The global economy, a complex tapestry woven from the threads of every nation’s financial health, presents a captivating study of intricate interconnections and dependencies. As we navigate further into the 21st century, understanding current economic trends and predicting future shifts becomes more important than ever. This detailed analysis will scrutinize the economic conditions of two major players on the world stage—China and the United States—examining the influence of inflation and the actions of central banking systems like the Federal Reserve on the trajectory of the global economy.

China’s Economic Landscape: A Detailed Investigation

Understanding the Chinese Economic Framework

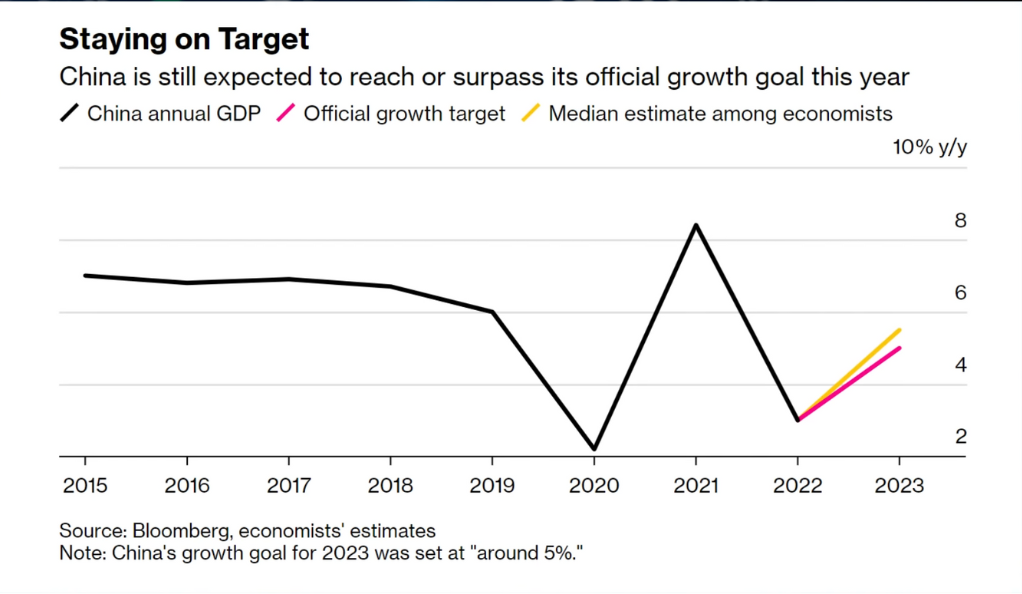

China, being the world’s second-largest economy, plays a critical role in the overall health of the global economy. Recently, its economic growth rate has been slowing, struggling to meet the government’s ambitious 5% target. This trend raises concerns about the future. Chinese officials, however, maintain a positive outlook, anticipating a second-half-year acceleration in economic activity.

Delving deeper into the economic mechanisms of China, we see that this massive engine of growth is fueled by several key sectors. Manufacturing has long been a cornerstone of China’s economy, turning the “world’s factory” into a global powerhouse. However, with rising wages and increased competition from other nations, China is facing significant challenges in maintaining its manufacturing supremacy.

Simultaneously, China’s economy is transitioning towards a more service-based model, with an increasing contribution from sectors such as retail, telecommunications, and finance. This transition, although necessary for the long-term sustainability of China’s growth, is fraught with short-term uncertainties and challenges. The effectiveness with which China navigates this transition will have a profound impact on its future economic trajectory.

The Global Impact of China’s Economy

The economic performance of China does not solely influence its domestic audience—it has far-reaching implications for the global economy. Many nations, particularly those in Europe and the U.S., rely heavily on Chinese consumption. Hence, a prolonged period of economic stagnation in China—a “lost decade”—could trigger ripple effects across the world, potentially leading to a global economic downturn.

Countries exporting commodities to China could experience significant economic stress. For example, a slowdown in Chinese construction would decrease demand for iron ore, which could hurt top exporting countries like Australia and Brazil. Moreover, lower consumption in China could impact luxury goods producers in Europe and technology companies in the U.S., underlining the complex interdependencies woven into the global economic fabric.

Economic Resurgence: The Potential for a Chinese Recovery

Despite the challenges, the potential for economic recovery in China also exists. A resurgence in China’s domestic consumption could result in higher global inflation. As Chinese demand for commodities such as oil, grains, metals, and meats increases, the global prices for these goods could rise, prompting central banks worldwide to maintain higher interest rates for longer periods.

However, the Chinese government is not sitting idle amid these economic uncertainties. It has unveiled various stimulus measures to bolster growth, including infrastructure spending, tax cuts, and lending directives to banks. While these policies may help invigorate the economy in the short term, it remains to be seen whether they will succeed in steering China towards a path of sustainable long-term growth.

The U.S. Economy: An Examination of Resilience

The U.S. Economy: Standing Firm Amid Challenges

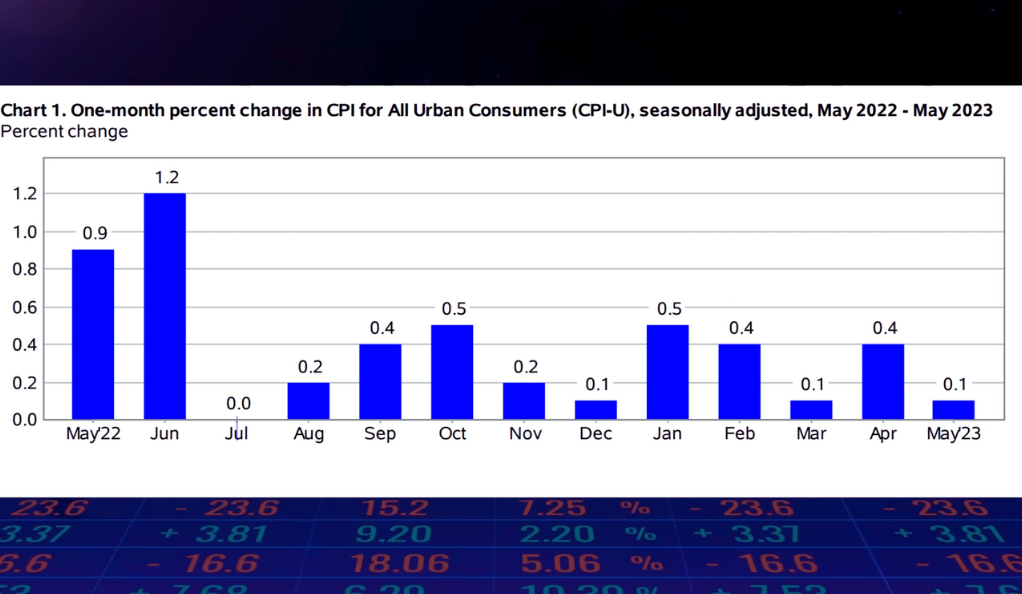

In contrast to the economic slowdown in China, the U.S. economy continues to display resilience. There is a noticeable upturn in consumer confidence, hitting a 17-month high, and demand for durable goods is on the rise. However, increased consumer spending could potentially lead to a rebound in inflation, impacting the cost of living and potentially causing ripple effects across the broader economic landscape.

The backbone of the U.S. economy is its diversity. From technology and healthcare to finance and manufacturing, the U.S. economic juggernaut is powered by a wide array of sectors, each contributing its unique strengths. However, recent challenges, such as supply chain disruptions caused by the COVID-19 pandemic and increasing global competition, have tested the robustness of this economic machine.

The Housing Market: A Stronghold of the U.S. Economy

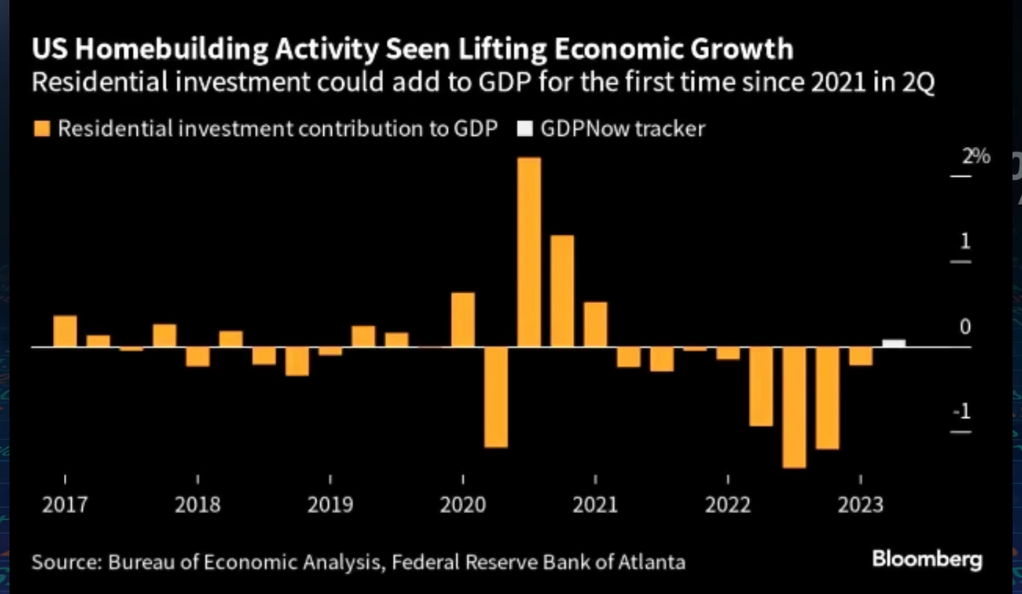

Despite interest rate hikes, the U.S. housing market remains robust, primarily driven by high aggregate demand. This sector’s strength indicates that it could spearhead an inflationary rebound in the economy, influencing everything from the cost of living to investment values. It also highlights the interplay between monetary policy and sector-specific dynamics, demonstrating the delicate balance that must be struck to maintain overall economic stability.

The Stock Market: Reflecting the Economic Pulse

The U.S. stock market provides a lens through which the economy’s health can be examined. Recently, while a rally in large-cap stocks has grabbed headlines, “secret rallies” are occurring in construction companies and homebuilder stocks. These trends, driven by increased fiscal spending, reflect the complex and multifaceted nature of the stock market and the economy at large. Different sectors can respond differently to the same economic conditions, underscoring the need for nuanced analysis when interpreting market trends.

Central Banking and Its Impacts: A Case Study of the Federal Reserve

The Federal Reserve: A Tightrope Walk

The Federal Reserve’s recent decision to pause interest rate hikes demonstrates the tightrope walk that central banks must navigate. This move could lead to a resurgence of inflation in the economy, a concern for both businesses and consumers. However, the decision has also attracted criticism, with some arguing that it could lay the groundwork for a financial accident. The actions of the Federal Reserve in the coming months will significantly influence the direction of both the U.S. and global economies.

Preparing for a Potential Hard Landing

The longer the Federal Reserve holds back on rate hikes, the higher the eventual terminal rate will likely be. This has vast implications for the trillions of dollars’ worth of debt slated for refinancing at potentially higher rates. The prospect of a “hard landing,” or severe recession, serves as a stark reminder of the delicate balance that central banks must strike between encouraging economic growth and preventing runaway inflation.

Central Banks’ Role in Global Economic Health

Central banks like the Federal Reserve play a critical role in preserving economic stability. By adjusting interest rates, they indirectly influence borrowing costs, investment, spending, and consequently, inflation. Their actions can either stimulate or suppress economic growth, preventing the economy from overheating while warding off stagnation.

The Future of the Global Economy: Opportunities and Challenges

The Interconnected Global Economy: Future Prospects

The future of the global economy is a panorama filled with myriad challenges and opportunities. The economic health of powerhouses like China and the U.S., inflation rates, and the actions of central banking institutions like the Federal Reserve will significantly mold the global economic landscape.

The Ties that Bind: Globalization and Interconnected Economies

In today’s globalized world, no economy exists in isolation. A hiccup in a major economy, such as China, can impact a factory worker in Germany, a farmer in Brazil, or a software engineer in India. Grasping these economic interconnections can help individuals and nations navigate the complex terrain of the global economy.

Technological Disruptions in the Global Economy

Technology is another factor that will continue to sculpt the global economic landscape. Developments in artificial intelligence, automation, blockchain, and fintech are disrupting traditional economic models, creating new avenues of growth while simultaneously presenting fresh challenges.

The Long Shadow of Climate Change

Climate change, while primarily an environmental issue, also has far-reaching economic implications. From altered agricultural patterns to increased costs tied to extreme weather events and rising sea levels, the financial implications of climate change are expansive and cannot be ignored.

The Role of Emerging Economies

India: The Next Economic Powerhouse

India, one of the fastest-growing economies in the world, is set to play an increasingly significant role in the global economy. India’s potential stems from its demographics, with a large young workforce ready to power its industries. However, the country also faces significant challenges, including infrastructural deficiencies, bureaucratic red tape, and socio-economic inequality. The manner in which India addresses these issues will significantly determine its economic trajectory.

The African Continent: A Sleeping Giant

Africa, while often overlooked in global economic discussions, holds enormous potential. The continent is home to several of the world’s fastest-growing economies, including Ethiopia, Ghana, and Côte d’Ivoire. However, hurdles such as political instability, inadequate infrastructure, and economic inequality need to be overcome for Africa to fully realize its potential. Successful management of these issues could make Africa a significant player in the global economic landscape.

The Future of Work and Its Impact on the Global Economy

Automation and AI: A Double-Edged Sword

Automation and AI are disrupting the traditional labor market, rendering some jobs obsolete while creating new ones. On the one hand, these technologies could boost productivity, leading to economic growth. On the other hand, they could also result in job displacement, leading to economic and social challenges. Policymakers will need to navigate this delicate balance, ensuring that the benefits of these technologies are widely shared while minimizing their negative impacts.

The Rise of Remote Work

The COVID-19 pandemic has catalyzed a shift towards remote work, which could have significant economic implications. For instance, increased remote work could lead to reduced demand for commercial real estate, impacting the construction industry. However, it could also result in cost savings for businesses and improve work-life balance for employees. The future evolution of remote work and its effects on the global economy will be an important area to watch.

The Impact of Global Political Dynamics on the Economy

The Influence of U.S.-China Relations

The relationship between the world’s two largest economies, the U.S. and China, will significantly shape the global economy. Trade tensions between these two countries can create economic uncertainty, impacting markets worldwide. On the other hand, cooperation between the U.S. and China could lead to increased global economic stability and growth.

The Role of International Organizations

International organizations like the World Trade Organization, the International Monetary Fund, and the World Bank play significant roles in the global economy. These institutions help maintain global economic stability and facilitate international trade and development. The effectiveness of these organizations in addressing global economic challenges will be a critical factor shaping the global economy’s future.

Conclusion

As we gaze into the future, the global economy seems poised on the precipice of a complex web of possibilities. Every element, from the economic health of powerhouse nations to inflation rates and actions of central banking systems, contributes to the kaleidoscope of global economic conditions. Add to this the influence of emerging economies, the changing nature of work, and the dynamics of global politics, and we have a panorama filled with challenges and opportunities. Through a nuanced understanding of these factors, we can equip ourselves to navigate the complexities of the global economic landscape, steering towards a future of shared prosperity and sustainable growth.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)