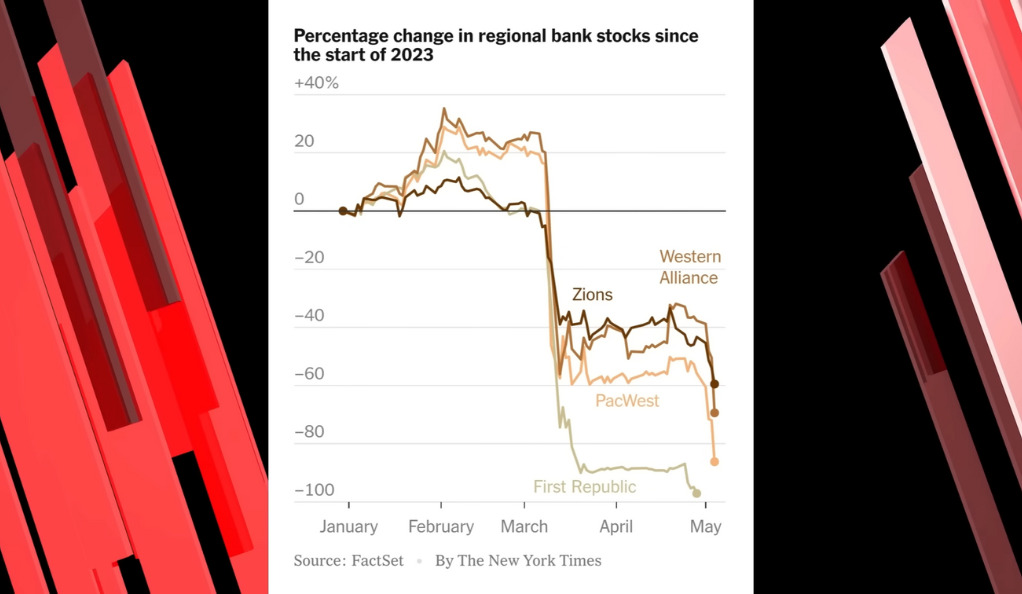

In the ever-changing landscape of financial markets, the role of short selling has become a subject of intense scrutiny and debate. The recent statement by Federal Reserve Chairman Jerome Powell, describing the U.S. banking system as “sound and resilient,” sparked both laughter and criticism. This seemingly humorous remark has opened a Pandora’s box of questions and concerns about the current state of banks and the role of short selling. Is the banking system really as robust as it’s portrayed? Or are there underlying vulnerabilities that are being overlooked? This introduction sets the stage for a comprehensive exploration of short selling, a complex and often misunderstood practice that has far-reaching implications for the banking sector.

The Taylor Swift Solution: A Humorous Take on a Serious Issue

In a world grappling with financial uncertainties, the idea of hiring pop sensation Taylor Swift to endorse Regional Banks might seem absurd. But this humorous proposal, made by a financial commentator, highlights a desperate need for innovative solutions in a troubled banking landscape. While the idea was met with disbelief and laughter, it serves as a metaphor for the unconventional thinking required to navigate the complex world of banking. Whether it’s celebrity endorsements or radical regulatory changes, the banking sector needs fresh perspectives and bold ideas to address its challenges. The “Taylor Swift Solution” may be a joke, but it underscores the seriousness of the issues at hand.

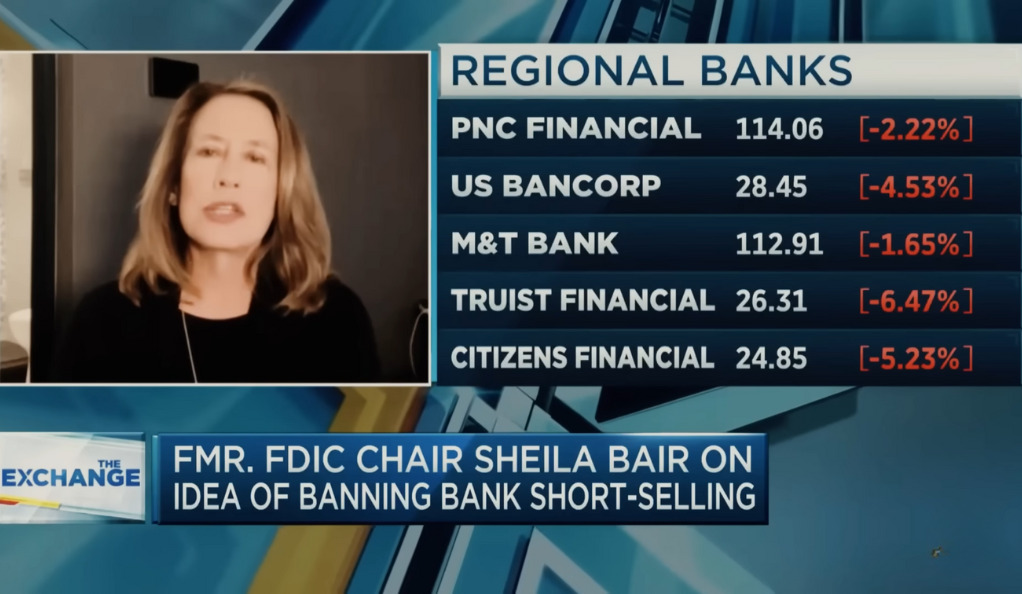

Sheila Blair’s Stance on Short Selling: Rational or Mistaken?

Former FDIC chair Sheila Blair’s comments on CNBC regarding short selling and the banking sector have stirred controversy. She seemed to support a short selling ban, a stance that has been criticized by many. But is she entirely wrong? Her perspective reflects a growing concern about the potential negative impact of short selling on financial stability. However, critics argue that short selling plays a vital role in market efficiency and transparency. Blair’s stance opens up a broader debate about the role of short selling in the financial system. Is it a necessary evil, or does it pose a genuine threat to financial stability? Her comments provide a starting point for a nuanced discussion on this complex issue.

Blaming Short Sellers for Bank Failures: A Misguided Accusation?

The narrative that short sellers are responsible for banks collapsing is a convenient but misguided accusation. It’s easy to point fingers at short sellers and portray them as villains, but this overlooks the real culprits: bad management practices, lack of oversight by the FED, and other underlying factors. Short sellers are often blamed for driving down stock prices and causing financial instability, but they also play a vital role in uncovering fraud and mismanagement. By focusing solely on short sellers, we risk ignoring the deeper systemic issues that contribute to bank failures. A more balanced and informed perspective is needed to understand the true dynamics at play.

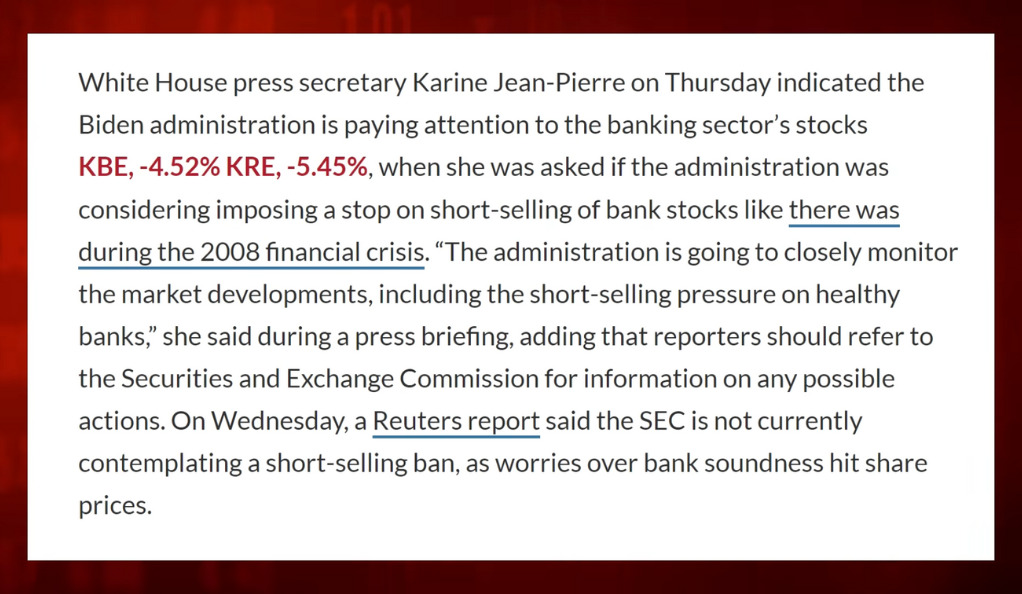

White House and SEC’s Stance on Short Selling: A Balanced Approach?

The White House’s monitoring of short selling pressure on bank stocks and the SEC’s position on short-selling bans reflect a cautious and balanced approach. But is this enough? On one hand, short selling is seen as a legitimate investment strategy that contributes to market efficiency. On the other hand, there are concerns that unchecked short selling can lead to market manipulation and financial instability. The White House and SEC’s stance highlights the delicate balance that regulators must strike between promoting market integrity and preserving investor freedom. It’s a complex issue that requires careful consideration and a nuanced understanding of the potential risks and benefits of short selling.

Short Sellers’ Role in Warning Markets: Unsung Heroes?

Contrary to popular belief, short sellers often play a vital role in warning markets about potential challenges. Far from being mere opportunists, they conduct thorough research, identify problems, and sometimes even act as whistleblowers. In the case of Regional Banks, short sellers were among the first to spot the looming crisis, while regulators and other authorities failed to see the warning signs. By vilifying short sellers, we risk overlooking their valuable contributions to market transparency and accountability. Recognizing their role as unsung heroes rather than villains may lead to a more informed and balanced perspective on the practice of short selling.

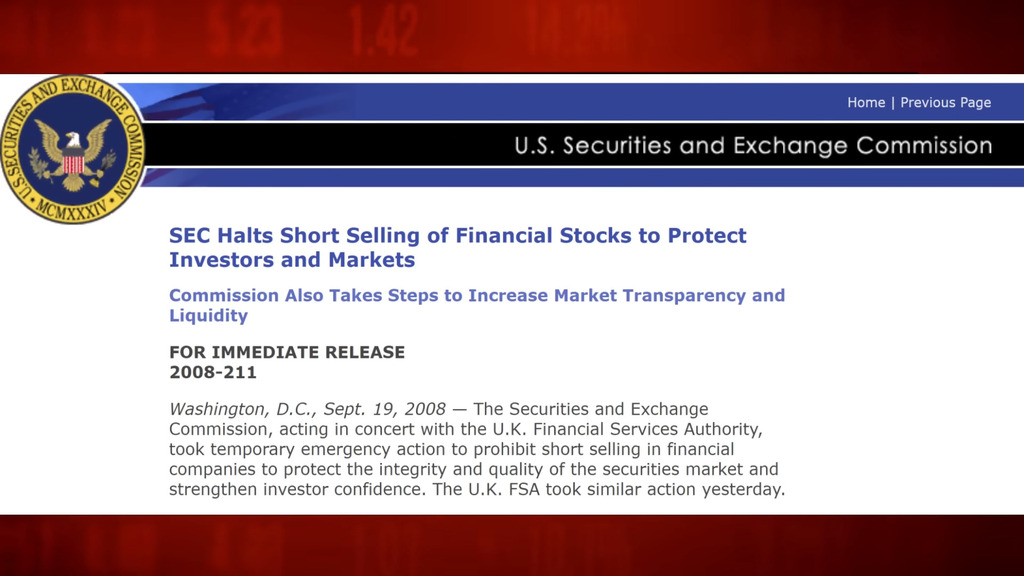

2008 Ban on Short Selling: A Lesson from History

The 2008 ban on short selling is a stark reminder of how well-intentioned regulations can lead to unintended consequences. Implemented during the financial crisis, the ban was intended to slow the decline in financial stocks. However, far from achieving its goal, the ban seemed to exacerbate the problem. Prices fell sharply during the ban and stabilized once it was lifted. This historical misstep offers valuable lessons for policymakers and regulators. It underscores the importance of understanding the complex dynamics of short selling and the potential risks of regulatory interventions. Learning from the past can help us navigate the future with greater wisdom and foresight.

Lehman Brothers and Short Selling: A Cautionary Tale

The collapse of Lehman Brothers and the role of short selling in it is a complex and cautionary tale. From the CEO’s aggressive stance against short sellers to the lavish lifestyles of its executives, the story of Lehman Brothers offers a window into the high-stakes world of finance. The failure of Lehman Brothers was not simply a result of short selling; it was a culmination of poor management, excessive risk-taking, and regulatory failures. Blaming short sellers for the collapse oversimplifies a multifaceted problem. The lessons from Lehman Brothers serve as a sobering reminder of the importance of responsible management, effective oversight, and the need for a nuanced understanding of the role of short selling.

Experts’ Opinions on Short Selling: A Diverse Spectrum

From Steve Forbes to Duke School of Business, opinions on short selling vary widely. Some see it as a necessary tool for market efficiency, while others view it as a potential threat to financial stability. The diverse spectrum of opinions reflects the complexity of short selling and the challenges of regulating it. Some experts argue that banning short selling is a mistake, as it can dampen overvaluation and curb excessive speculation. Others believe that restrictions are necessary to prevent market manipulation and protect investors. Navigating these diverse opinions requires a careful examination of the evidence, a willingness to engage with different perspectives, and a commitment to finding a balanced and informed approach.

GameStop and AMC Short Selling: A Modern Saga

The GameStop and AMC short selling saga has become a modern financial folklore. With hedge funds like Citadel making massive profits and retail investors caught in the crossfire, this saga offers a glimpse into the high-stakes world of short selling. The GameStop episode has raised questions about market manipulation, investor protection, and the role of social media in shaping investment decisions. It has also sparked a broader debate about the ethics and legality of short selling. The lessons from GameStop and AMC are still being unpacked, but they offer valuable insights into the dynamics of short selling in today’s interconnected and rapidly changing market landscape.

South Korea’s Experience with Short Selling: A Warning Sign?

South Korea’s ban on short selling led to market mania, widespread fraud, and a subsequent call for short sellers to return. This experience serves as a warning sign for other markets considering similar bans. The South Korean case illustrates the potential dangers of overregulating short selling. Without the checks and balances provided by short sellers, markets can become susceptible to manipulation, fraud, and irrational exuberance. South Korea’s experience underscores the importance of a balanced and informed approach to regulating short selling. It’s a cautionary tale that highlights the need for careful consideration, thoughtful regulation, and a recognition of the potential unintended consequences of regulatory interventions.

Dick Bove’s Comments on Short Sellers: A Meaningful Service

Analyst Dick Bove’s comments that short sellers are providing a “meaningful service” by forcing banks to stabilize their financial statements offer a refreshing perspective. Far from being mere opportunists, short sellers often act as watchdogs, holding companies accountable for their financial practices. Bove’s comments highlight the importance of recognizing the positive role that short sellers can play in promoting financial integrity and transparency. By challenging conventional wisdom and offering a more nuanced perspective, Bove’s insights contribute to a more balanced and informed understanding of short selling.

Lawyers’ and Bankers’ Push for Short Selling Ban: A Risky Proposition?

The push by lawyers and bankers for a short-selling ban is a risky proposition that could lead to a crash in bank stocks. While the intention may be to protect banks and restore confidence, history has shown that such bans can have the opposite effect. The 2008 experience serves as a stark reminder of the potential dangers of such interventions. The push for a ban reflects a broader tension between the need for regulation and the risks of overregulation. It’s a complex issue that requires careful consideration, a deep understanding of market dynamics, and a willingness to learn from past mistakes.

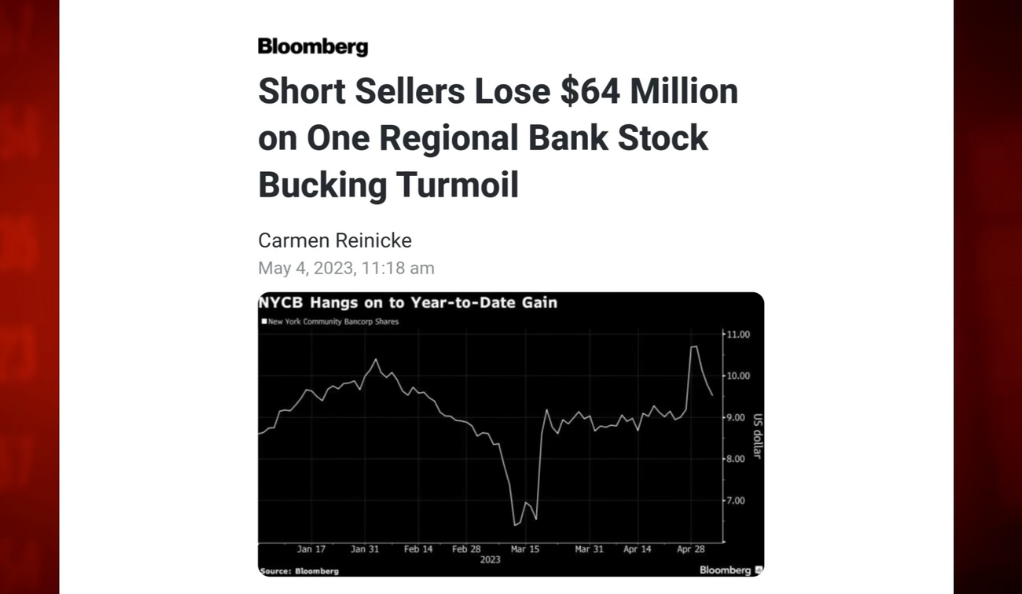

Challenges of Short Selling: Not an Easy Job

Short selling is often portrayed as a quick and easy way to make money, but the reality is far more complex. It’s a high-risk, high-reward strategy that requires thorough research, careful analysis, and a deep understanding of market dynamics. Short sellers take on significant risks, and the potential for losses is substantial. The case of New York Community Bank Corp, where short sellers lost $64 million, illustrates the challenges and uncertainties of short selling. Recognizing the complexities and challenges of short selling is essential for a balanced and informed perspective on this often-misunderstood practice.

Jim Cramer’s Opinion: A Voice of Reason?

Jim Cramer’s 2008 statement that honest firms cannot be brought down by short sellers offers a voice of reason in a heated debate. Cramer’s insights reflect a fundamental truth: short selling is not inherently evil or destructive. It’s a legitimate investment strategy that can uncover fraud, mismanagement, and overvaluation. Cramer’s perspective offers a refreshing counterpoint to the often sensationalized portrayals of short selling. His words serve as a reminder of the importance of integrity, transparency, and responsible management in the world of finance.

Conclusion: Unraveling the Complexities of Short Selling

Short selling is a complex and often misunderstood practice that continues to shape our financial landscape. From humorous proposals to serious considerations, from historical lessons to modern sagas, the world of short selling is multifaceted and rich in insights. This comprehensive exploration has unraveled the complexities, shed light on the controversies, and offered a balanced perspective on a practice that is both vilified and celebrated. Whether seen as a necessary tool for market efficiency or a potential threat to financial stability, short selling remains a vital part of our financial system. Understanding its dynamics, recognizing its challenges, and appreciating its contributions is essential for informed decision-making and responsible financial management. The debate on short selling is far from over, but this analysis offers a valuable starting point for those seeking to navigate the intricate and ever-changing world of finance.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)