As financial markets become increasingly complex, the need for sophisticated tools to navigate these waters has become apparent. With its ability to learn from data and make predictions, has emerged as a game-changer. It has revolutionized trading strategies, making them more efficient, and has significantly improved decision-making processes in trading.

One of the most intriguing developments in this area is the advent of AI-based trading strategies. These strategies leverage the power to predict market movements and make trading decisions. One such strategy, boasts a win rate of 74% and a profit of 427% after 100 trades. However, as promising as these figures may seem, it’s crucial to understand the intricacies of this strategy, its potential benefits, and most importantly, the importance of backtesting before implementation. Backtesting allows traders to evaluate the strategy’s effectiveness and adjust it as necessary, ensuring that it’s tailored to their specific trading needs and goals.

The Advent of AI in Trading

The advent of Artificial Intelligence (AI) has been a transformative force across various industries. Its ability to learn from data, adapt to patterns, and make intelligent predictions has made it a powerful tool in many fields. The financial sector, with its complex data patterns and high stakes, is no exception. AI’s capabilities have been harnessed to create sophisticated models that can analyze market trends, making it a game-changer in the world of trading.

By leveraging machine learning and predictive analytics, AI has the potential to significantly transform trading. Machine learning algorithms can analyze vast amounts of data at lightning speed, identifying patterns and trends that would be impossible for a human to discern. Predictive analytics, on the other hand, uses this data to forecast future market movements. Together, these capabilities can make trading more efficient and profitable, opening up new possibilities for traders and investors alike.

The AI-Based Trading Strategy: A Closer Look

In the realm of AI-based trading strategies, one particular approach has garnered attention. This strategy, stands out with its impressive claim of a 74% win rate and a profit of 427% after 100 trades. These figures are certainly eye-catching, but it’s the strategy’s versatility that truly sets it apart.

Designed to function across markets with high daily volume, this strategy is not limited to a specific market. It can be applied to various financial markets, such as Forex and crypto, making it a versatile tool for traders. Moreover, it’s adaptable to various time frames. Whether you’re looking at a 5-minute, 15-minute, or even a one-hour chart, this strategy can be effectively utilized. This flexibility allows traders to tailor their use of the strategy to their specific trading style and goals.

The Power of Three: Key Indicators

The AI-based trading strategy under discussion harnesses the power of three key trading view indicators. These are the Machine Learning K N Based Strategy by Capissimo, Momentum Deviation Bands by Locks, and Step M A Filtered Stochastic by Locks. These indicators are freely available, making the strategy accessible for traders of all levels.

Each of these indicators plays a pivotal role in the successful execution of the strategy. They work in tandem to provide traders with valuable insights, helping to determine the optimal times to enter and exit trades. By analyzing various market conditions and trends, these indicators provide a comprehensive view of the market, thereby aiding in making informed trading decisions.

Customizing the Indicators

To harness the full potential of the trading indicators used in this AI-based strategy, customization is crucial. Each indicator has its own set of parameters that can be adjusted to better suit the market conditions and the trader’s individual style. This flexibility allows traders to fine-tune the indicators to their specific needs, thereby maximizing their effectiveness.

These detailed instructions are invaluable, as they enable traders to optimize the performance of each indicator. By understanding how to customize these tools, traders can ensure they are getting the most accurate and useful information to inform their trading decisions.

Entering Long and Short Positions

The AI-based trading strategy offers a clear framework for entering both long and short positions. For a long position, the strategy requires the alignment of three specific conditions. The first condition is the generation of a blue Buy Signal from the machine learning indicator. This signal is an indication of a potential upward trend in the market, suggesting that it might be an opportune time to buy.

In addition to the Buy Signal, the momentum line should be colored green. This green color is indicative of positive momentum, further reinforcing the decision to enter a long position. The third condition involves the stochastic line, another crucial indicator in this strategy. This line should be green and positioned below the 80 level, suggesting that the asset is not overbought and there may be room for further price increases.

On the flip side, for short positions, the opposite conditions are required. These rules are designed to help traders identify potential trading opportunities and make informed decisions. By adhering to these guidelines, traders can navigate the market with a higher degree of confidence and precision, potentially leading to more successful trades.

The Importance of Timing

Timing is a critical aspect of any trading strategy, and this AI-based strategy is no exception. The precise moment of trade entry can significantly impact the outcome of the trade. It’s not just about identifying the right signals; it’s also about acting on them at the right time.

The speaker in the video emphasizes the importance of waiting for the candlestick to close before entering a trade. This is because the signals generated by the machine learning indicator can disappear or change until the candlestick is fully formed. By waiting for the candlestick to close, traders can ensure they are acting on reliable signals, thereby increasing their chances of a successful trade.

Backtesting: A Crucial Step

Backtesting is a crucial step in the process of implementing any trading strategy. It involves applying the strategy to historical data to evaluate its performance under various market conditions. This step is essential as it allows traders to assess the effectiveness of the strategy and make necessary adjustments before using it in live trading.

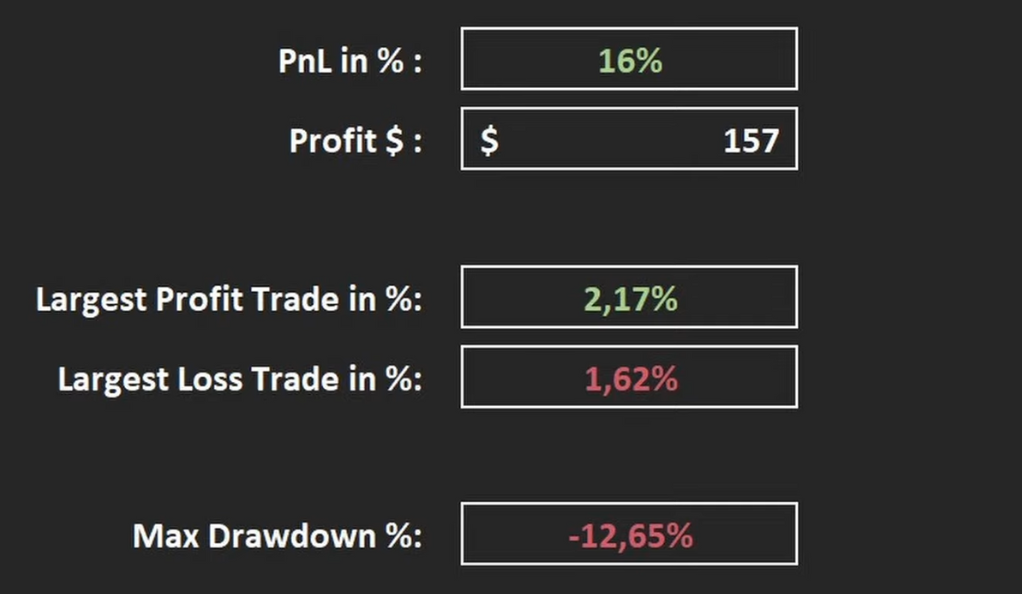

Demonstrates the importance of backtesting by applying the AI-based strategy to past market data. Starting with an initial balance of $1,000 and using 2x leverage, the speaker conducted 100 trades. The result was an increase in the account size to almost $1,160, translating to a profit of 16%. This exercise underscores the potential profitability of the strategy when applied correctly and the importance of backtesting in validating its effectiveness.

Interpreting the Results

Interpreting the results of backtesting is an integral part of the trading process. The backtest conducted by the speaker in the video provides a practical example. At first glance, the results may not seem extraordinary. However, when you consider the average daily gain of 0.36% on a five-minute time frame, the results become quite impressive. This seemingly small gain, when accumulated over time, can lead to substantial profits, highlighting the potential effectiveness of the strategy.

However, it’s essential to approach these results with a balanced perspective. In the world of trading, promises of quick riches are often misleading and can lead to significant losses. It’s crucial to maintain a realistic outlook and not get swayed by the allure of high profits.

The speaker further encourages traders to test strategies themselves. This hands-on approach ensures that traders fully understand the strategy and can adapt it to their unique trading style and market conditions. By doing so, traders can gain confidence in the strategy and be better prepared to handle the dynamic nature of the markets.

The Human Element in AI Trading

Despite the significant advancements in AI and its application in trading, the human element remains a crucial component. AI can analyze vast amounts of data and identify patterns far beyond human capabilities. However, it’s the trader who makes the final decision, bringing their unique perspective, experience, and intuition to the table.

Before implementing any strategy, including AI-based ones, traders should engage in paper trading. This practice allows traders to test the strategy in a risk-free environment, gaining familiarity and confidence before risking real money. Additionally, sharing thoughts and ideas about the strategy with others can provide valuable insights and perspectives, further enhancing the trading process.

Conclusion

Artificial Intelligence has undeniably revolutionized trading, introducing strategies that promise high win rates and substantial profits. These AI-based strategies, backed by sophisticated algorithms and machine learning, have the potential to transform the way we trade, making it more efficient and potentially more profitable.

However, it’s crucial to approach these strategies with a critical eye. Thorough backtesting is essential to validate their effectiveness and suitability for individual trading styles. Moreover, the human element in trading should never be overlooked. Despite the power of AI, human intuition, experience, and judgment play a vital role in trading decisions. After all, in the world of finance, there’s no such thing as a sure bet.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)