In the world of trading, everyone is on the lookout for a strategy that can provide a high win ratio. Today, we’re going to delve into a simple trading strategy that claims to have a win ratio of over 80% on a five-minute chart. This strategy is based on two indicators: the Edgeway Extreme Points Buy/Sell by Spuddo and the EMA (Exponential Moving Average) with a length set to 100. Intrigued? Let’s dive in!

This trading strategy is not merely about the allure of high returns; it’s a testament to the power of simplicity and adaptability in the often complex world of trading. It’s meticulously designed to maximize trading efforts, eliminating the need for intricate chart patterns or complex calculations that often serve as barriers for many traders. The strategy’s simplicity does not compromise its effectiveness, making it an accessible tool for both seasoned traders and those new to the trading scene. Its adaptability allows it to be tailored to various market conditions and individual risk tolerances, making it a versatile tool in any trader’s arsenal. Whether you’re an experienced trader looking to diversify your strategies or a beginner seeking a straightforward yet effective approach, this strategy could potentially revolutionize your trading portfolio, paving the way for improved trading performance.

Strategy Overview: Simplicity at Its Best

The beauty of this strategy lies in its simplicity. It doesn’t use a stop loss or take profit target. Instead, it buys when two conditions are met: the Extreme Points Buy/Sell indicator gives a buy alert, and the price is below the EMA. The position runs until a sell signal is given. For sell trades, the rules are the opposite. The strategy recommends using leverage no higher than 5:1. Sounds simple, right? But how does it all come together?

While this trading strategy is simple in its design, it is far from being simplistic. It is a carefully crafted approach that harnesses the strength of two reliable indicators: the Edgeway Extreme Points Buy/Sell by Spuddo and the EMA. The strategy’s power lies in its focus on these two indicators and the interplay between them. By doing so, it can pinpoint potential trading opportunities that might be overlooked in more complex strategies. This approach underscores the principle that simplicity can often lead to clarity, allowing traders to cut through the noise of the market and focus on what truly matters. It’s a practical embodiment of the wisdom in the saying “less is more,” demonstrating that a streamlined, focused strategy can often outperform more convoluted methods in identifying profitable trading opportunities.

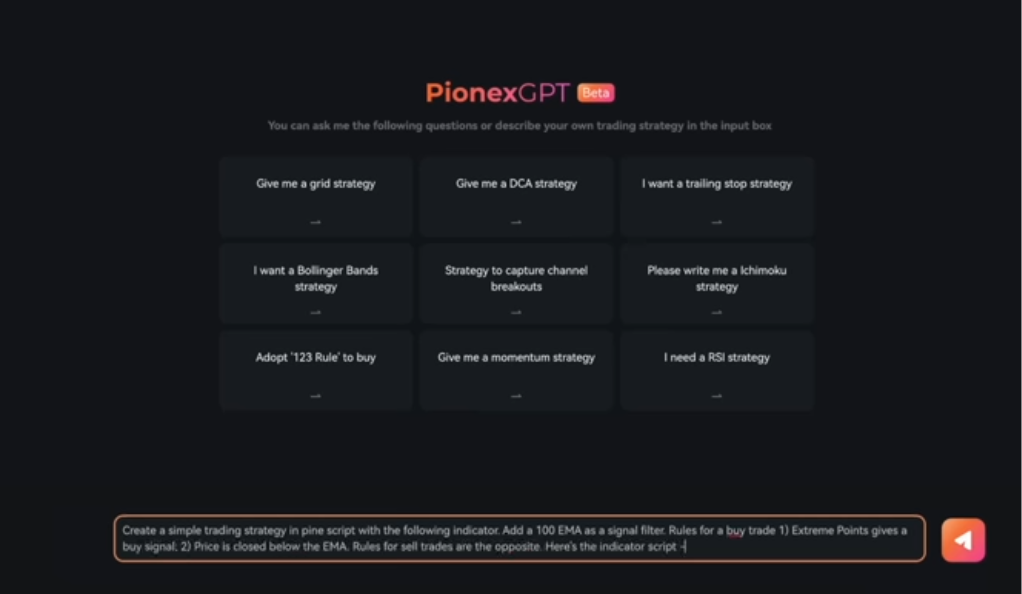

Script Creation: The Magic of PionexGPT

To bring this strategy to life, we combine these two indicators into one script using PionexGPT, a chat GPT alternative developed specifically for coding trading strategies. The script is then pasted into the Pine Editor and added to the chart. But what if you want to tweak the strategy to suit your trading style?

PionexGPT is a potent tool that revolutionizes the process of coding trading strategies, transforming it from a potentially complex task into a straightforward, user-friendly experience. Regardless of your coding proficiency, PionexGPT empowers you to create a script that encapsulates your trading strategy, effectively bridging the gap between technical expertise and trading acumen. It’s akin to having a personal assistant who specializes in coding trading strategies, ready to translate your trading ideas into a functional script. This allows you to channel your energy and focus on refining your strategy and making strategic decisions, rather than grappling with the intricacies of code. In essence, PionexGPT democratizes the process of strategy creation, making it accessible to traders of all levels of technical expertise.

Strategy Modification: Tailoring to Your Needs

The strategy’s inputs can be modified in the strategy tester. For example, the entry signal source can be changed from CCI to momentum, and the indicator’s length, RSI overbought and oversold levels, and RSI length can be adjusted. This flexibility allows you to tailor the strategy to your specific needs and risk tolerance.

The capacity to modify this trading strategy is a substantial benefit that underscores its flexibility and adaptability. This feature enables you to customize the strategy to align with your unique trading style, risk tolerance, and the ever-changing market conditions. Unlike rigid, one-size-fits-all strategies, this approach allows for a personalized trading plan that caters specifically to your needs and preferences. It’s akin to tailoring a suit to fit perfectly, ensuring maximum comfort and optimal performance. This level of customization puts you firmly in the driver’s seat of your trading journey, empowering you to make strategic adjustments that can enhance your trading performance and potential profitability. It’s a strategy that not only works for you but also works with you, adapting to your individual trading landscape.

Backtesting Results: The Proof is in the Pudding

The backtest results on the ETH/USDT price chart with a 15-minute timeframe showed a win ratio of 71% out of 78 closed trades, a net profit of 87, and a maximum drawdown of 29. I suggest adding a volume filter to the script to eliminate more losing trades. But what about the risk of significant drawdowns?

Backtesting is an indispensable component in the process of validating any trading strategy. It serves as a time machine of sorts, enabling you to retrospectively apply your strategy to historical data to assess its past performance. This retrospective analysis provides a glimpse into the strategy’s potential future performance, offering a predictive lens through which you can view your strategy. While it’s important to remember that past performance doesn’t guarantee future results, backtesting can yield valuable insights. It can highlight potential strengths and weaknesses of the strategy, reveal its risk and return characteristics, and help identify optimal parameters. These insights can guide you in fine-tuning your strategy and making informed trading decisions, thereby enhancing your preparedness for the dynamic nature of the markets. Backtesting, therefore, is not just a step in strategy validation, but a powerful tool for strategy optimization and risk management.

Drawdown Management: Keeping Risks in Check

The strategy can lead to significant drawdowns due to the lack of a stop loss. To manage this, I suggest implementing the Super Trend indicator into the strategy for exiting a losing trade earlier. This way, you can keep your losses small and your wins big.

Drawdowns, or the decline in the value of an investment or trading account, are an inherent part of trading. However, accepting large drawdowns is not a prerequisite for trading. By incorporating the Super Trend indicator as an exit strategy, you can potentially mitigate your losses and curtail drawdowns. The Super Trend indicator serves as a dynamic line of defense, helping you exit trades that are not going in your favor, thereby limiting potential losses. This approach is a strategic way to manage risk while still capitalizing on trading opportunities. It’s akin to having a safety net that catches you when a trade falls, allowing you to get back up and continue trading. This risk management technique not only helps preserve your trading capital but also ensures that you are better positioned to take advantage of future trading opportunities. It’s a smart, proactive approach to trading that balances risk and reward.

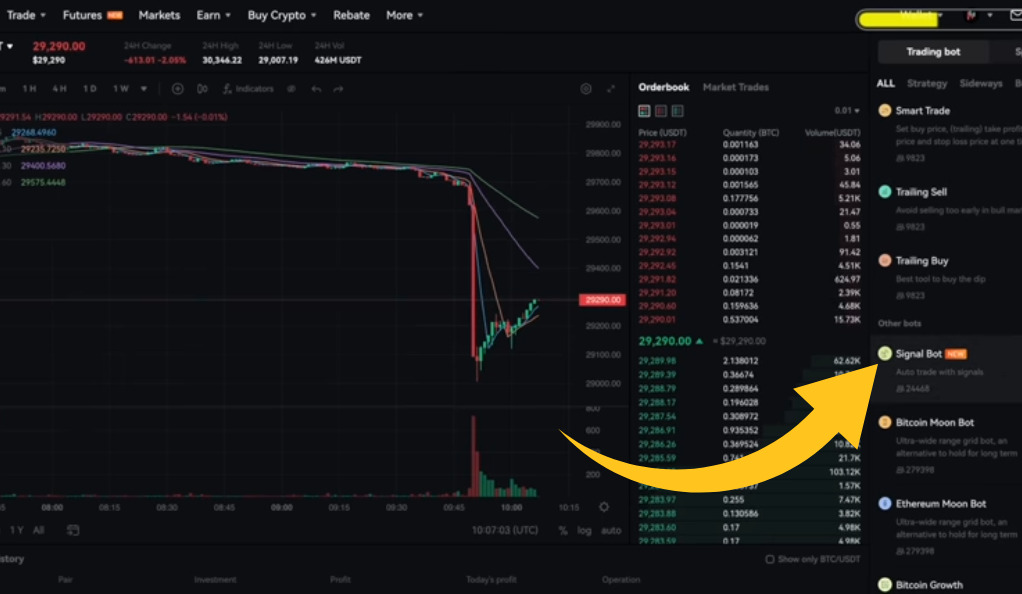

Bot Automation: Let the Bot Do the Work

The strategy can be automated into a trading bot using Pionex. The bot copies signals directly from the strategy on TradingView. I suggest testing the bot on a paper account before using it on a real account. This way, you can ensure the bot performs as expected before risking real money.

Bot automation in trading transcends mere convenience; it’s a powerful tool for achieving consistency in executing your trading strategy. A trading bot operates with machine precision, adhering strictly to your predefined strategy. It’s immune to the emotional swings and cognitive biases that often affect human traders, ensuring that your trading decisions are based solely on your strategy, not on fear or greed. Moreover, a bot is not subject to fatigue or distractions, effectively offering you a tireless trader that works around the clock, scanning the markets for trading opportunities even while you sleep. With Pionex, setting up a trading bot is a straightforward process, making this powerful tool accessible even to novice traders. In essence, a trading bot is like a dedicated personal trader, relentlessly executing your strategy and helping you strive for consistency in your trading results, which is often a key determinant of long-term trading success.

Conclusion

In conclusion, this simple trading strategy, based on the Edgeway Extreme Points Buy/Sell by Spuddo and the EMA, offers a promising win ratio. With its flexibility, ease of automation, and risk management features, it could be a valuable addition to your trading toolkit. Remember, while the strategy claims to have a high win ratio, it’s important to do your own research and consider the risks before implementing any trading strategy. Happy trading!

This strategy is a testament to the power of simplicity and adaptability in trading. It shows that you don’t need a complex strategy to achieve high win ratios. With the right indicators, a flexible approach, and effective risk management, you can create a trading strategy that delivers results. So why not give it a try? You might be pleasantly surprised by what you can achieve.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)