In the intricate dance of economics, few relationships have been as closely examined as that between inflation and unemployment. Historically intertwined, these two vital indicators have often moved in opposite directions, guided by theories and models that economists have relied upon for decades. But what happens when the music changes, and the dance takes an unexpected turn?

In recent times, the economic landscape has shifted, challenging traditional paradigms and giving rise to new perspectives. From the emergence of the Soft Landing Theory to debates over wage inflation and the mysterious disconnect between core CPI and unemployment rates, the old rules seem to be bending, if not breaking.

This article embarks on a journey through this evolving terrain, exploring the complexities, contradictions, and new horizons of the inflation-unemployment relationship. Whether you’re an investor, policymaker, student, or simply curious about the forces shaping our economic world, this exploration offers insights and understanding for navigating the maze of modern economics.

Join us as we delve into the theories, analyze the data, question the assumptions, and seek to unravel the economic enigma of inflation and unemployment in the 21st century.

The Traditional Correlation Between Inflation and Unemployment

The Phillips Curve

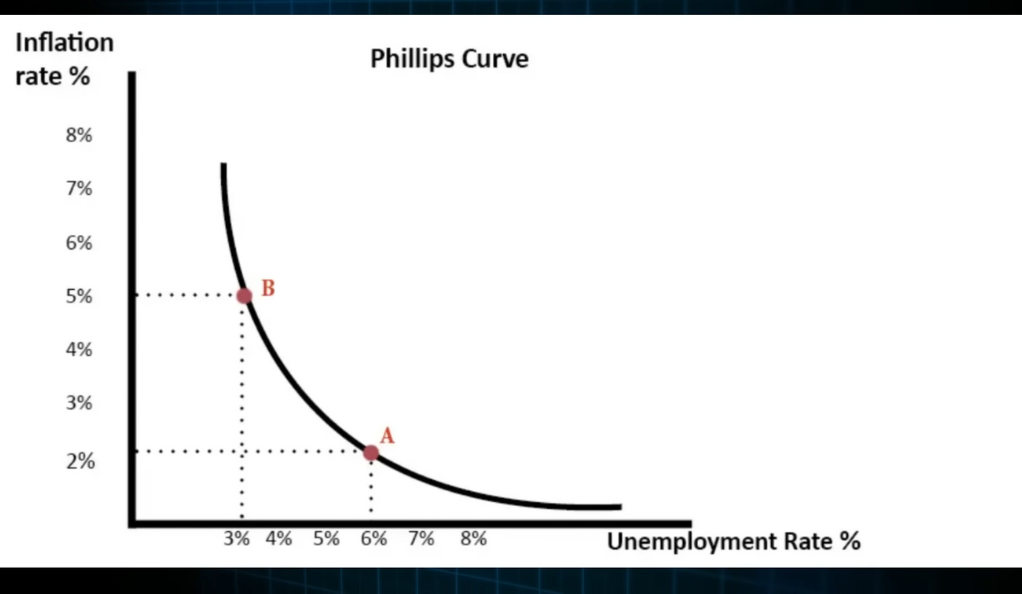

The Phillips Curve has long been a cornerstone in economics, illustrating the inverse relationship between inflation and unemployment. Named after economist A.W. Phillips, it posits that as unemployment decreases, inflation increases, and vice versa. This relationship is grounded in the demand-pull inflation theory, where increased demand for goods and services leads to higher prices. As more people are employed, they have more disposable income, leading to increased demand and, consequently, inflation. Conversely, when unemployment rises, demand falls, leading to a decrease in inflation. This traditional understanding has guided monetary policy for decades but is now being challenged by new economic phenomena.

Exceptions to the Rule

While the Phillips Curve has been a reliable model for many years, recent economic trends have shown exceptions to this rule. In some cases, both inflation and unemployment have risen simultaneously, defying the traditional inverse relationship. Factors such as globalization, technological advancements, and changes in labor market dynamics have contributed to these anomalies. For instance, the increased ability to outsource labor can lead to both domestic unemployment and inflation in certain goods. These exceptions have led economists to question the universal applicability of the Phillips Curve, sparking debates and leading to the development of new theories like the Soft Landing Theory.

Soft Landing Theory: A New Perspective

The Basics of Soft Landing

The Soft Landing Theory is a relatively new concept that challenges traditional economic thinking. It suggests that it’s possible to reduce inflation without necessarily increasing unemployment. In a “soft landing,” the economy slows down just enough to prevent inflation from rising but not enough to cause a recession. This delicate balance is achieved through careful monetary policy, such as adjusting interest rates. The idea of a soft landing is appealing because it promises economic stability without the painful trade-off of increased unemployment. However, achieving a soft landing is a complex task that requires precise timing and understanding of various economic indicators.

The Role of the Federal Reserve (FED)

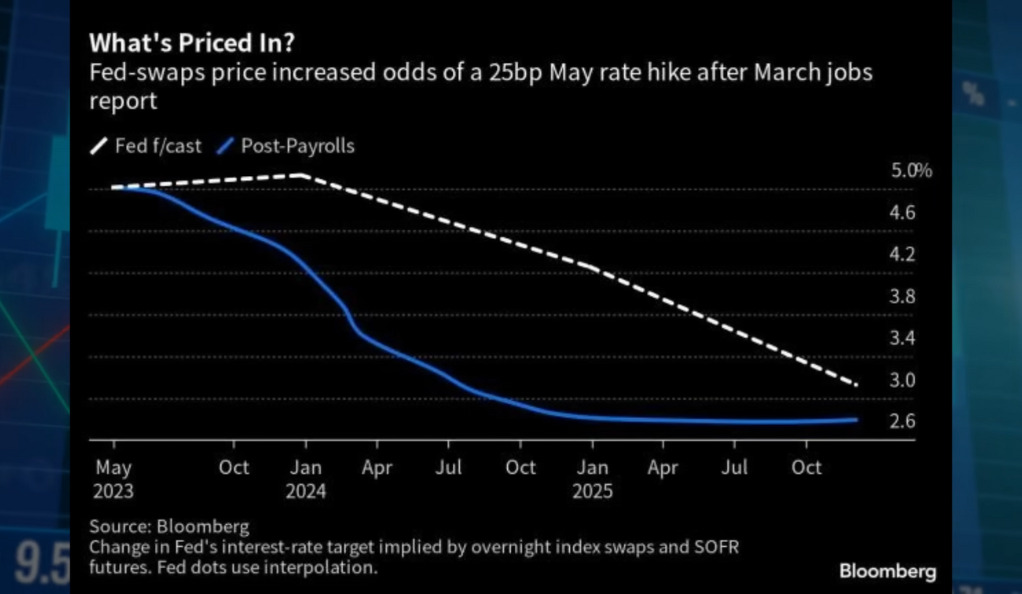

The Federal Reserve (FED) plays a crucial role in the Soft Landing Theory by controlling interest rates to manage inflation and unemployment. By cutting rates as inflation goes down, the FED can stimulate economic growth without causing a spike in unemployment. This approach requires a deep understanding of the current economic landscape and the ability to predict future trends. The FED’s actions can have far-reaching effects on the stock market, consumer spending, and overall economic health. The idea that the FED can engineer a soft landing is both promising and contentious, as it requires a delicate balance between various economic forces.

Rate Cuts vs. Unemployment Rate: A Historical Analysis

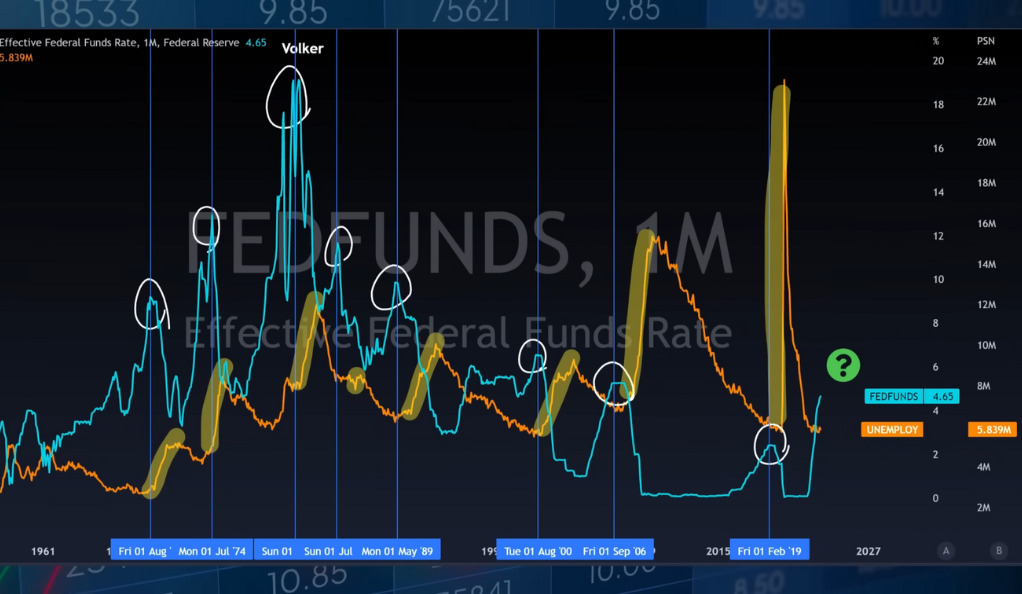

FED Funds Rate and Unemployment

Historically, there has been a clear pattern between the FED funds rate and unemployment. When the FED funds rate peaks and starts cutting rates, unemployment typically begins to rise. This relationship is rooted in the idea that to take inflation down, the unemployment rate must move higher. When the FED cuts rates, it’s often in response to signs of economic slowdown, which can lead to increased unemployment. This pattern has been observed in various economic cycles and has been a guiding principle for monetary policy. However, recent trends are challenging this established understanding, leading to questions and new theories.

The Current Disconnect

The current economic situation presents a disconnect between traditional patterns of inflation and unemployment. Core CPI is dropping, while the unemployment rate is not rising, contrary to historical trends. This could be due to core CPI just dipping temporarily before moving higher again, or perhaps the unemployment data itself is misleading. Factors such as changes in the global economy, government policies, and sector-specific trends might be contributing to this disconnect. Understanding this anomaly is vital for policymakers, investors, and economists, as it may signal a fundamental shift in the economic landscape.

Misleading Unemployment Data: A Closer Look

Layoffs and Employment Data

Layoffs have surged nearly five-fold this year, but this dramatic increase is not reflected in the overall employment data. This discrepancy may be due to the way unemployment is measured or reported. For example, temporary layoffs might not be counted in the official unemployment rate, or there may be a lag in reporting. Additionally, the nature of the layoffs, such as whether they are concentrated in specific industries or regions, can affect how they are reflected in the data. This misleading unemployment data presents a challenge for policymakers and analysts trying to understand the true state of the labor market and the economy as a whole.

Sector-wise Job Gains and Losses

The current employment data shows significant job gains in sectors like leisure and hospitality, healthcare, and government, while other sectors like retail trade, construction, manufacturing, and financial activities are losing jobs or experiencing slow growth. This uneven distribution of job gains and losses may not accurately represent the overall strength of the economy and job market. For instance, job gains in lower-wage sectors might mask losses in higher-wage industries, leading to a skewed perception of economic health. Analyzing sector-wise trends is essential for a nuanced understanding of the labor market and its implications for the broader economy.

Wage Inflation: A Debate Between Bulls and Bears

The Bulls’ Perspective

Bulls in the financial market argue that wage growth is going down on an annual basis, signaling a decrease in inflation. They point to factors such as increased labor supply, technological advancements, and global competition as reasons for subdued wage growth. According to this view, the fear of runaway inflation is overblown, and the economy is on a stable path. The bulls’ perspective is often optimistic, focusing on positive economic indicators and downplaying potential risks. Their argument forms a critical part of the ongoing debate about the direction of the economy and the appropriate policy responses.

The Bears’ Perspective

On the other hand, bears point to the month-over-month increase in wages as a sign of continued inflation. They argue that short-term trends are more indicative of the current economic momentum and that rising wages will inevitably lead to higher prices. The bears often emphasize potential risks and uncertainties, such as supply chain disruptions, labor shortages, and geopolitical tensions, that could drive inflation higher. Their more cautious outlook forms a counterpoint to the bulls’ optimism and adds complexity to the debate over wage inflation. Understanding both perspectives is essential for a balanced view of the economic landscape.

FED Rate Hikes: Market Expectations

Post-payrolls FED Swaps

The market’s expectations for FED rate hikes are reflected in post-payrolls FED swaps, with 71.2% of participants expecting the FED to raise rates by 25 basis points in the next meeting. This significant majority indicates a strong belief that inflation is not over yet, despite recent declines in core CPI. These expectations are shaped by various factors, including economic data, global events, and statements from FED officials. The market’s anticipation of rate hikes can influence investment decisions, currency values, and overall economic sentiment. Monitoring these expectations is crucial for investors, policymakers, and businesses looking to navigate the uncertain economic environment.

Bond Yields and Stock Market: A Complex Relationship

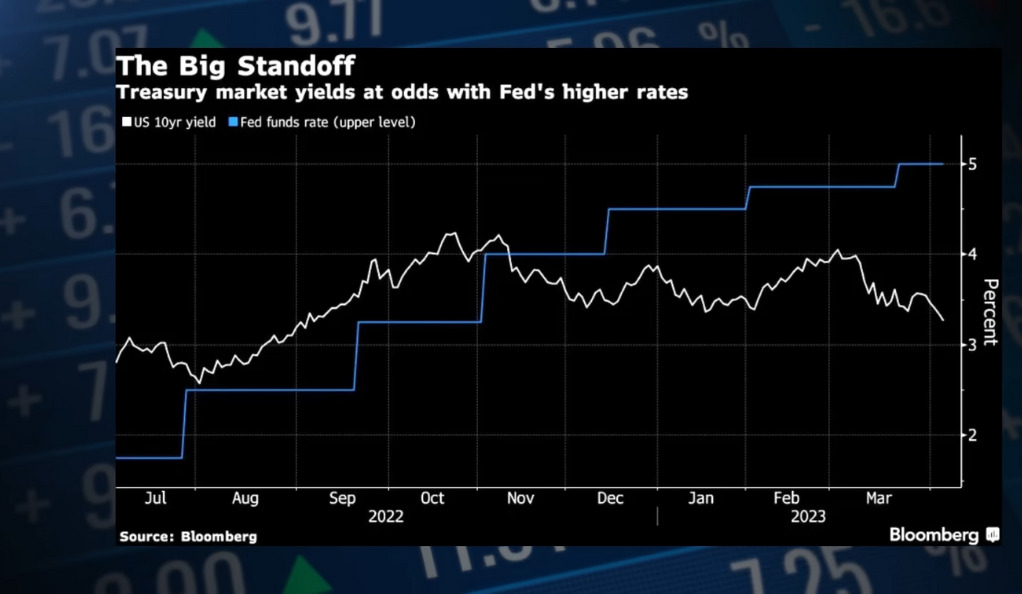

The Impact of Core CPI on Bond Yields

If core CPI rebounds higher, bond yields and the dollar may rise, which could negatively impact the equities market. This relationship is rooted in the idea that higher inflation erodes the real value of fixed-income investments like bonds, leading to higher yields. A rise in bond yields can make bonds more attractive compared to stocks, leading to a shift in investment preferences. Additionally, a stronger dollar can hurt U.S. exports and multinational companies, further weighing on the stock market. Understanding the interplay between core CPI, bond yields, and the stock market is essential for investors looking to make informed decisions in a dynamic economic landscape.

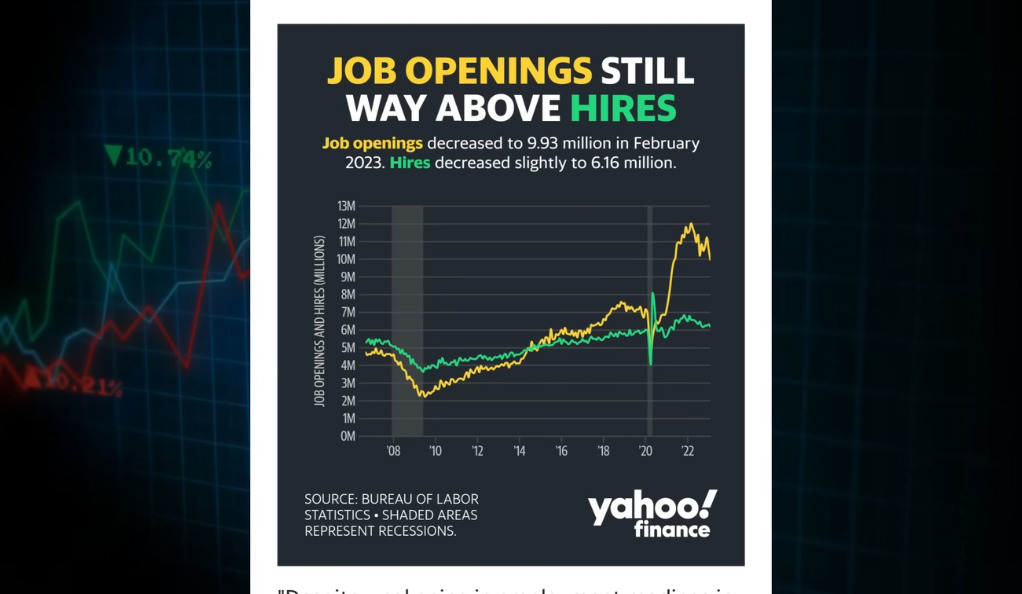

Job Openings as a Fugazi: A Misleading Indicator?

The Reality Behind Job Openings

The high number of job openings reported in recent times may not accurately represent the strength of the job market. Some companies may list jobs without actually looking to hire, either to gauge interest or to create a perception of growth. This practice can inflate the number of job openings, creating a “fugazi” or illusion of a robust job market. Additionally, the quality and nature of the job openings may not align with the skills and preferences of job seekers, leading to a mismatch in the labor market. Analyzing the reality behind job openings is essential for a true understanding of the employment landscape and its implications for the economy.

Conclusion

The relationship between inflation and unemployment is more complex than ever, reflecting a new economic paradigm. The Soft Landing Theory, misleading unemployment data, debates over wage inflation, and market expectations are reshaping our understanding of these critical economic variables. The traditional models and assumptions are being challenged, requiring a fresh perspective and innovative thinking. As we navigate this new landscape, it’s essential to keep an eye on the ever-changing dynamics and be prepared to adapt to new economic realities. In a world where the only constant is change, understanding the nuances and complexities of inflation and unemployment is key to making informed decisions for the future.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)