Day trading, the act of buying and selling financial instruments within the same day, is a journey that can be as challenging as it is rewarding. It’s a world where knowledge is power, and continuous learning is the key to success. But how do you start? How do you navigate this complex landscape and emerge victorious? This comprehensive guide will walk you through the process, step by step, to help you kickstart your day trading journey.

The Importance of Continuous Learning in Day Trading

Embrace the Learning Curve

Day trading is not a get-rich-quick scheme. It requires dedication, patience, and a thirst for knowledge. The most successful traders are those who never stop learning, who constantly seek to improve their strategies and understand the market better.

In the world of day trading, the learning never stops. Even the most seasoned traders continually seek to expand their knowledge and improve their strategies. This is because the financial markets are dynamic and ever-changing, with new trends and patterns emerging all the time. Staying on top of these changes and adapting your strategies accordingly is crucial for success.

So, make learning a habit. Watch trading videos, read books, attend webinars, and soak up as much knowledge as you can. The internet is a treasure trove of information, with countless resources available at your fingertips. Use these resources to your advantage and strive to learn something new every day.

The Three Stages of Trading

Every journey begins with a single step, and the journey into the world of trading is no different. It’s a process that unfolds in three distinct stages: learning, testing, and execution. Each stage is crucial and builds upon the previous one, forming a comprehensive roadmap to trading success. Let’s delve deeper into these stages and understand what each one entails.

The Learning Phase: Building a Strong Foundation

The first stage of the trading journey is the learning phase. This is where you lay the groundwork for your future trading endeavors. It’s about absorbing as much information as possible and developing a solid understanding of the trading landscape.

Studying the Markets

The financial markets are complex and dynamic, with countless factors influencing their movements. As a trader, you need to understand these factors and how they interact with each other. This involves studying different asset classes, understanding market trends, and keeping up-to-date with economic news and events that could impact the markets.

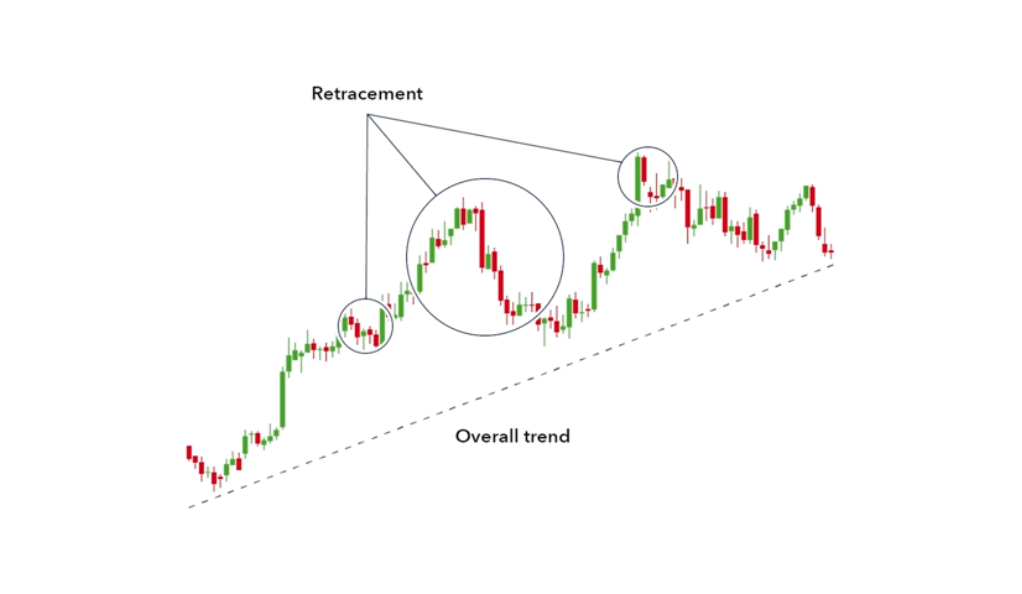

Learning About Trading Strategies

There are numerous trading strategies out there, each with its own set of rules and principles. Some traders might prefer technical analysis, using charts and indicators to predict future price movements. Others might lean towards fundamental analysis, examining economic data to assess the intrinsic value of an asset. During the learning phase, you should explore these different strategies, understand their pros and cons, and decide which one aligns best with your trading goals and risk tolerance.

The Testing Phase: Putting Knowledge into Practice

Once you’ve armed yourself with knowledge, it’s time to put it to the test. The testing phase is all about applying what you’ve learned in a risk-free environment. This stage is crucial as it allows you to gain practical experience and refine your strategies without the risk of losing real money.

Paper Trading and Trading Simulators

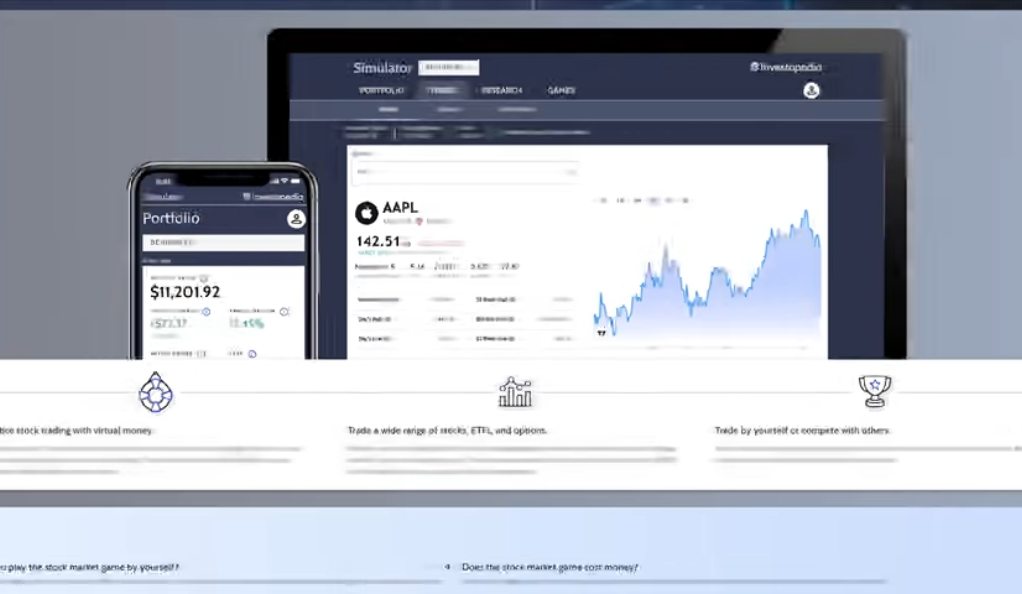

Paper trading involves making hypothetical trades based on real market data. You’re not risking any real money, but you’re gaining valuable experience in executing trades and managing risk. Trading simulators take this a step further by replicating the live market environment, providing real-time market data and all the tools and features you’d find on a live trading platform. Both methods allow you to practice your strategies, learn from your mistakes, and build confidence in your trading abilities.

The Execution Phase: Entering the Real Market

The final stage of the trading journey is the execution phase. This is where you take the leap into the real market, putting your tested strategies into action.

Profits as a Byproduct of Knowledge and Skills

In the execution phase, you’ll start to see the fruits of your labor. But remember, profits are not the end goal in themselves. They are a byproduct of your knowledge, skills, and trading discipline. Your focus should always be on executing your strategies effectively and managing your risk, not on making quick profits.

The Power of Trading Simulators

Practice Makes Perfect

Before you dive into the deep end, it’s crucial to practice in a safe environment. Trading simulators allow you to trade with virtual money, giving you the chance to gain experience and confidence without the risk of losing real money.

Trading simulators replicate the live market environment, providing real-time market data and all the tools and features you’d find on a live trading platform. This allows you to get a feel for the markets and gain practical experience executing trades.

Treat this virtual money as if it were real, experiencing the emotions and pressures of live trading. This will help you develop the mental toughness needed to handle the ups and downs of real trading.

Choosing the Right Broker

Your Trading Partner

Your broker is your gateway to the markets, so choose wisely. Look for a broker that offers low fees, a user-friendly platform, and excellent customer service.

Different brokers offer different features and services, so it’s important to choose one that aligns with your trading goals and strategies. For example, if you plan on day trading stocks, you’ll want a broker that offers access to a wide range of stocks, has low commissions, and provides a robust trading platform with advanced charting tools.

For forex or crypto trading, consider brokers like HankoTrade,known for their competitive spreads and user-friendly dashboard. They also offer a 100% deposit bonus up to $25,000, which can be a great way to boost your trading capital.

The Value of a Mentor and a Trading Community

Learning from the Best

A mentor can provide invaluable insights and guidance, helping you avoid common pitfalls and accelerate your learning process. They can share their experiences, provide feedback on your strategies, and offer advice on how to handle the psychological challenges of trading.

Finding a mentor who is a successful trader themselves can be a game-changer. They’ve been where you are and have navigated the path to success. They can provide you with practical tips and strategies that they’ve personally used and found effective.

Joining a trading community can also be beneficial, providing a platform to share ideas, ask questions, and learn from other traders’ experiences. These communities are filled with traders of all levels, from beginners to seasoned pros, and can be a great source of support and inspiration.

The Importance of a Trading Journal

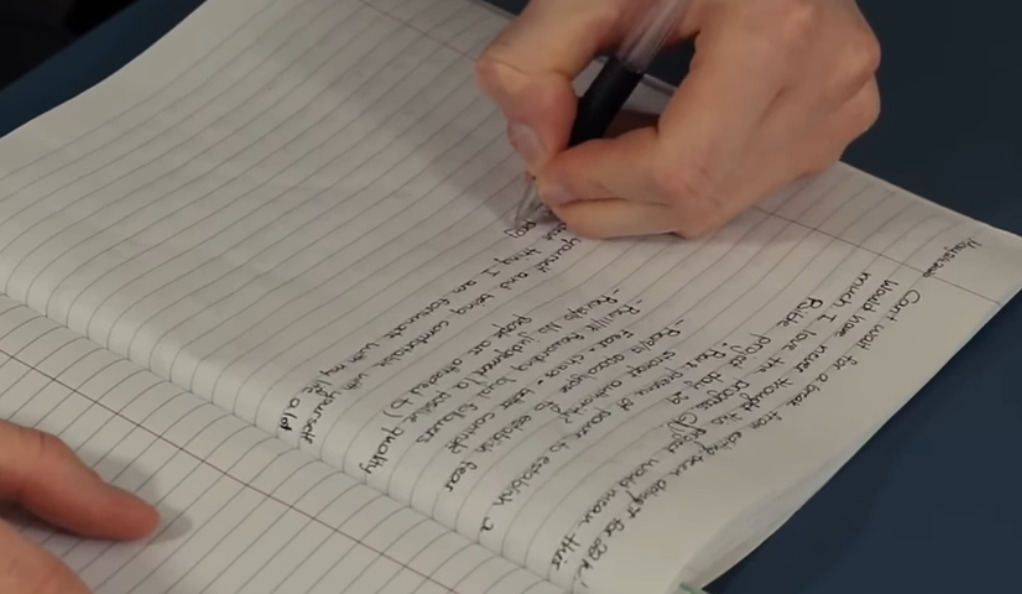

Learning from Your Trades

Keeping a trading journal is a game-changer. By recording all your trades, you can analyze your performance, identify patterns, and learn from both your successes and failures.

A trading journal is more than just a record of your trades. It’s a tool for self-reflection and improvement. By reviewing your journal regularly, you can identify trends in your trading performance, pinpoint areas for improvement, and develop strategies to address these areas.

This continuous feedback loop is crucial for improving your trading skills and strategies. It allows you to learn from your mistakes, reinforce successful behaviors, and ultimately become a better trader.

Patience: The Virtue of Successful Traders

Don’t Force Trades

In trading, patience is indeed a virtue. You don’t need to be in a trade 24/7. If the market conditions are not favorable, it’s better to sit on your hands and wait for a better opportunity.

The financial markets are filled with opportunities, but not all of them will be right for you. It’s important to wait for the opportunities that align with your trading strategy and risk tolerance. This requires patience and discipline, but it’s crucial for long-term success.

Remember, the market is always there. Don’t rush. Wait for the right setup that aligns with your strategy.

Testing Your Strategy

The Proof is in the Pudding

Once you’ve learned the basics, found a mentor, and practiced on a simulator, it’s time to test your strategy. This is where the rubber meets the road. Test your strategy thoroughly, tweak it as necessary, and once you’re consistently profitable, only then consider moving to a live account.

Testing your strategy involves applying it to historical market data and seeing how it would have performed. This can give you an idea of its potential profitability and help you identify any weaknesses or areas for improvement.

Conclusion

Day trading is a journey of continuous learning, testing, and refining. It’s not about getting rich quick, but about developing the skills, knowledge, and discipline to navigate the markets effectively. By following this guide, you’ll be well on your way to becoming a successful day trader. Remember, the key to success in day trading lies in your commitment to learning, patience, and consistent application of tested strategies. So, are you ready to embark on your day trading journey?

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)