In a world where economic stability often feels like a fleeting dream, understanding the intricate web of factors that shape our financial landscape is more crucial than ever. From the individual struggling to make ends meet to the multinational corporation eyeing global expansion, the economy impacts us all in profound and often unpredictable ways.

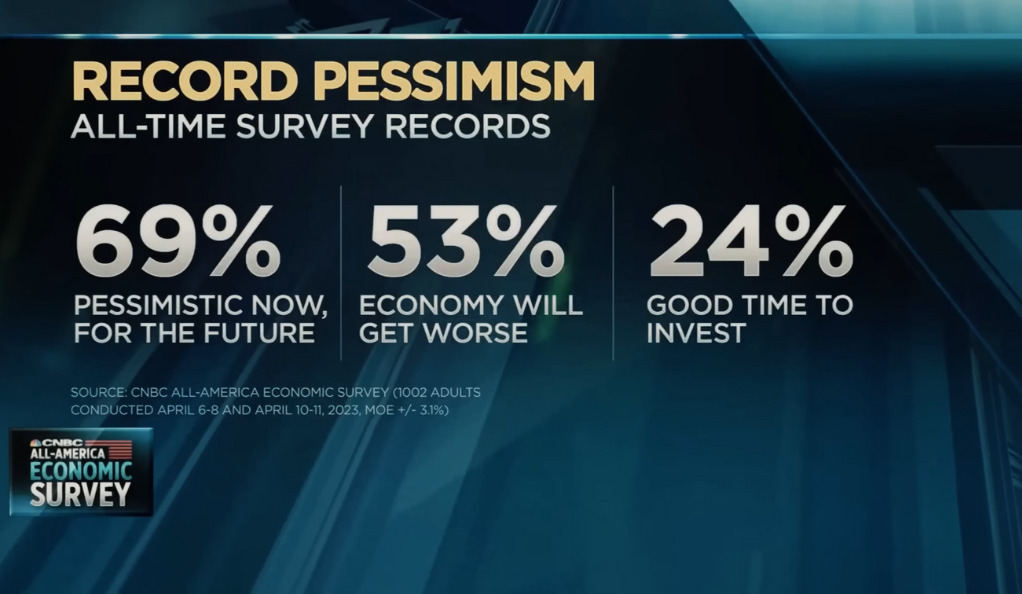

The recent CNBC All-America economic survey has unveiled a record level of pessimism, with 69% of respondents expressing concern about the present and future economic conditions. But what’s driving this sentiment? Is it the struggle of wages against relentless inflation? The uncertainty surrounding corporate earnings? Or perhaps the global influences like China’s unexpected growth?

This article aims to unravel the complexities of the current economic situation, diving into various facets such as consumer debt, Federal Reserve policies, systemic risks, and more. Through a detailed exploration of these topics, we’ll attempt to shed light on what’s happening now and what it might mean for the future.

So, buckle up and join us on this journey through the economic maze. Whether you’re an investor, a policy-maker, or simply a curious observer, there’s something here for everyone. Let’s delve into the numbers, the trends, and the human stories behind the economic headlines, and see if we can make sense of it all.

Record Pessimism: A Sign of the Times?

The CNBC All-America Economic Survey

The CNBC All-America economic survey paints a grim picture, with 69% of respondents expressing pessimism about the current economic situation and the future. This all-time high in negative sentiment is alarming.

- 53% Believe Things Will Get Worse: This figure represents a significant portion of the population who feel that the economy is on a downward spiral. It’s not just a fleeting feeling; it’s a deeply ingrained fear that things are not going to improve anytime soon.

- 24% Think It’s a Bad Time to Invest: Investment is often a sign of confidence in the economy. With nearly a quarter of respondents hesitant to invest, it reflects a broader lack of faith in economic stability.

Contrarian Indicator or Warning Sign?

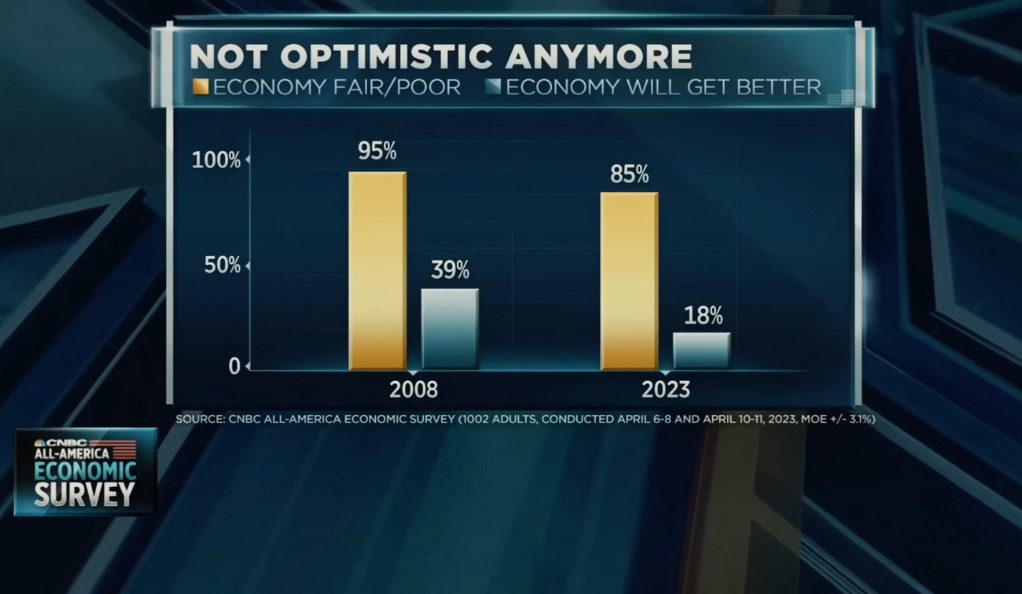

The high level of pessimism might be seen by some as a contrarian indicator, suggesting that the economy could rebound. However, this was also the sentiment in 2008 before the financial crisis. The question then arises: Are we facing a similar situation now? Or is this pessimism unfounded, and we’re in for a soft landing? Analyzing historical trends and current market conditions might provide some clues, but the uncertainty remains a concern.

Wages vs. Inflation: The Struggle Continues

Falling Behind Inflation

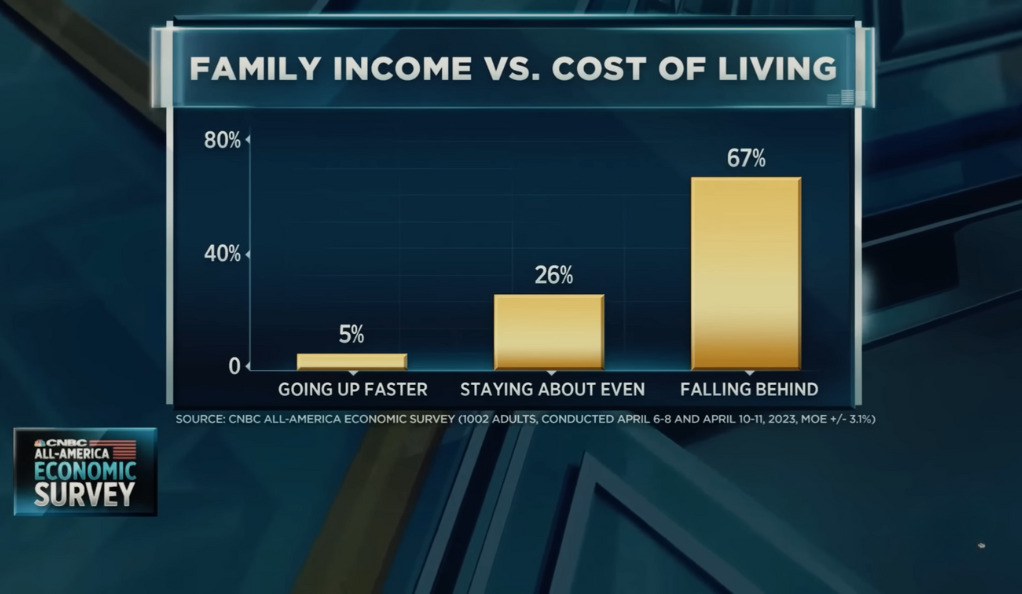

Inflation is a word that’s been on everyone’s lips lately. With just 5% of people saying their wages are rising faster than inflation and 67% believing they’re falling behind, it’s clear that this is a widespread problem.

- Feeling the Pressure: Consumers are struggling to keep up with rising prices, and the inflation problem seems far from over. From groceries to gas, everything seems more expensive, and wages are not keeping pace.

- A Vicious Cycle: This wage-inflation gap can create a vicious cycle. With less spending power, consumers may cut back on purchases, leading to a potential economic slowdown. Businesses might then cut back on hiring or even lay off workers, further exacerbating the problem.

Corporate Earnings: The Heartbeat of the Stock Market

Consumer Spending and Corporate Health

Corporate earnings are often seen as the heartbeat of the stock market. They depend heavily on consumer spending, which is currently under pressure due to inflation and wage stagnation.

- A Delicate Balance: If consumers cut back on spending, corporate earnings may take a hit. This could lead to a decline in stock prices and even affect the broader economy.

- A Chain Reaction: Reduced earnings could lead to job cuts, further dampening consumer spending. It’s a chain reaction that could have far-reaching consequences.

Consumer Debt: A Growing Concern

Falling Behind on Payments

The rise in U.S. consumers falling behind on payments is a growing concern. It’s not just about individual financial stability; it’s a sign of broader economic stress.

- A Warning Sign: Increased debt and defaults could lead to financial instability for many households. This isn’t just a problem for those in debt; it could have ripple effects throughout the economy.

- A Ripple Effect: If defaults rise significantly, it could affect banks and other financial institutions, leading to a potential credit crunch. This could further slow down the economy, creating a vicious cycle of debt and economic stagnation.

China’s Impact: A Global Player

China’s Q1 GDP Growth

China’s economic growth, particularly its Q1 GDP growth, has been higher than expected. This has led to increased demand for commodities, driving inflation higher globally.

- A Double-Edged Sword: While growth in China is generally seen as positive, it may keep inflation elevated for longer than anticipated. This could affect everything from the price of goods to interest rates in countries around the world.

- A Global Influence: China’s economic decisions have far-reaching effects. Its growth or slowdown can impact global trade, currency exchange rates, and even political relationships. What happens in China doesn’t stay in China; it resonates globally.

Fed Rate Cuts: A Tricky Balancing Act

Inflation and Interest Rates

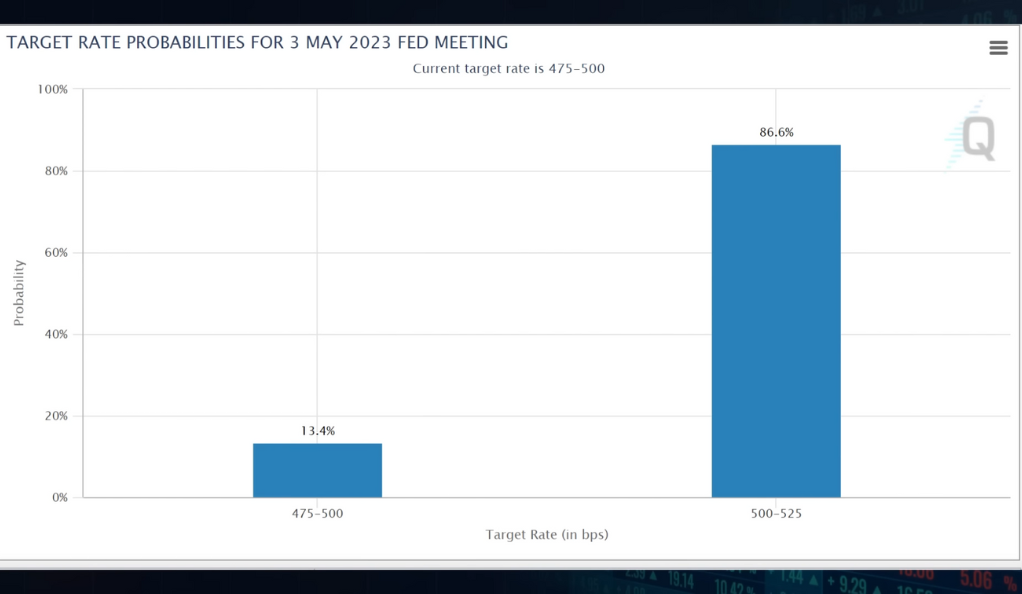

The Federal Reserve’s decisions on interest rates are always closely watched, but the current situation makes them even more critical. Despite calls for rate cuts, inflation remains a persistent issue.

- A Forecasted Cycle: Some believe that the current rate hike cycle is the most forecasted in history. This means that many have anticipated the Fed’s moves, but it doesn’t make the balancing act any easier.

- A Delicate Dance: The Fed must balance the need to control inflation with the desire to support economic growth. Cut rates too much, and inflation could spiral out of control. Raise them too high, and growth could stall. It’s a delicate dance with significant consequences.

Systemic Risk: A Lurking Danger?

Interest Rates and Defaults

The possibility of higher interest rates leading to increased defaults in commercial real estate and other sectors is a concern. It raises the question of whether systemic risk is creeping back into the financial system.

- A Hidden Threat: While the banking crisis may be averted for now, other dangers could be lurking. The interconnected nature of the financial system means that a problem in one area can quickly spread.

- A Complex Web: The financial system is a complex web of relationships and dependencies. A default in one sector could lead to problems in others, potentially reintroducing systemic risk.

Conclusion

The economic landscape is a complex and multifaceted picture, with various elements interacting and influencing each other. From record pessimism to the struggles between wages and inflation, the current situation is filled with challenges and uncertainties.

Understanding these dynamics is crucial for anyone looking to navigate the turbulent economic waters. Whether we’re on the brink of a downturn or facing a temporary hiccup, only time will tell. But one thing is clear: Knowledge and awareness of these factors can empower individuals, businesses, and policymakers to make informed decisions in these uncertain times.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)