Charlie Burton, a renowned trader, emphasizes the importance of thinking in percentage terms rather than focusing solely on the money. This shift in perspective is crucial for traders as it helps them to maintain a balanced approach to their trading activities. Instead of being driven by the desire to make large sums of money, traders should focus on making consistent percentage gains. This approach encourages discipline and patience, two key traits of successful traders.

For instance, a 10% gain on a $100 investment is $10. While this may seem small in absolute terms, it is significant when viewed as a percentage. If a trader can consistently achieve such gains, their trading account will grow exponentially over time. By focusing on percentage gains, traders can also better manage their risk. They can determine the appropriate position size for each trade based on their risk tolerance and the potential return. This approach can help traders avoid the pitfalls of greed and fear, which often lead to poor trading decisions.

Trading as a Game: Al Brooks’ Perspective

Al Brooks offers a unique perspective on trading, viewing it as a game where you need to take money from someone else. This viewpoint underscores the competitive nature of trading and the need for strategic thinking. Brooks advises beginners to start with paper trading and fake money to gain experience without risking real capital. Paper trading allows beginners to practice their trading strategies in a risk-free environment.

They can learn how to analyze the markets, place trades, and manage their risk without the fear of losing money. This practice can help beginners develop the skills and confidence needed to trade with real money. Brooks also emphasizes the importance of understanding that in order for you to make money in trading, someone else has to lose. This zero-sum nature of trading requires traders to be better than the average market participant. They need to develop a competitive edge, which can come from superior market knowledge, a proven trading strategy, or effective risk management. By viewing trading as a game, traders can better navigate the competitive and challenging world of trading.

Timing the Market: Larry Williams’ Strategy

Larry Williams, a seasoned trader, highlights the importance of timing in trading. He observes that the market has the most volatility when it first opens, dies during lunch hours, and shoots back with volatility at market close. By understanding and leveraging these patterns, traders can take advantage of market volatility. Market volatility refers to the rate at which the price of an asset increases or decreases for a set of returns. Volatility is a measure of risk, and it is a key factor in trading decisions. High volatility means that the price of the asset can change dramatically over a short period in either direction.

On the other hand, low volatility means that the price of the asset does not fluctuate dramatically, but changes at a steady pace over a period of time. Traders can use these patterns to time their trades. For instance, they can enter the market when volatility is high to maximize their potential return. Conversely, they can exit the market during periods of low volatility to minimize their risk. By timing the market, traders can enhance their trading performance and increase their profitability.

The Psychology of Trading: Insights from Brett Steenbarger

Brett Steenbarger, a trading psychologist, emphasizes that trading is not gambling. He advises traders to aim for slow, consistent gains rather than chasing huge 100x plays. This approach promotes a more sustainable and less risky trading strategy. Trading psychology is a critical aspect of trading success. It refers to the emotions and mental state that dictate a trader’s decisions. Traders who approach the markets as a gambler, betting on big wins, often end up losing because they let their emotions dictate their trading decisions. They may take on too much risk, hold on to losing trades, or exit winning trades too early.

On the other hand, traders who approach the markets as a business, focusing on slow and consistent gains, are more likely to succeed. They understand that trading is not about making a quick buck, but about growing their capital over time. They have a disciplined approach, sticking to their trading plan and managing their risk effectively. They also understand the importance of maintaining a positive mindset, staying calm under pressure, and learning from their mistakes. By adopting this psychological approach to trading, traders can improve their decision-making process and increase their chances of success.

The Impact of Personal Traits: Brett Steenbarger on Behaviors

Steenbarger also discusses how the market magnifies your character traits. If you’re impulsive, OCD, or easily angered, it will show in your trading. Recognizing and managing these traits can help traders improve their decision-making process and overall trading performance. Trading is a highly stressful activity that can bring out the best and worst in people. It can magnify personal traits, both positive and negative. For instance, if a trader is naturally impulsive, they may be prone to making rash trading decisions, entering or exiting trades without proper analysis or consideration of their trading plan. On the other hand, if a trader is naturally patient and disciplined, they may be better able to stick to their trading plan and make rational trading decisions. Understanding and managing these personal traits is crucial for trading success. Traders need to be self-aware, recognizing their strengths and weaknesses, and taking steps to mitigate their negative traits and leverage their positive ones. This could involve using trading tools and techniques to control impulsivity, seeking professional help to manage OCD, or learning stress management techniques to control anger. By managing their personal traits, traders can improve their trading performance and increase their chances of success.

Finding Your Edge: Mark Douglas’ Approach

Mark Douglas, a trading coach, suggests that traders should find one thing that has a high probability of happening and write a step-by-step plan to trade around it. Once the plan is in place, it’s all profit from there. This method encourages traders to develop a systematic and disciplined approach to trading. Finding an edge in trading means identifying a factor or set of factors that give a trader a superior chance of predicting the direction of market movement. This edge could be a unique trading strategy, superior market knowledge, or advanced analytical skills.

Once a trader has identified their edge, they need to develop a trading plan around it. This plan should detail the specific conditions under which the trader will enter and exit trades, how much they will risk on each trade, and how they will manage their trades. By following this plan consistently, traders can exploit their edge and make consistent profits. However, finding an edge and developing a trading plan is not enough. Traders also need to have the discipline to stick to their plan, even when the markets are volatile or when they are facing a series of losses. This discipline is what separates successful traders from unsuccessful ones.

The Importance of Preparation: Linda’s Advice

Linda, a successful trader, stresses the importance of preparation. She advises traders to do all preparation before entering the trade to avoid making decisions based on emotions while trading live. This approach can help traders maintain a clear head and stick to their trading plan. Preparation in trading involves conducting thorough market analysis, developing a trading plan, and setting up trading tools and platforms.

Traders need to analyze the markets to identify trading opportunities, understand market trends, and assess market risks. They need to develop a trading plan that details their trading strategy, risk management rules, and trading goals. They also need to set up their trading tools and platforms, ensuring that they have all the necessary information and resources at their fingertips when they start trading. By doing all this preparation before entering the trade, traders can avoid making impulsive or emotional trading decisions. They can stick to their trading plan, make rational trading decisions, and manage their trades effectively. This preparation can also help traders to stay calm and focused during the trading session, reducing stress and improving their trading performance.

The Role of Market News: Al Brooks’ View

Al Brooks suggests that news is already baked into the price charts. Traders don’t need to follow the news; they can read the chart itself for a non-biased story. This perspective can help traders avoid the noise and focus on the underlying market dynamics. Market news can be a useful source of information for traders, providing insights into market trends, economic indicators, and company performance. However, it can also be a source of noise, causing traders to react impulsively to news events and make poor trading decisions. Brooks suggests that traders should focus on the price charts instead of the news. Price charts provide a visual representation of market activity, showing the opening, closing, high, and low prices for a specific period. They also show the volume of trading activity, which can indicate the strength of a price movement. By analyzing the price charts, traders can identify patterns and trends, predict future price movements, and make informed trading decisions. This approach can help traders to stay focused on the market dynamics, ignore the noise, and maintain a disciplined approach to trading.

Learning from the Inside: Bill Ackman’s Approach

Bill Ackman, a billionaire hedge fund manager, believes that to truly understand investing, it’s best to go inside businesses and see how they work. Even going into a bad business can teach you what to look for. This hands-on approach can provide valuable insights into the inner workings of businesses and the market.

Learning from the inside involves understanding the business model, financial performance, competitive landscape, and industry trends of a company. It involves analyzing the company’s financial statements, attending company presentations and meetings, and talking to company management and employees. This approach can provide a deep understanding of the company and its prospects, helping traders to make informed investment decisions.

Even going into a bad business can be a valuable learning experience. It can teach traders what to avoid, what red flags to look for, and how to identify a failing business. By learning from the inside, traders can gain a competitive edge, make better investment decisions, and increase their chances of trading success.

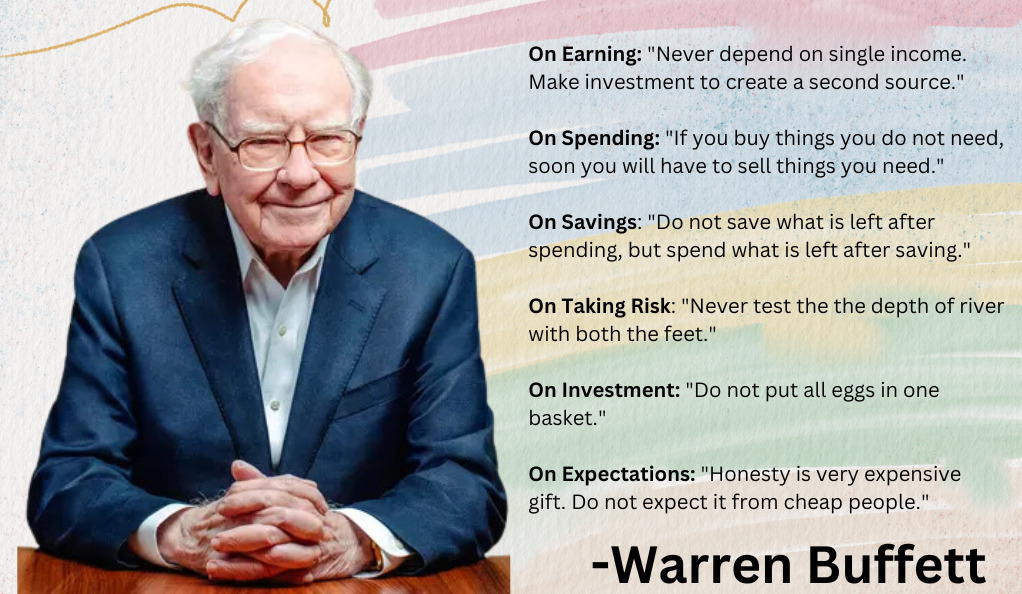

The Power of Patience: Warren Buffett’s Strategy

Warren Buffett, one of the most successful investors of all time, emphasizes the power of patience in trading. Traders have the advantage of only swinging when they want to. They can wait for the perfect pitch that fits all of their standards. This strategy underscores the importance of patience and selective trading. Patience in trading involves waiting for the right trading opportunity, sticking to your trading plan, and not rushing your trading decisions. It involves resisting the urge to trade for the sake of trading, and instead waiting for the market conditions to align with your trading strategy. This approach can help traders avoid making impulsive or emotional trading decisions, reduce their trading costs, and increase their trading profits.

Selective trading involves choosing only the best trading opportunities that meet all your trading criteria. It involves being selective about the markets you trade, the trading strategies you use, and the trades you enter. This approach can help traders to focus on quality over quantity, reduce their risk, and increase their trading success. By practicing patience and selective trading, traders can take advantage of their unique position, make better trading decisions, and increase their chances of success.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)