In the fast-paced and ever-changing world of trading, developing a robust strategy is crucial for success. One innovative approach to finding a profitable strategy involves utilizing three free TradingView indicators: Kitchenson Plus by Irwin Beckers, DD Index by Everget, and Neglected Volume by DGT.

The Kitchenson Plus indicator, developed by Irwin Beckers, offers a comprehensive analysis of market trends by combining various technical indicators, including moving averages, relative strength index (RSI), and volume analysis. By integrating these indicators, traders can gain valuable insights to identify potential entry and exit points based on reliable data. This holistic approach provides a broader perspective on market conditions, enabling traders to make informed decisions.

The DD Index by Everget measures price deviation, indicating volatility and reversals. Monitoring it helps identify overbought/oversold conditions. The Neglected Volume indicator by DGT detects significant volume spikes, revealing potential market movements. Combining these indicators enhances decision-making, but requires analysis and risk management. Trading success necessitates continuous learning and understanding market dynamics.

Lastly, the Neglected Volume indicator, developed by DGT, helps traders identify significant volume spikes that may have been overlooked by the market. This indicator highlights instances where trading volume significantly deviates from the norm, indicating potential market movements. By paying attention to neglected volume, traders can spot emerging trends or reversals before they become apparent to others.

The Three Pillars of the Strategy

The Three Pillars of the Strategy are the foundation for a successful trading approach. These pillars encompass a robust risk management plan, thorough market analysis, and disciplined execution. By focusing on these key aspects, traders can minimize losses, capitalize on opportunities, and maintain consistency in their trading activities. Effective risk management ensures the preservation of capital, while comprehensive market analysis provides valuable insights for making informed decisions. Finally, disciplined execution involves sticking to the trading plan, following predefined rules, and managing emotions effectively. Together, these three pillars form a solid framework for achieving trading success.

Kitchenson Plus by Irwin Beckers

The first cornerstone of this strategy is the Kitchenson Plus indicator, created by Irwin Beckers. This powerful tool offers traders a comprehensive view of market trends by combining various technical indicators, including moving averages, RSI, and volume analysis. By incorporating these indicators, the Kitchenson Plus indicator provides a holistic perspective on market conditions, allowing traders to identify potential entry and exit points with greater accuracy. It acts as a valuable tool for traders, offering them a bird’s eye view of the market and empowering them to make informed decisions based on reliable data.

With the Kitchenson Plus indicator, traders can gain insights into the overall trend direction, momentum, and the strength of market movements. By analyzing the moving averages and RSI, traders can assess whether the market is bullish or bearish and make decisions accordingly. Additionally, the volume analysis helps in understanding the level of market participation and can provide confirmation or divergence signals for price movements. This comprehensive approach provided by the Kitchenson Plus indicator allows traders to have a deeper understanding of market dynamics, increasing their chances of success in the fast-paced and competitive world of trading.

DD Index by Everget

The second pillar of this strategy is the DD Index, developed by Everget. Considered as a compass in the vast ocean of trading, this indicator serves as a valuable tool for navigating the market. The DD Index focuses on measuring the deviation of price from its expected value by calculating the distance between the price and its moving average. By doing so, it offers insights into market volatility and potential reversals.

By monitoring the DD Index, traders can identify overbought or oversold conditions in the market. This information enables them to make necessary adjustments to their trading strategies, such as implementing appropriate risk management measures or seeking potential entry or exit points. The DD Index acts as a guide, providing traders with a sense of direction and helping them make informed decisions based on the market’s current state. Its ability to gauge volatility and anticipate potential reversals makes it a valuable asset in the trading toolkit, assisting traders in navigating the complexities of the market with greater precision and confidence.

Neglected Volume by DGT

The third and final pillar of this strategy is the Neglected Volume indicator, developed by DGT. This powerful tool acts as a treasure hunter’s metal detector in the trading world. It helps traders uncover hidden trading opportunities that may go unnoticed by others.

The Neglected Volume indicator focuses on detecting significant volume spikes that deviate from the norm. By pinpointing these unusual volume movements, traders can identify potential market shifts, emerging trends, or reversals before they become apparent to others. This allows traders to stay one step ahead in the market and capitalize on opportunities that might otherwise be overlooked.

By incorporating the Neglected Volume indicator into their strategy, traders can gain a competitive edge by spotting hidden gems in the market. It serves as a valuable tool for traders who want to make well-informed decisions based on comprehensive volume analysis. This pillar of the strategy acts as a guide, enhancing traders’ ability to identify market dynamics and seize lucrative trading opportunities that others may miss.

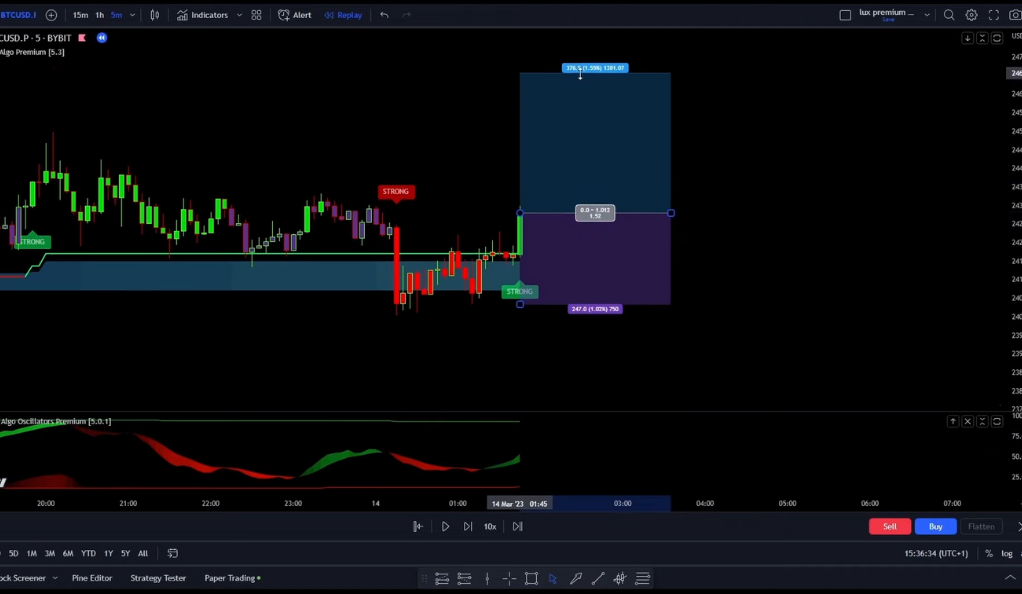

Backtesting: The Key to Confidence

Backtesting plays a pivotal role in instilling confidence in a trading strategy. It serves as a crucial step before implementing the strategy in live trading. In this strategy, the author utilized a Trader’s Edge spreadsheet for conducting backtests. By exporting the list of trades from TradingView and importing it into the spreadsheet, the author was able to meticulously analyze the strategy’s performance in a controlled environment. Consider it as a dress rehearsal, allowing the trader to fine-tune and validate the strategy’s effectiveness before risking real capital.

Backtesting provides valuable insights into the strategy’s historical performance, including its profitability, win rate, and risk-reward ratio. By thoroughly analyzing the data, traders can identify potential strengths and weaknesses, make necessary adjustments, and optimize their strategy for improved results. It also helps traders gain confidence in the strategy by showcasing its performance across various market conditions and timeframes. The ability to simulate trades and evaluate performance in a controlled setting allows traders to refine their strategy and make informed decisions based on historical evidence, ultimately increasing their confidence when executing trades in real-time situations.

Flipping the Signals: A Game-Changing Move

In the world of trading, embracing unconventional approaches can lead to game-changing outcomes. The author of this strategy made a significant discovery by flipping the signals, defying the traditional trading wisdom. Surprisingly, this unorthodox move proved to be highly profitable, with an impressive win rate of nearly 59% after executing 242 trades. It’s akin to uncovering that the secret ingredient for a perfect dish lies in the least expected element.

By flipping the signals, the author challenged conventional assumptions and ventured into uncharted territory. This unique perspective allowed for a fresh interpretation of market dynamics and revealed previously unseen patterns or opportunities. It highlights the importance of thinking outside the box and being open to innovative strategies that may diverge from common trading practices. This unexpected twist serves as a reminder that exploring alternative approaches can sometimes unlock hidden potentials and lead to remarkable success in the world of trading.

Optimal Settings: The Sweet Spot

Determining the optimal settings for a trading strategy is akin to fine-tuning a musical instrument to create a harmonious melody. The author of this strategy conducted extensive testing on various markets and time frames to identify the most effective settings. Through rigorous experimentation, it was discovered that the ideal configuration for this strategy involved setting Keyton Sent to 50 D, short on 7, medium on 15, and long on 30. Additionally, the neglected volume length was set to 12 with a threshold of 6. These settings struck the perfect chord, leading to a harmonious balance in the trading results.

Just as a skilled musician understands the importance of adjusting each instrument’s settings, the author’s meticulous testing process led to the discovery of the optimal combination for this strategy. By fine-tuning the settings to align with the specific market conditions and time frames, traders can enhance the strategy’s performance and increase the likelihood of successful trades. The quest for the sweet spot in settings demonstrates the dedication and precision required to achieve trading excellence, resulting in a harmonious trading experience and improved overall results.

Conclusion

In conclusion, the combination of TradingView indicators, including Kitchenson Plus, DD Index, and Neglected Volume, presents a powerful opportunity for traders to develop a winning strategy. The utilization of these indicators in innovative ways allows for a comprehensive analysis of market trends, volatility, and neglected volume. By backtesting the strategy and flipping the signals, traders can gain confidence in its effectiveness and uncover hidden potentials.

Furthermore, finding the optimal settings adds another layer of refinement to the strategy, enhancing its performance and aligning it with specific market conditions. The comprehensive approach presented in this strategy provides traders with a robust framework for making informed trading decisions. So, don’t hesitate to explore the world of TradingView and harness the potential of this winning strategy. It’s time to seize the opportunity and embark on a journey towards trading success.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)