In the vast world of trading, strategies are as diverse as the traders who use them. One such strategy, brought to light by a YouTube channel called Power of Trading, has been making waves in the trading community. This strategy, which involves the use of two Tradingview indicators on Heikin Ashi candles, is said to be a game-changer. But how effective is it really? Let’s delve deeper into this intriguing approach.

The world of trading is a complex and dynamic environment where strategies and techniques are constantly evolving. Traders are always on the lookout for new ways to maximize their profits and minimize their risks. In this context, the Power of Trading’s strategy has emerged as a promising approach. By combining the use of two Tradingview indicators with Heikin Ashi candles, this strategy offers a unique perspective on market trends and potential trading opportunities.

Understanding the Strategy

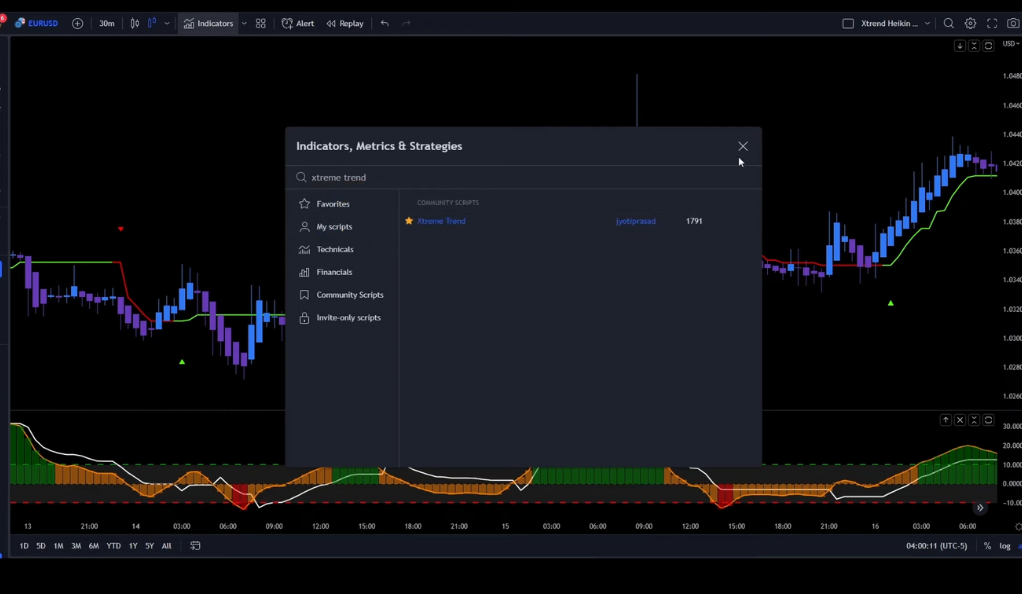

The Power of Trading’s strategy is a unique blend of simplicity and effectiveness. It employs two specific Tradingview indicators on Heikin Ashi candles, a type of price chart that originated in Japan. These indicators are not randomly chosen; they are meticulously selected to identify potential buy and sell areas across various markets. The Heikin Ashi candles, known for their ability to filter out market noise and better identify trends, serve as an ideal tool for this strategy. This combination provides a unique perspective on market trends, enabling traders to make informed decisions and potentially enhance their profitability.

The Power of Trading’s Approach

The Power of Trading’s strategy is unique in its simplicity. It involves the use of two Tradingview indicators on Heikin Ashi candles. These indicators are not just random tools; they are carefully selected to identify potential buy and sell areas in any market.

The beauty of this strategy lies in its simplicity and effectiveness. By using two specific Tradingview indicators, traders can gain a clear understanding of market trends and potential trading opportunities. These indicators, when applied to Heikin Ashi candles, provide a unique perspective on the market, allowing traders to make informed decisions and potentially increase their profits.

The Role of Heikin Ashi Candles

Heikin Ashi candles are a type of price chart that originated in Japan. Unlike traditional candlestick charts, Heikin Ashi candles help traders filter out market noise and better identify trends. This makes them an ideal tool for this strategy.

Heikin Ashi candles are a powerful tool in the trader’s arsenal. They offer a unique perspective on market trends, helping traders filter out the noise and focus on the underlying trends. This makes them an ideal tool for the Power of Trading’s strategy. By applying two specific Tradingview indicators to Heikin Ashi candles, traders can gain a clear understanding of market trends and potential trading opportunities.

Backtesting the Strategy

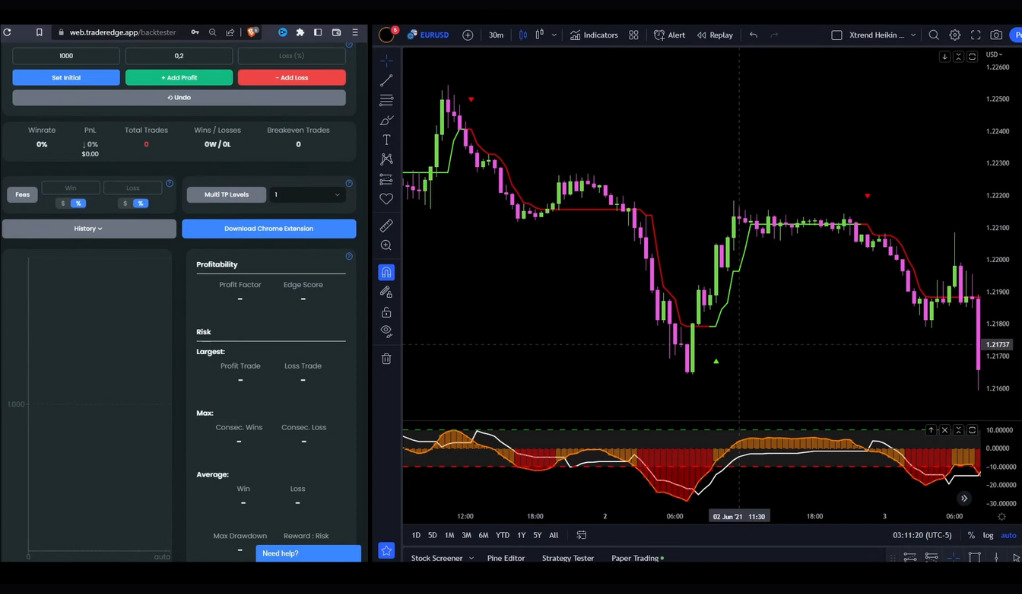

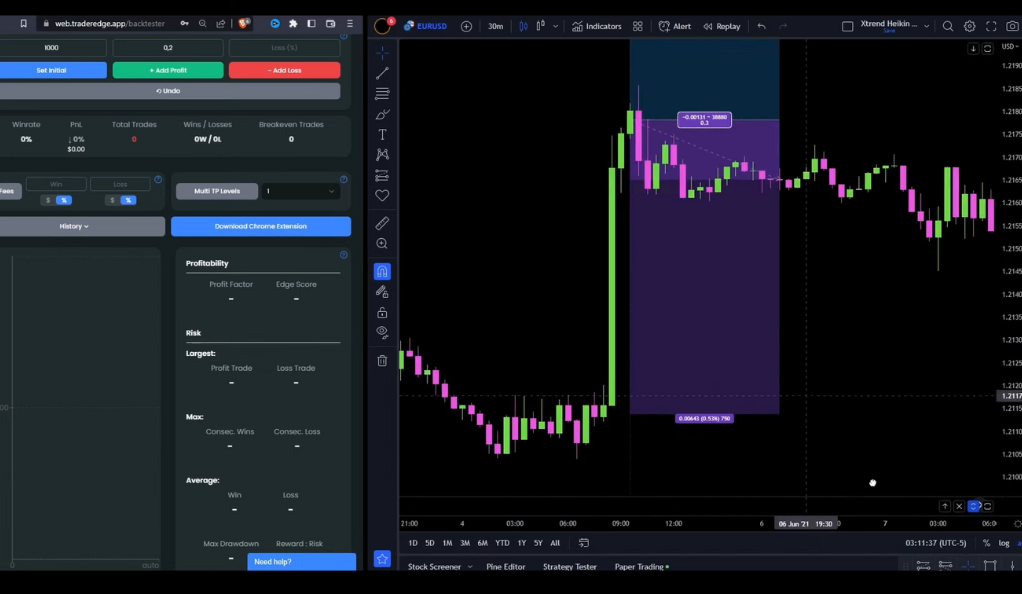

To gauge the effectiveness of this strategy, the author used Traders Edge, a tool designed for backtesting trading strategies across different markets and timeframes. In this instance, the strategy was tested on the Euro USD 30 Minutes Chart. Backtesting is a crucial step in validating a trading strategy as it provides insights into its potential effectiveness before risking real money. The results of the backtest, which involved 100 trades, were revealing and provided a clear picture of the strategy’s potential.

Using Traders Edge

To test the effectiveness of this strategy, the author used a tool called Traders Edge. This tool is designed to backtest trading strategies on various markets and timeframes. In this case, the author tested the strategy on the Euro USD 30 Minutes Chart.

Traders Edge is a powerful tool that allows traders to backtest their strategies on various markets and timeframes. This provides invaluable insights into the effectiveness of a strategy, allowing traders to fine-tune their approach before risking real money. In this case, the author used Traders Edge to backtest the Power of Trading’s strategy on the Euro USD 30 Minutes Chart, providing a clear picture of its potential effectiveness.

The Results

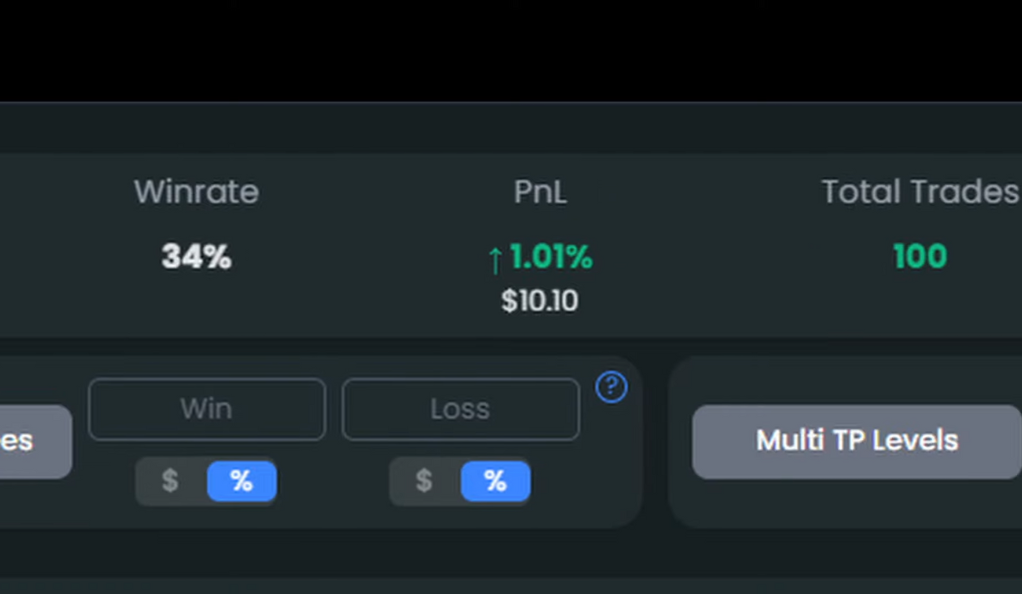

The backtest results were quite revealing. After 100 trades, the strategy showed a win rate of 34%. While this might not seem impressive at first glance, it’s important to remember that trading is not about winning every trade, but about overall profitability. And in this regard, the strategy didn’t disappoint, yielding a profit of 1%.

The results of the backtest were quite revealing. Despite a win rate of only 34%, the strategy proved to be profitable, yielding a profit of 1% after 100 trades. This highlights the importance of looking beyond the win rate when evaluating a trading strategy. It’s not about winning every trade, but about making a profit in the long run. And in this regard, the Power of Trading’s strategy certainly delivers.

Interpreting the Results

The backtest results showed a win rate of 34% and a profit of 1% after 100 trades. While a 34% win rate might seem low, it’s crucial to remember that trading isn’t about winning every trade but about overall profitability. The strategy proved profitable despite the seemingly low win rate. This highlights the importance of looking beyond the win rate when evaluating a trading strategy. The consistency of the strategy, with a steady win rate and a positive return, underscores the effectiveness of a well-executed plan in trading.

Win Rate and Profitability

In the world of trading, a 34% win rate might initially seem low. However, it’s crucial to remember that trading isn’t solely about the number of wins. It’s about the size of the wins versus the losses. In this case, the Power of Trading’s strategy proved profitable, yielding a 1% profit after 100 trades. This highlights an important aspect of trading that is often misunderstood: the relationship between win rate and profitability.

Win rate, or the percentage of trades that result in a profit, is only one part of the equation. A high win rate is certainly desirable, but it doesn’t guarantee profitability. A trader could win 90% of their trades, but if the losses on the remaining 10% are large enough, they could still end up losing money overall. Conversely, a trader could have a win rate of less than 50%, but if their winning trades are significantly larger than their losing ones, they could still be profitable.

This is where the concept of risk-reward ratio comes into play. This ratio compares the potential profit of a trade to the potential loss. A strategy with a high risk-reward ratio can be profitable even with a lower win rate, as the profits from winning trades outweigh the losses from losing trades. The Power of Trading’s strategy demonstrates this principle. Despite a win rate of only 34%, it was able to generate a profit, indicating that the winning trades were sufficiently profitable to cover the losses from the losing trades.

Profitability, therefore, is not just about winning more trades, but about managing risk and maximizing the profits from winning trades. This is a critical lesson for all traders and a key factor in the success of the Power of Trading’s strategy.

The Power of Consistency

The strength of the Power of Trading’s strategy lies in its consistency. Despite a win rate of only 34%, it consistently yielded a positive return, demonstrating the effectiveness of a well-executed plan. This highlights the importance of consistency in trading. It’s not about winning every trade, but about consistently making a profit in the long run.

Consistency in trading is often overlooked, but it is a critical factor in long-term success. A strategy that consistently yields positive returns, even if the win rate is not exceptionally high, can be more effective than a strategy with a high win rate but erratic returns.

The Power of Trading’s strategy exemplifies this principle. It may not win every trade, but it consistently delivers positive returns, proving that a well-planned and executed strategy can lead to success over time. This consistency also helps in managing risk and maintaining emotional balance, which are crucial aspects of successful trading.

Moreover, consistency in applying a strategy also allows for more accurate analysis and refinement. By sticking to the plan and executing it consistently, traders can gather valuable data about the strategy’s performance, identify areas for improvement, and make necessary adjustments. This iterative process of consistent application, analysis, and refinement can lead to continuous improvement and increased profitability over time.

Conclusion

In conclusion, the Power of Trading’s strategy offers a unique approach to trading. By using two Tradingview indicators on Heikin Ashi candles, it provides a clear method to identify potential buy and sell areas. While the win rate might not seem high, the overall profitability of the strategy proves its effectiveness. As with any trading strategy, it’s crucial to remember that results can vary, and past performance is not indicative of future results. However, this strategy’s backtest results certainly make it worth considering for those in search of a consistent and profitable approach to trading.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)