Genuine Parts Company (GPC) is a global distributor of automotive replacement parts, industrial parts, and business products. Recently, GPC’s stock has been declining along with the broader market trends. In this article, we will analyze the reasons behind GPC’s poor performance and understand the broader factors affecting the stock market.

Genuine Parts (GPC) Drops: Market Analysis

As of July 19th, 2021, Genuine Parts Company’s stock price is $121.06, which is a 0.67% drop from the previous day’s closing price of $121.85. This decline is primarily attributable to the broader market trend, where the Dow Jones Industrial Average and the S&P 500 both declined by 1.59% and 1.51%, respectively, on July 19th, 2021. In the last twelve months, GPC’s stock price has fluctuated between $90.05 and $139.32, with an average price of $110.37.

Understanding the Broader Factors Behind GPC’s Performance

The performance of Genuine Parts Company is closely related to the broader industry and market trends. The automotive industry, in particular, has been experiencing a slowdown in sales due to the COVID-19 pandemic’s impact on consumer behavior. Further, the semiconductor chip shortage, which has affected the production of cars and trucks worldwide, has led to a decline in demand for automotive replacement parts. These factors have negatively impacted GPC’s sales and profitability.

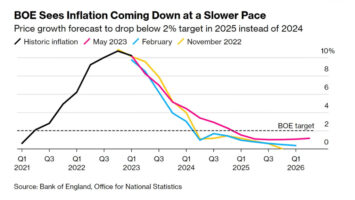

Additionally, the recent surge in inflation has affected the entire economy, including the stock market. As inflation rises, the purchasing power of consumers decreases, leading to a decline in demand for goods and services. This trend has also contributed to the decline in GPC’s stock price.

In conclusion, Genuine Parts Company’s stock price has declined, primarily due to the broader market trend and industry-specific factors affecting the automotive industry. With the ongoing COVID-19 pandemic and the semiconductor chip shortage, it is uncertain when GPC’s sales and profitability will recover. As always, it’s essential to keep an eye on broader market trends and industry-specific indicators to make informed investment decisions.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)