Embarking on a financial journey through trading often begins with a small account. The initial capital, however modest, signifies the first step towards building a potential fortune. However, growing a small trading account can be a challenging task, especially for novice traders. It requires strategic planning, understanding of the market dynamics, robust risk management, judicious use of leverage, and above all, patience and discipline. In this detailed article, we’ll delve into five powerful strategies that can help transform a small trading account into a more significant one.

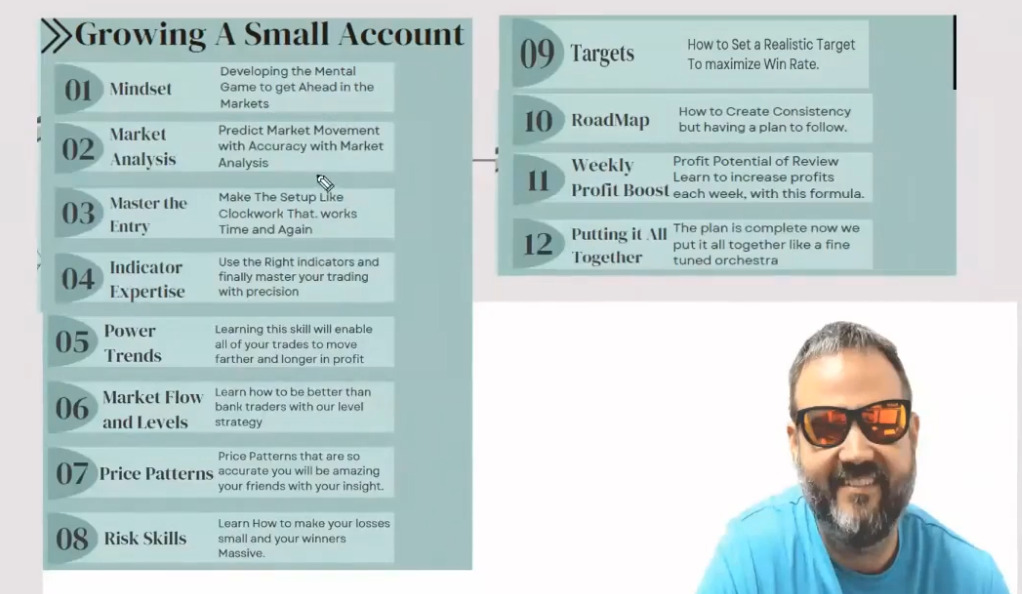

Mastering Market Knowledge

Decoding Market Dynamics

Understanding the pulse of the market is the cornerstone of successful trading. Every market movement is a result of numerous influencing factors such as global and local economic indicators, geopolitical events, market sentiment, and industry trends. Staying informed about these factors and interpreting their impact can lead to more insightful and calculated trading decisions.

The Value of Lifelong Learning

Learning is an ongoing process in the ever-evolving world of trading. Regularly consuming financial news, following market trends, and seeking wisdom from seasoned traders can significantly enhance your trading acumen. This habit of continuous learning not only keeps you in sync with the market changes but also empowers you to refine your strategies and improve your trading performance over time.

Crafting a Comprehensive Trading Plan

Trading Plan: Your Blueprint to Success

A well-thought-out trading plan is your strategic blueprint in the potentially turbulent world of trading. It outlines your trading objectives, risk appetite, and the specific trading strategies you intend to employ. This plan should reflect your financial goals and trading style and serve as a rational guide to help you navigate through the market’s emotional roller-coaster.

The Discipline to Adhere to Your Plan

Developing a trading plan is just half the battle; the real challenge lies in its diligent execution. Market volatility can lead to impulsive decisions driven by fear or greed. However, consistency and discipline in sticking to your plan can keep these emotions at bay. It’s crucial to stay committed to your plan while also maintaining the flexibility to adapt it based on changing market conditions.

Implementing Rigorous Risk Management

Risk Management: Your Protective Shield

Risk management is a vital part of any trader’s strategy. It serves as a protective shield for your trading account, shielding it from substantial losses that could potentially jeopardize your trading career. Effective risk management requires implementing a variety of tactics, including setting appropriate stop-loss orders, diversifying your portfolio, and adhering to the rule of only risking what you can afford to lose. In this section, we’ll delve deeper into these strategies and discuss how they contribute to a successful and sustainable trading journey.

Stop-Loss Orders: Capping Potential Losses

One of the most widely used risk management techniques is the stop-loss order. A stop-loss order is a directive given to the broker to sell an asset when it reaches a certain price. The primary aim of a stop-loss order is to limit the potential loss on a trade. By setting a stop-loss, traders predetermine the maximum amount they’re willing to lose on a single trade if the market moves against them. This technique helps traders prevent major drawdowns in their account, ensuring that a single unsuccessful trade doesn’t significantly impact their overall account balance.

Diversification: Spreading the Risk

Diversification is another critical strategy in risk management. It involves spreading your investments across various asset classes or sectors. The rationale behind diversification is that different assets often perform differently under various market conditions. If one asset or sector performs poorly, other parts of your portfolio might perform well, thus balancing the overall performance.

For instance, if you diversify your portfolio by investing in both technology stocks and commodities, a downturn in the technology sector may be cushioned by a strong performance in commodities. Therefore, diversification helps mitigate the risk of substantial losses and contributes to more stable portfolio performance over time.

Risking Only What You Can Afford to Lose

Another golden rule in risk management is to only risk what you can afford to lose. It’s a fundamental principle that traders should set their risk per trade based on their total account balance. A common practice among experienced traders is not to risk more than 1-2% of their account balance on a single trade.

Adhering to this rule helps prevent substantial losses that can drastically reduce your account balance and impair your ability to recover. By risking only a small percentage of your account, you ensure that you have enough capital to continue trading and possibly recover even after a series of unsuccessful trades.

The Significance of a Risk-to-Reward Ratio

In addition to the above strategies, another essential aspect of risk management is the risk-to-reward ratio. This ratio measures the potential loss (risk) of a trade compared to the potential profit (reward). A favorable risk-to-reward ratio ensures that the potential profits on a trade outweigh the potential loss. Many traders follow a rule of thumb of a risk-to-reward ratio of at least 1:2. This approach means that for every dollar risked, the potential return is two dollars.

Leveraging Responsibly

Leverage: A Tool to Use with Caution

Leverage in trading can be a powerful ally when used judiciously. It enables traders to control large positions with relatively small capital. However, leverage is akin to a double-edged sword – while it can magnify your profits, it can also exacerbate your losses. Therefore, leverage should be used judiciously, keeping in mind the associated risks and your ability to absorb potential losses.

Comparison between Good trader and a Forex master trader

A good trader and a forex master trader both operate in the financial markets, but they differ significantly in their skill levels, experience, and strategies. A good trader is proficient in analyzing market trends, making informed decisions, and managing risks. They have a solid understanding of trading principles and can consistently generate profits. However, a forex master trader takes these skills to an entirely new level. They possess an in-depth understanding of the forex market, including its complexities and nuances. They are adept at using advanced trading strategies and tools, and they can adapt quickly to changing market conditions. A forex master trader also has a high level of emotional intelligence, allowing them to stay calm under pressure and make decisions without letting emotions cloud their judgment. They have a track record of consistently high returns and can navigate the market with precision, even during periods of high volatility.

Fostering Patience and Discipline

The Virtues of Patience and Discipline in Trading

In the world of trading, success is seldom achieved overnight. Instead, it’s a long-distance run requiring enduring qualities like patience, discipline, and a long-term perspective. Traders who learn to cultivate and master these virtues often find themselves in a more advantageous position to grow their small trading account into a significant one.

Patience: Waiting for the Right Opportunities

Patience in trading is the ability to wait for the right opportunities to present themselves, rather than rushing into trades due to fear of missing out (FOMO). This patience is rooted in the understanding that the market offers numerous trading opportunities. The key is to wait for the situations that align with your trading plan and where the potential reward justifies the risk.

To develop patience, traders must first recognize that each trade is merely one among hundreds they will execute over their trading career. Rushing into suboptimal trades can lead to unnecessary losses and erode trading capital. Therefore, being patient means trusting your trading plan and understanding that the markets are abundant with opportunities. If one opportunity is missed, another will inevitably arise.

Discipline: Adhering to Your Trading Plan

While patience is essential in waiting for the right trading opportunities, discipline is critical in acting on these opportunities without deviation. Discipline in trading refers to the ability to execute trades in strict accordance with your trading plan, regardless of emotions like fear or greed.

Discipline can often be the most challenging aspect of trading to master, particularly during volatile market conditions where emotional decision-making can lead to irrational trades. It requires a strong mental framework and the ability to control impulses. Traders who maintain discipline can manage their risks effectively, stay focused on their trading strategy, and avoid impulsive and potentially damaging decisions.

Long-term Perspective: Playing the Long Game

Successful trading requires a long-term perspective. This involves understanding that any single trade does not define success or failure but rather that success is measured over a series of trades. It requires accepting that losses are part of the process and what truly matters is the net outcome over many trades.

A long-term perspective also encourages sustainable trading practices, such as not over-leveraging, keeping risks within defined limits, and regularly reviewing and refining trading strategies. It emphasizes the importance of ongoing learning, adapting to changing market conditions, and constant self-improvement.

The Interplay of Patience, Discipline, and a Long-term Perspective

While patience, discipline, and a long-term perspective are individually important, their real power lies in their combined application. Patience helps you wait for the best opportunities, discipline ensures you act on these opportunities in alignment with your trading plan, and a long-term perspective keeps you focused on sustainable success. These virtues, when practiced together, form the foundation of a robust trading mindset that can navigate the ups and downs of the market, leading to long-term profitability and success in trading.

Conclusion

Expanding a small trading account into a sizeable one is a blend of comprehensive marketknowledge, a well-structured trading plan, robust risk management, prudent use of leverage, and an unwavering commitment to discipline and patience. By diligently applying these strategies, you can progressively grow your account and navigate the financial markets confidently. Remember, in trading, the journey is just as important as the destination. Stay patient, continue learning, relish the journey, and let the process of trading shape your path to financial growth. Trading success isn’t measured solely by the destination reached, but by the discipline and knowledge gained during the journey.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)