In the fast-paced world of cryptocurrency trading, various strategies and indicators abound, each promising impressive results. One such strategy that has gained attention is the “Smarter Money + ABC” trading approach. Claiming a notable win rate of 60-80% on the 15-minute timeframe, this strategy has intrigued many traders seeking an edge in the market. However, before fully embracing it, it is essential to approach such claims with caution and thoroughly test the strategy in real trading scenarios.

Cryptocurrency markets can be highly volatile and subject to sudden changes, so traders should exercise diligence and not solely rely on unverified claims, even from well-known sources. It is advisable to thoroughly research, backtest, and potentially experiment with the strategy using a demo account or with a small amount of capital to gauge its effectiveness and compatibility with one’s trading style and risk tolerance. Additionally, seeking insights from multiple reputable sources, and combining elements from various strategies, can often lead to a more well-rounded approach to cryptocurrency trading.

Accessing the Strategy

After paying the monthly fee of €18.60 to access the “Smarter Money + ABC” indicator, I gained access to the trading strategy. While the initial cost might appear significant, the potential for a high win rate and successful trades could make it a worthwhile investment in the long run. However, as with any trading strategy, there are inherent risks involved, and it is crucial to exercise caution and trade responsibly.

For the purpose of backtesting the strategy, I opted to use Bybit, a well-known cryptocurrency trading platform. Backtesting involves testing the strategy using historical market data to simulate real trading conditions without risking actual capital. This allows for a better understanding of how the strategy performs under different market scenarios and can help identify potential strengths and weaknesses. It is important to remember that past performance is not indicative of future results, and live trading might produce different outcomes. Therefore, while backtesting can provide valuable insights, it is essential to combine it with ongoing observation and analysis in real trading situations. As I embark on testing the “Smarter Money + ABC” strategy, I approach it with an open mind, prepared to learn and adapt based on actual market dynamics and outcomes.

The Trading Process

In the “Smarter Money + ABC” trading strategy, the trading process employed a combination of market orders for entry and stop loss, along with limit orders for exit. Market orders were used to enter a trade at the prevailing market price, providing a quick execution but potentially exposing the trader to slippage during highly volatile market conditions. Stop-loss orders were utilized to manage risk, automatically triggering a sell order if the trade moved against the trader beyond a predetermined level, helping to limit potential losses. On the other hand, limit orders were employed to exit the trade once a specific profit target was reached, aiming to secure gains at a pre-defined price level. This approach allowed for a balanced approach to risk management and potential profit, crucial elements in successful trading.

During the trading process, a position size of 100 was set per trade, which means each trade had a fixed value. Additionally, a leverage of 25x was applied. Leverage allows traders to control a larger position with a smaller amount of capital, potentially magnifying profits. However, it is essential to recognize that leverage also amplifies losses, making it a high-risk tool that requires careful consideration and risk management. While leverage can be appealing due to its profit-boosting potential, traders must exercise discipline and prudence, as excessive leverage can lead to significant losses if not managed properly. Overall, the trading process utilized a combination of different order types and position sizing strategies to maximize potential gains while minimizing risk exposure.

The Backtesting Process

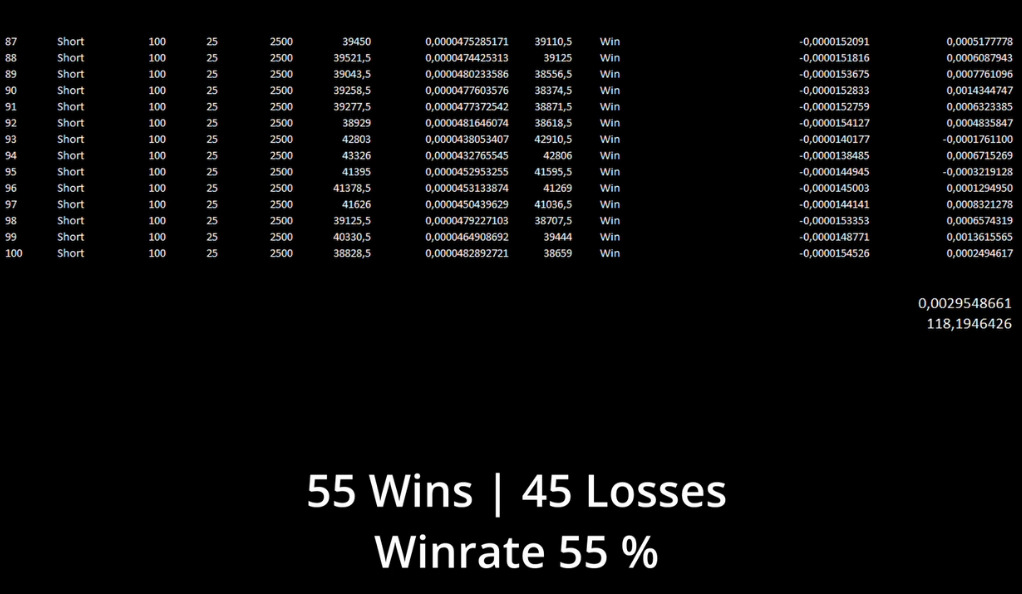

Backtesting the “Smarter Money + ABC” trading strategy involved applying it to historical cryptocurrency market data. By conducting the backtest 100 times, a substantial sample size was achieved, allowing for a more reliable assessment of the strategy’s performance and statistical significance. During the backtesting process, each trade’s entry and exit points were simulated based on the strategy’s rules and indicators, using the historical price data available for the chosen cryptocurrency asset. This process enabled the evaluation of the strategy’s effectiveness across various market conditions and price movements.

Analyzing the backtest results involved examining key performance metrics such as the overall win rate, average profit and loss, maximum drawdown, and the profit-to-loss ratio. These metrics help gauge the strategy’s profitability, risk-reward ratio, and its ability to withstand adverse market conditions. Additionally, the backtesting process allowed for the identification of potential flaws or areas for improvement in the strategy. It’s important to note that while backtesting provides valuable insights, it is still a simulation and might not perfectly mirror real-world trading dynamics. Therefore, once the backtesting phase is completed, further validation through live trading with a small amount of capital or using a demo account is essential to ascertain the strategy’s practicality and real-world performance. Continuous monitoring and adaptation based on changing market conditions are also crucial to maintaining the strategy’s effectiveness over time.

The Results

Upon analyzing the backtest results of the “Smarter Money + ABC” trading strategy, it revealed a total profit of 0.0029548661 Bitcoin, equivalent to $118, after executing 100 trades. While this may not appear substantial at first glance, it is essential to consider the context of this outcome. Backtesting is typically conducted over a specific historical period, and the sample size of 100 trades might not be sufficient to fully capture the strategy’s potential. A larger dataset with more trades and data from various market conditions could provide a more accurate representation of the strategy’s long-term performance.

Real-world market dynamics can differ significantly from historical data, and cryptocurrency markets can be highly unpredictable. As a result, traders must approach the strategy cautiously and combine the backtest findings with ongoing observations during live trading. Moreover, continuously assessing and fine-tuning the strategy based on real-time market feedback is crucial for enhancing its effectiveness and optimizing potential profits. Responsible risk management and an adaptable approach are key elements in achieving long-term success in cryptocurrency trading.

Understanding the Win Rate

The win rate of a trading strategy, as promised by the “Smarter Money + ABC” approach, indicates the percentage of profitable trades out of the total number of trades executed. A win rate of 60-80% suggests that, on average, 60 to 80 trades out of every 100 would result in a profit. While a high win rate can be enticing and may instill a sense of confidence in the strategy’s effectiveness, it is crucial to recognize that profitability is not solely determined by the win rate. The size of the profits and losses incurred in each trade plays a significant role in determining the overall success of the strategy.

A trading strategy with a high win rate but small profits and large losses could still result in an overall negative outcome. On the other hand, a strategy with a lower win rate but substantial profits and limited losses might lead to higher overall profitability. The risk-reward ratio is an essential factor to consider when evaluating a trading strategy. Traders must aim for a balance between the win rate and the size of the profits and losses to achieve a favorable risk-reward profile. It is crucial to assess the strategy’s performance over a more extended period and a more extensive sample size to gain a more accurate understanding of its potential profitability and risk management capabilities. This involves combining the win rate with other performance metrics such as the average profit-to-loss ratio, maximum drawdown, and overall return on investment to form a comprehensive assessment of the strategy’s viability.

The Role of Leverage

Leverage is a powerful tool in trading that allows traders to control larger positions with a smaller amount of capital. In the context of the “Smarter Money + ABC” strategy, a leverage of 25x was employed, which means for every $1 in the trader’s account, they could trade up to $25 worth of assets. This high leverage offers the potential for significant profits, as even small price movements can result in amplified gains. However, it is essential to recognize that leverage also magnifies losses, making it a double-edged sword. The higher the leverage, the greater the risk exposure, and if the market moves against the trader’s position, losses can accumulate rapidly. Therefore, traders must exercise caution when using leverage and be prepared to manage risk diligently.

Due to the inherent risk associated with leverage, it is crucial to assess the risk-reward profile of a trade thoroughly. While higher leverage can enhance profitability, it also requires precise risk management. Implementing appropriate stop-loss orders and position sizing techniques becomes even more critical when trading with leverage. Traders should avoid overleveraging their positions, as this can lead to a significant loss of capital in adverse market conditions. Responsible use of leverage involves balancing the potential for profit with the risk of loss, ensuring that the trader’s account remains sufficiently capitalized to withstand market fluctuations. Overall, understanding the implications of leverage and using it judiciously can be instrumental in successful trading, particularly in the dynamic and volatile world of cryptocurrency markets.

Risk Management

Risk management is a crucial aspect of any trading strategy, and the “Smarter Money + ABC” approach incorporates sound risk management principles by utilizing stop loss orders. By employing market orders for entry and stop loss orders for exit, traders can mitigate potential losses and protect their capital from excessive risk. Stop loss orders act as a safety net, automatically triggering the sale of an asset if its price reaches a predefined level. This ensures that losses are limited to a predetermined amount, preventing significant drawdowns in the trader’s account. Implementing stop loss orders is particularly important in the highly volatile cryptocurrency markets, where price movements can be rapid and unpredictable. By defining clear exit points in advance, traders can take emotions out of the equation and maintain discipline even during turbulent market conditions.

Furthermore, incorporating stop loss orders also helps traders maintain a favorable risk-reward ratio. By capping potential losses and letting winning trades run, traders can aim for a risk-reward ratio that favors profitability over the long term. A disciplined and consistent risk management strategy is essential for the sustainability of a trading approach, especially when using leverage or trading in highly volatile markets. While no strategy can guarantee absolute success, effective risk management ensures that losses are controlled and manageable, allowing traders to stay in the game and seize profitable opportunities as they arise. As traders continue to refine and adapt their strategies, prudent risk management remains a critical pillar in navigating the challenges of cryptocurrency trading.

Conclusion

In conclusion, the “Smarter Money + ABC” trading strategy shows promise, with a decent win rate and potential for profit. However, like any trading strategy, it comes with risks, especially when using leverage. Therefore, it’s crucial for traders to understand these risks and implement sound risk management strategies. As always, remember that past performance is not indicative of future results, and every strategy should be backtested and validated before live trading.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.