arsenal, providing them with the insights and recommendations they need to navigate the complex and ever-changing world of trading.

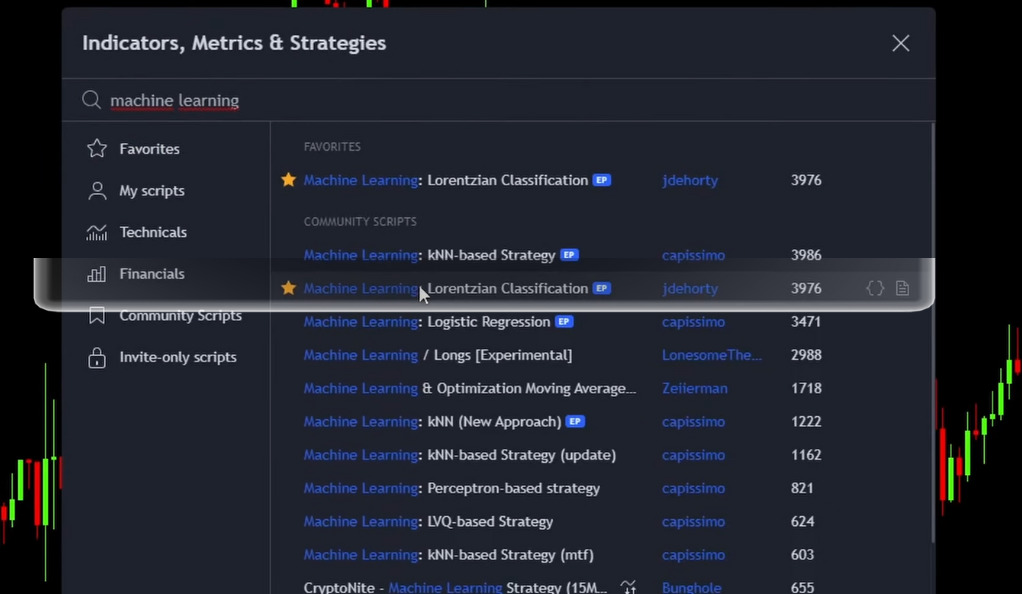

Unpacking the AI Indicator Strategy

One of the most promising AI tools in the trading arena is the AI indicator strategy. This strategy uses machine learning, a subset of AI, to analyze market trends and generate trading signals. The strategy we’ll focus on in this guide uses a specific indicator known as the “Machine Learning Lorenzian Classification” by jdhordy, a tool that has gained popularity due to its effectiveness.

Customizing the AI Indicator for Optimal Performance

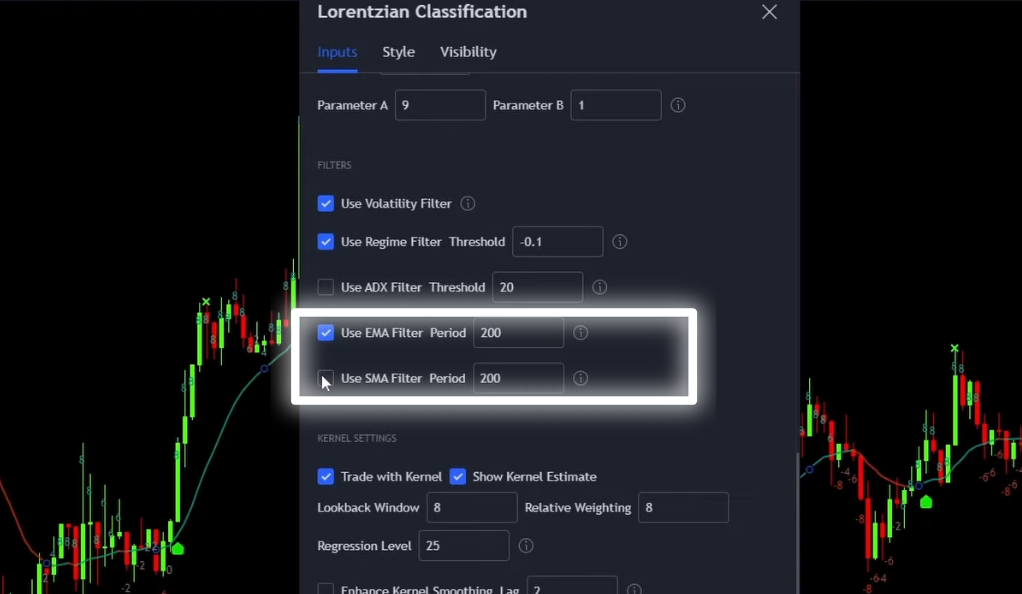

To maximize the effectiveness of the AI indicator, it’s crucial to customize it according to your trading style and the specific market conditions. For instance, you can adjust the feature count from five to two, and the relative weighting from 8 to 0.1. These modifications can significantly increase your win rate, making your trading strategy more effective and potentially more profitable.

Incorporating EMA and SMA Filters for Enhanced Accuracy

Adding Exponential Moving Average (EMA) and Simple Moving Average (SMA) filters to your strategy can further increase your win rate. These filters help to smooth out price data by creating a constantly updated average price, which can be beneficial in identifying potential market trends. However, keep in mind that using these filters may result in fewer signals, which could mean fewer trading opportunities. It’s a balance between quality and quantity that each trader needs to find for themselves.

The Entry Strategy: Timing is Everything

The entry strategy in trading is a critical aspect that can significantly impact the success of your trades. With the AI indicator strategy, once the entry signal appears, you enter a position. There’s no need to wait for the candle to close, which is a common practice in many other trading strategies. Your entry is always in the middle of the candlestick, which can provide a more advantageous entry point, potentially increasing your profit margin.

The Exit Strategy: Knowing When to Bow Out

Exiting a position is just as important, if not more so, as entering one. With this strategy, you exit the position as soon as the color of the line changes and you’re in profit. This approach helps to lock in profits and minimize losses, a key aspect of successful trading. It’s all about knowing when to hold on and when to let go.

Using Stop Loss to Protect Your Investment

A stop loss is a tool that helps protect your investment from significant losses. It’s like an insurance policy for your trades. For long positions, place your stop loss at the recent swing low. For short positions, place it at the recent swing high. This strategy helps to limit potential losses, allowing you to trade with more confidence and less fear of significant losses.

Understanding Stop Loss

A stop loss is a predetermined order to sell an asset when it reaches a particular price point. It’s designed to limit an investor’s loss on a position in a security. Although no one wants to admit defeat, sometimes it’s better to close a losing position and move on, rather than holding onto it in the hope that its fortunes will reverse. This is where a stop loss comes into play.

The Mechanics of Stop Loss

When you place a stop loss order, you’re instructing your broker to sell a security when it reaches a specific price. For long positions, you place your stop loss at the recent swing low, which is the lowest price point of the recent downward price fluctuation. If the price falls to this level, your stop loss order is triggered, and your position is sold, thereby preventing further losses.

For short positions, you place your stop loss at the recent swing high, which is the highest price point of the recent upward price fluctuation. If the price rises to this level, your stop loss order is triggered, and your position is covered, again preventing further losses.

The Benefits of Using Stop Loss

The primary benefit of using a stop loss is that it removes the emotional aspect from your trading decisions. It can prevent traders from holding on to losing positions in the hope that the price will bounce back. It also allows traders to define their risk tolerance on each trade, providing a safety net against substantial losses.

Strategic Use of Stop Loss

While stop loss is an effective tool, it’s important to use it strategically. Setting your stop loss too close to your entry price can result in your position being closed out prematurely due to normal market volatility. On the other hand, setting it too far away might result in larger than necessary losses. Therefore, it’s crucial to find a balance that suits your risk tolerance and the specific market conditions.

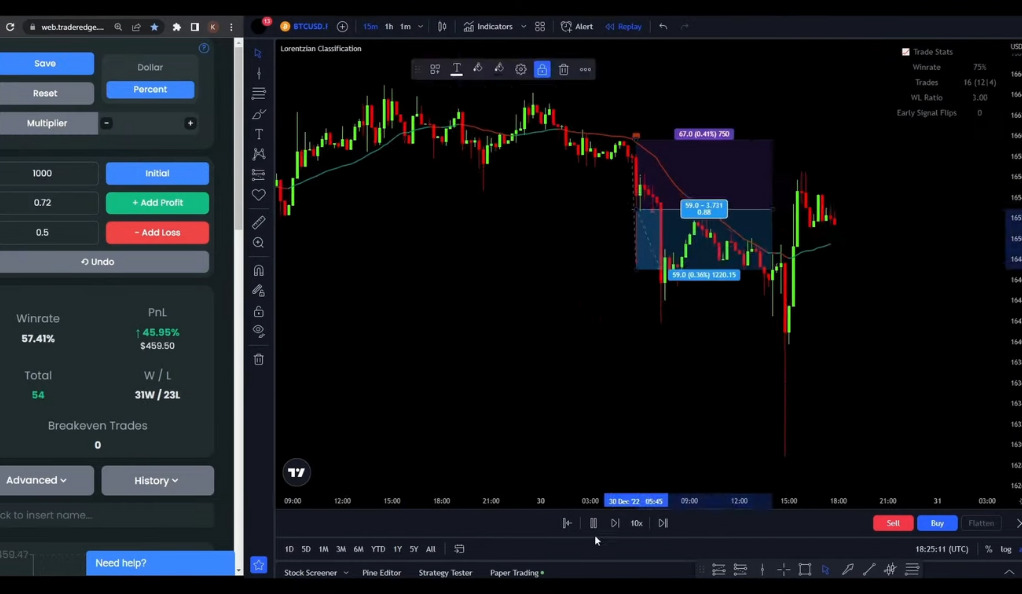

Backtesting Your Strategy: The Importance of Historical Data

Backtesting is a critical step in validating your strategy. It involves applying your strategy to historical market data to see how it would have performed. Using a tool like the Traders Edge app, you can simulate your strategy with historical data. This gives you a clear picture of how your strategy would have performed in the past, providing valuable insights that can help you refine your strategy.

The Results: Proof is in the Numbers

After backtesting with an initial balance of $1,000 and using 2x leverage, the AI indicator strategy had a win rate of 54% and made a profit of 61% over four months. These results show the potential of this strategy. However, it’s important to remember that past performance is not a guarantee of future results. Always use caution and conduct your own research when implementing a new strategy.

Conclusion

In conclusion, the AI indicator strategy offers a promising way to enhance your cryptocurrency trading. By customizing the AI indicator, incorporating EMA and SMA filters, and using a clear entry and exit strategy, you can potentially increase your win rate and profits. However, as with any trading strategy, it’s essential to do your own research, backtest the strategy, and always be aware of the risks involved. Remember, trading is not a guaranteed way to make money, but with the right tools and strategies, you can increase your chances of success.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)