The stock market, a labyrinth of complexities, is a ceaselessly evolving entity that never fails to intrigue its observers. It’s a dynamic ecosystem where the ebb and flow of investments are influenced by a multitude of factors, from macroeconomic indicators to investor sentiment. Among the various phenomena that the stock market presents, one that has been drawing significant attention recently is the concept of market rotation. This strategy involves investors shifting their capital from one industry sector to another, a move often dictated by changing market conditions. It’s a strategic maneuver that investors employ to navigate the ever-changing market landscape, capitalizing on emerging opportunities while mitigating risks.

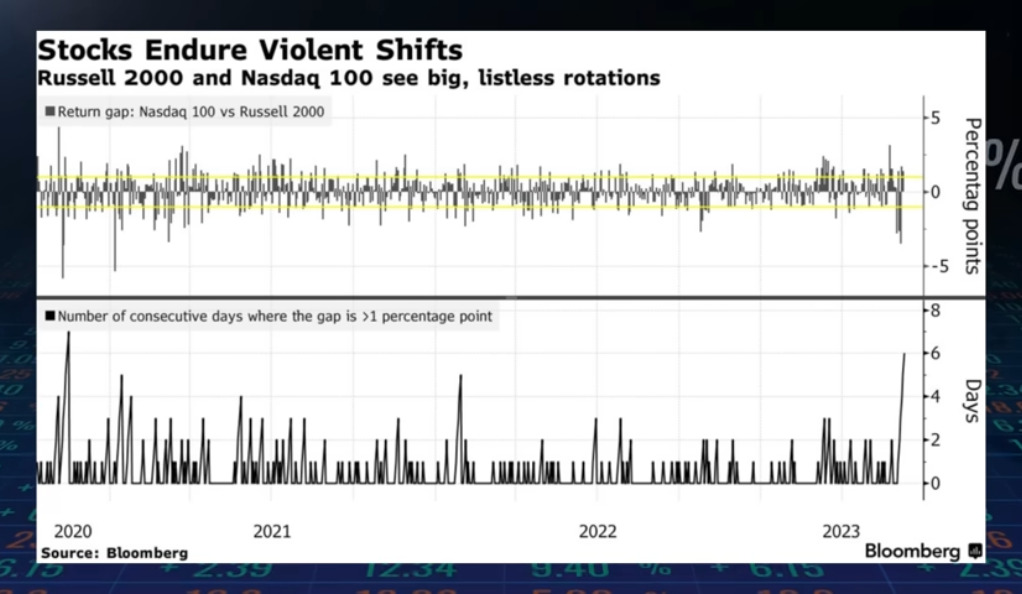

In recent times, a notable shift has been observed from the technology-centric NASDAQ to the Russell 2000, a small-cap stock market index. This shift is significant because the NASDAQ is dominated by large, global technology companies, while the Russell 2000 is composed of smaller, more domestically focused companies. This rotation has sparked a flurry of debates among investors and market analysts. The central question being asked is: does this shift signal the advent of a new bull market, or is it a precursor to a bubble that’s about to burst? To answer this question, it’s crucial to dissect this phenomenon, understand its underlying causes, and assess its potential implications. This will provide a clearer picture of the market’s direction and help investors make informed decisions.

Market Rotation: A Primer

Market rotation is a pivotal strategy that investors utilize to adapt to the ever-changing landscape of the market. This strategy involves the reallocation of investments from one sector of the economy to another, often in response to evolving market conditions or economic indicators. This shift in investments is not just a reactive measure, but can also serve as a critical indicator of future market trends and the overall health of the economy. It provides insights into which sectors are gaining favor among investors and which ones are falling out of favor, thereby offering a glimpse into potential future market movements.

In the current market scenario, a noteworthy rotation has been observed from the tech-heavy NASDAQ to the Russell 2000. The NASDAQ is known for its concentration of large, global technology companies, while the Russell 2000 is an index composed of smaller, more domestically focused companies. This shift in preference from large tech companies to smaller, more diverse companies could be interpreted as a sign of a more robust and diversified economy. However, it’s crucial to scrutinize this shift from all angles. It’s important to understand the factors driving this rotation, the potential implications for different sectors, and what it could mean for the broader economy. A thorough analysis can help investors make informed decisions and potentially capitalize on emerging trends.

The Bullish Interpretation: A New Dawn for the Market?

If the ongoing rotation from the tech-dominated NASDAQ to the Russell 2000, an index primarily composed of smaller, more domestically-focused companies, proves successful, it could be a bullish signal for the stock market. This shift, if it holds, indicates a strong conviction among investors and could potentially mark the onset of a new bull market.

The argument underpinning this perspective is rooted in the economic cycle. If we are indeed on the cusp of a soft landing in the economy – a scenario where economic activity slows but does not result in a recession – this could be the initiation of a new bull market that could span a decade or two. In such a scenario, we should witness a rotation from big cap stocks, typically large multinational corporations, to the cyclical side of the economy, which includes sectors like materials, industrials, and financials that tend to do well as the economy improves.

Most importantly, this rotation should also involve a shift towards small-cap stocks, which are often seen as the lifeblood of the domestic economy. These smaller companies, represented by the Russell 2000, are often more sensitive to economic conditions, and their growth can signal a healthy, robust economy. Therefore, a successful rotation to these stocks could be a strong indication of a long-term bullish market.

The Bubble Hypothesis: A Mirage of Prosperity?

However, as with any market trend, there’s another perspective to consider. If money managers, the individuals or institutions responsible for making investment decisions, fail to rotate out of big cap stocks and into smaller cap and cyclical stocks, it could suggest that the current rally is more of a hype-driven event rather than the genuine commencement of a new bull market. In simpler terms, it could be a bubble, not a bull market. A bubble refers to a market condition where prices are inflated beyond their intrinsic values, often driven by speculative trading rather than underlying fundamentals.

This phenomenon isn’t a new occurrence in the financial markets. We’ve witnessed it unfold several times in the past, where hype and speculation have driven market rallies, only to end in sharp corrections when the bubble bursts. The most recent instance of this was in 2020, when several sectors experienced inflated valuations driven by speculative trading. Therefore, while a successful rotation from big caps to smaller caps and cyclical stocks could signal a bullish market, the failure to do so could indicate a potential bubble. This underlines the importance of careful, informed investment decisions based on thorough market analysis rather than following market hype.

The Federal Reserve’s Influence: A Game-Changer?

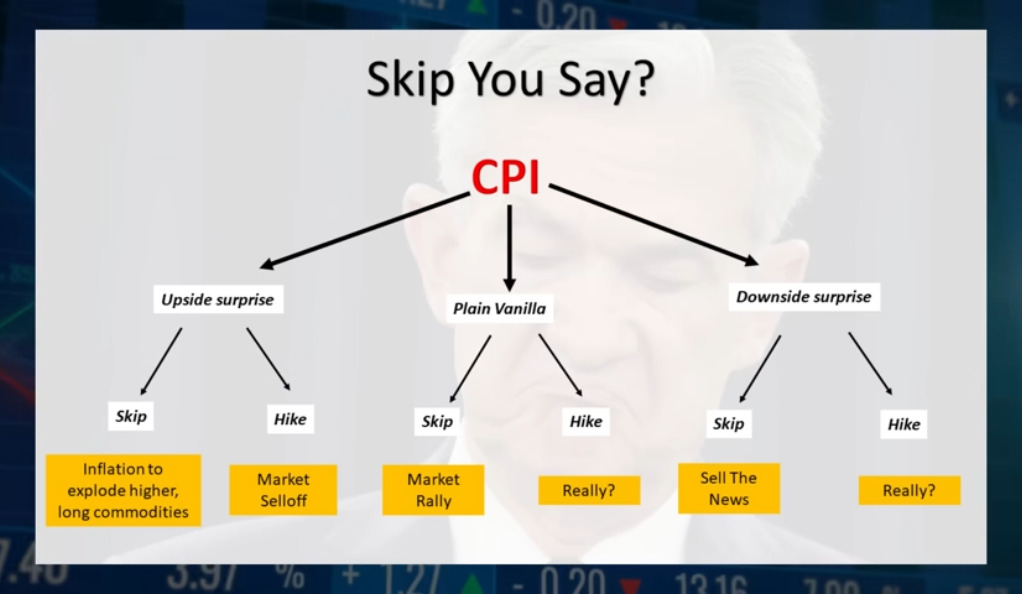

The role of the Federal Reserve in this scenario cannot be overlooked. The Fed’s recent guidance towards a “skip” in rate hikes adds another dimension to the situation. The question that arises is, why would the Fed choose to do this now, especially in light of the recent jobs report? This decision could potentially trigger a major market surprise that could lead to a massive and sizable reaction.

Potential Scenarios: What Could the Future Hold?

The future course of the market could be influenced by how the Consumer Price Index (CPI) fares and what decision the Fed makes. An upside surprise in the CPI coupled with a Fed decision to skip could ignite an explosive rally in commodities. On the other hand, an upside surprise coupled with a Fed decision to hike could trigger a massive market sell-off.

The New Bull Market: Reality or Hyperbole?

Lastly, let’s address the buzz around the new bull market. Are these claims premature, or do they hold water? The market, with its “dark sense of humor,” often makes fools out of the majority of participants. It’s essential to approach these claims with a healthy dose of skepticism and a solid understanding of market dynamics.

Wrapping Up: The Final Verdict

In conclusion, the ongoing market rotation could be a bullish sign or a bubble, depending on a multitude of factors, including the actions of the Federal Reserve and the state of the Consumer Price Index (CPI). As investors, it’s paramount to stay informed, analyze market trends, and make decisions based on a comprehensive understanding of the market. Remember, the stock market is not a game of chance, but a game of strategy and knowledge.

The Market Rotation Phenomenon: A Closer Look

Market rotation is a fascinating phenomenon that can provide valuable insights into the health of the economy and the direction of market trends. It involves the movement of investments from one sector or industry to another, often in response to changing economic conditions or market trends. In the current scenario, the rotation from the tech-heavy NASDAQ to the Russell 2000, an index of smaller, more domestically-focused companies, is particularly noteworthy.

The Bullish Perspective: A Sign of a Robust Economy?

From a bullish perspective, a successful rotation from NASDAQ to the Russell 2000 could be a positive sign for the stock market. This shift could indicate a strong conviction in the strength and resilience of the economy, potentially signaling the start of a new bull market. This argument is based on the premise that a soft landing in the economy, coupled with a successful rotation from big caps to the cyclical side of the economy and small caps, could set the stage for a new bull market that could last for several years.

The Bubble Theory: A Warning Sign?

However, there’s another side to this story. If money managers fail to rotate out of big caps and into smaller caps and the cyclical side of the market, it could suggest that the current rally is more hype-driven than a genuine beginning of a new bull market. In other words, it could be a bubble waiting to burst, rather than a bull market. This theory is not new and has been observed in various market scenarios, most recently in 2020.

The Role of the Federal Reserve: A Key Player

The role of the Federal Reserve in this scenario is crucial. The Fed’s recent guidance towards a “skip” in rate hikes adds another layer of complexity to the situation. Why would the Fed choose to do this now, especially given the recent jobs report? This decision could potentially lead to a major market surprise, triggering a massive and sizable reaction.

Possible Scenarios: What Lies Ahead?

The future direction of the market could be influenced by several factors, including the outcome of the Consumer Price Index (CPI) and the decisions made by the Federal Reserve. For instance, an upside surprise in the CPI, coupled with a Fed decision to skip, could lead to an explosive rally in commodities. Conversely, an upside surprise coupled with a Fed decision to hike could trigger a massive market sell-off.

The New Bull Market: Fact or Fiction?

Finally, it’s important to address the recent headlines declaring a new bull market. Are these claims premature, or do they hold water? The market, with its “dark sense of humor,” often makes fools out of the majority of participants. It’s essential to approach these claims with a healthy dose of skepticism and a solid understanding of market dynamics.

Conclusion: The Final Word

In conclusion, the ongoing market rotation presents a complex picture that could be interpreted as either a bullish sign or a potential bubble. This interpretation largely depends on a variety of factors, including the actions of the Federal Reserve and the state of the Consumer Price Index (CPI). As investors navigating this intricate landscape, it’s absolutely essential to stay informed, continually analyze market trends, and base our decisions on a comprehensive understanding of the market’s dynamics. It’s crucial to remember that the stock market isn’t a game of chance or luck, but rather a strategic arena that requires knowledge, insight, and a keen understanding of economic indicators. By keeping abreast of market trends and economic indicators, we can make informed decisions that maximize returns and minimize risks.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)