Copper, known as ‘Dr. Copper’ in the finance and economics world, plays a crucial role as an indicator of the global economy’s health and trajectory. Its use in various sectors such as construction, power generation, and manufacturing makes it a reliable gauge of economic activity. Rising copper prices typically signal a robust economy, while a decline in prices may indicate an economic slowdown.

Currently, the ongoing debt ceiling negotiations in the United States pose a significant concern for the global economy and financial markets. As the deadline approaches without a resolution in sight, the potential for market panic intensifies. Investors may become increasingly cautious, hedging their bets or even withdrawing from the market altogether. Such a mass exodus of investors could lead to a profound shift in market sentiment and potentially trigger a market crash. Moreover, the alarming fluctuations in copper prices further reinforce the economic instability, reflecting investors’ growing concerns about the debt ceiling negotiations. These warning signs call for vigilance from investors and policymakers alike to avert potential economic fallout and work towards a prompt resolution.

The Role of Copper in the Economy

Copper, often referred to as ‘Dr. Copper,’ holds a vital position in the global economy due to its extensive use across multiple sectors. Construction, power generation, and manufacturing heavily rely on copper, making it an essential commodity for economic development. As a result, the price of copper serves as a reliable indicator of economic health. When copper prices rise, it typically signifies strong economic activity and increased demand for goods and services. It indicates growth in construction projects, infrastructure development, and manufacturing output. On the other hand, a decline in copper prices may suggest an economic slowdown or contraction, as it reflects reduced demand for copper-based products and a potential decrease in industrial production.

Moreover, copper’s significance extends beyond its role as an economic indicator. Its excellent electrical conductivity and resistance to corrosion make it an indispensable component in electrical wiring, power generation, and transmission. The metal’s heat transfer properties contribute to its extensive use in heating and cooling systems. Furthermore, its antimicrobial properties make it suitable for various applications in healthcare settings. Given its versatility and broad applications, copper’s performance in the market provides valuable insights into the overall state of the economy and its future prospects.

The Debt Ceiling Negotiations

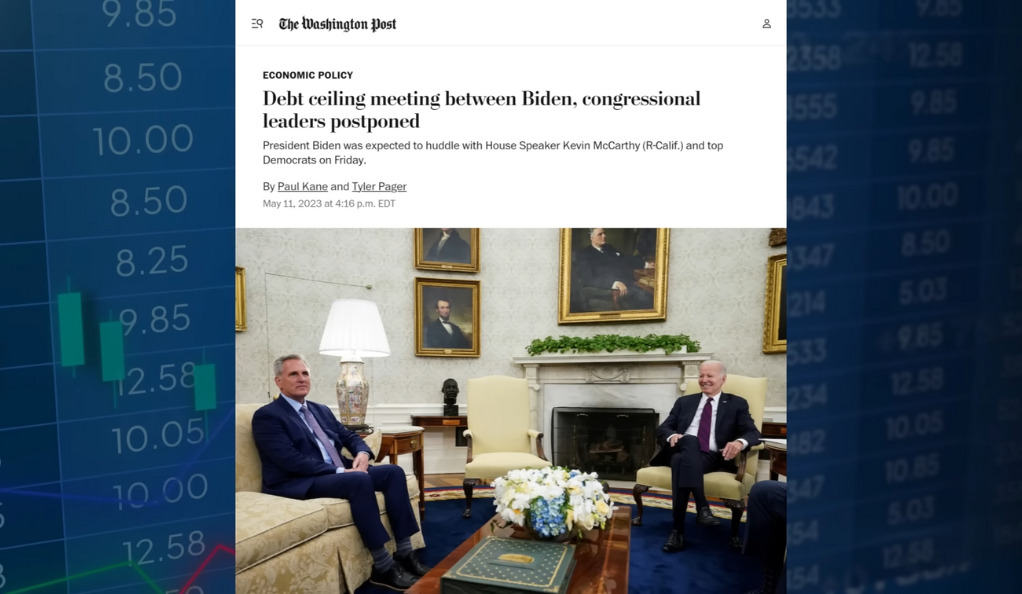

The ongoing debt ceiling negotiations in the United States have become a critical issue with far-reaching implications for the global economy and financial markets. The debt ceiling is a legal limit imposed on the amount of money the US government can borrow to fund its operations and fulfill its financial obligations. As the June 1st deadline looms closer without a resolution in sight, anxiety is mounting regarding the potential consequences.

Failure to reach a resolution on raising the debt ceiling can have severe repercussions. It could lead to a government shutdown, as the US Treasury may no longer have sufficient funds to meet its obligations, including paying government employees and honoring its debt payments. This can cause a ripple effect throughout the global financial system, impacting investor confidence and market stability. Financial markets are closely watching the progress of these negotiations, as any uncertainty or delay in resolving the debt ceiling issue can lead to increased market volatility and potential disruptions.

The debt ceiling negotiations are a delicate balancing act, requiring political consensus and bipartisan cooperation. The stakes are high, and the consequences of inaction could be detrimental not only to the United States but also to the global economy. It is crucial for policymakers to prioritize finding a resolution to this impasse to avoid triggering a financial crisis and to maintain stability in the global markets.

Potential Market Panic

The ongoing debt ceiling negotiations in the United States have raised concerns about the potential for market panic as the deadline approaches. If a resolution is not reached in time, it could trigger a wave of fear and uncertainty among investors. In such a scenario, investors may become apprehensive about the stability of the financial system and start taking defensive measures. This could involve hedging their bets by moving their investments to safer assets or even pulling out of the market entirely.

A mass exodus of investors from the market can have significant consequences for market sentiment. It can create a domino effect, leading to a downward spiral in stock prices and triggering a market crash. The interconnectedness of global markets means that such a crash in the United States can have far-reaching implications for economies around the world. The shockwaves can spread rapidly, affecting international stock markets, currencies, and investor confidence. The potential for market panic highlights the importance of reaching a timely resolution to the debt ceiling negotiations to avoid destabilizing the global financial system and mitigating the risks of a market crash.

The Warning from Wall Street

The warning signals regarding the potential market panic stemming from the ongoing debt ceiling negotiations have not gone unnoticed on Wall Street. Jamie Dimon, the CEO of JPMorgan Chase and a prominent figure in the financial industry, has voiced his concerns about the impending risk of panic engulfing the markets as the United States approaches a potential debt default. Dimon’s statement serves as a stark reminder of the gravity of the situation and the potential economic turmoil that could unfold if the debt ceiling issue remains unresolved.

Dimon’s sentiments resonate with many other financial experts and institutions who are closely monitoring the situation. The possibility of a debt default and the ensuing market panic are matters of significant apprehension within the financial community. The impact of such an event would extend beyond Wall Street, with potential reverberations felt across global financial markets. It underscores the urgent need for policymakers to find a timely resolution to the debt ceiling issue in order to mitigate the risk of a market meltdown and to safeguard economic stability.

Copper’s Alarming Message

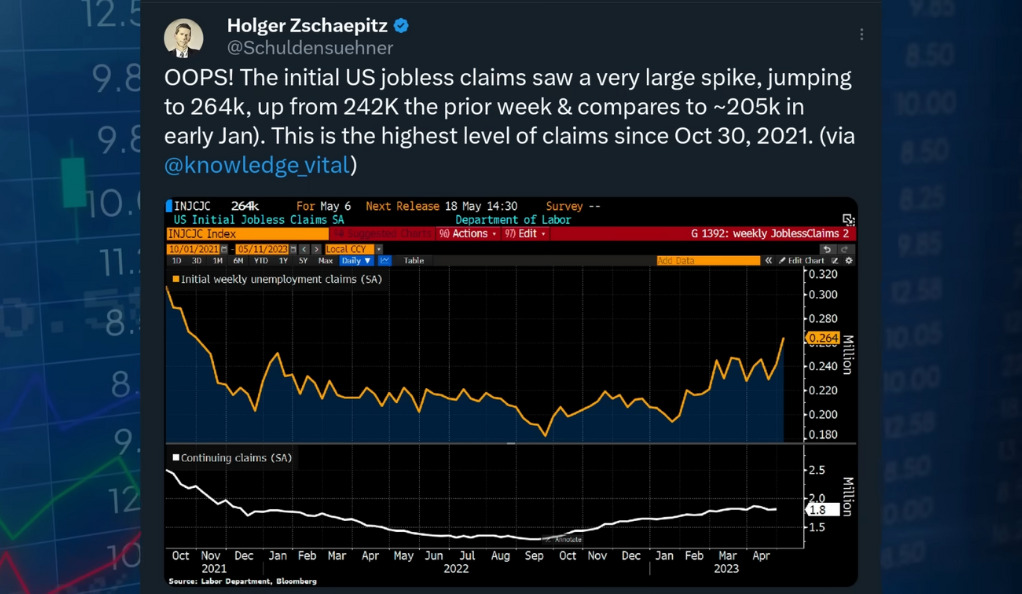

The recent fluctuations in copper prices have caught the attention of market participants, sending an alarming message about potential economic instability. The downward trend in copper prices is signaling the market’s anticipation of an economic downturn, reflecting the cautious sentiment among investors regarding the ongoing debt ceiling negotiations. Copper, being a key indicator of economic health, serves as a barometer for market confidence and future economic prospects.

The decline in copper prices suggests that investors are increasingly skeptical about the trajectory of the economy. As copper is widely used in various industries, including construction and manufacturing, a decrease in its demand and price often reflects a reduction in economic activity. The negative sentiment surrounding the debt ceiling negotiations and the uncertainty it brings have eroded investor confidence, leading to a decrease in copper prices.

The implications of declining copper prices extend beyond the copper market itself. It raises concerns about the broader financial markets and the overall state of the global economy. The correlation between copper prices and economic performance makes it a significant indicator for investors and policymakers alike. The downward trend in copper prices should be closely monitored as it could be indicative of potential economic headwinds and may warrant precautionary measures to mitigate any adverse effects.

The Potential Market Crash

The potential for a market crash stemming from the unresolved debt ceiling issue raises concerns about the broader implications for investors and the general population. While some might view a market crash as a strategic move to exert pressure on the federal government, the consequences would extend far beyond the financial sector. A market crash can have severe ramifications, affecting the livelihoods of everyday citizens who rely on a stable economy.

One of the immediate impacts of a market crash would be the potential loss of jobs. As companies face financial turmoil and uncertainty, they may be compelled to downsize or even shut down operations, leading to significant layoffs. This would result in increased unemployment rates and financial hardship for individuals and families.

Moreover, a market crash would likely have a detrimental effect on consumer spending. As confidence wanes and people become more cautious about their financial situation, they tend to tighten their belts and reduce discretionary spending. This decrease in consumer spending can have a ripple effect throughout the economy, affecting businesses across various sectors, from retail to hospitality to entertainment. The resulting decline in revenue and profitability for these businesses may lead to further job losses and perpetuate the cycle of economic hardship.

Navigating Through Uncertainty

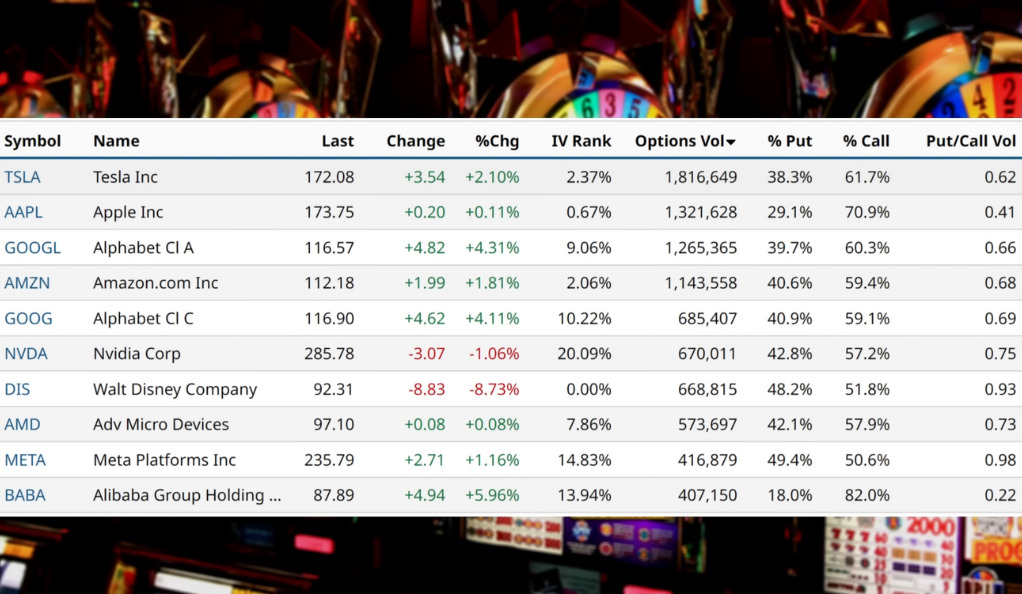

In these uncertain times, it is crucial for investors to stay informed and prepared. Understanding market indicators like copper can provide valuable insights into potential shifts in the economy and help investors make informed decisions.

Conclusion

The ongoing debt ceiling negotiations and potential for a U.S debt default present significant challenges for the global economy. The alarming message being sent by copper prices highlights the gravity of these issues. As we approach the deadline, investors and policymakers alike must heed these warning signs to prevent potential economic fallout. It’s a high-stakes game of economic chess where every move counts, and ‘Dr. Copper’ seems to be suggesting that we’re on thin ice.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)