The financial world has no shortage of legends. Yet, even in such a remarkable landscape, the story of Larry Williams stands out. This professional trader’s journey from $10,000 to an astounding $1.1 million, all within a short span of 12 months, is truly extraordinary. Achieving this monumental success wasn’t just about random luck or chance. It required a solid understanding of market dynamics, a unique trading strategy, and an unyielding determination to capitalize on these elements.

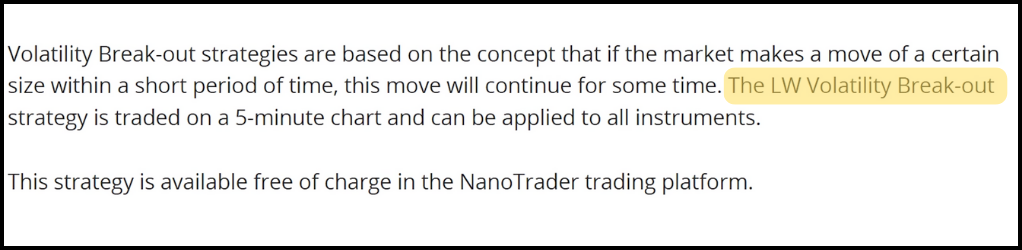

Williams’ trading strategy, christened the Lw Volatility Breakout Strategy, was the cornerstone of his success. Yet, it wasn’t the strategy alone that skyrocketed his portfolio. There were two additional confirmation indicators and a secret trick that played a pivotal role. Together, these components formed the formidable arsenal that Williams deployed in the highly volatile battlefield of trading.

The Powerhouse: Lw Volatility Breakout Strategy

The backbone of Williams’ trading success is the Lw Volatility Breakout Strategy. But what is this strategy all about? It’s a method that targets volatility in the financial markets. In a nutshell, it involves patiently waiting for a substantial price movement, known as a “breakout,” in an asset such as a stock, then making calculated trades based on this sudden volatility.

The effectiveness of this strategy lies in its simplicity and power. It acknowledges the fundamental truth of the financial markets: they are inherently volatile. Instead of attempting to suppress or ignore this volatility, the Lw Volatility Breakout Strategy embraces it. It works with the volatility, using it as a lever to unlock significant trading opportunities.

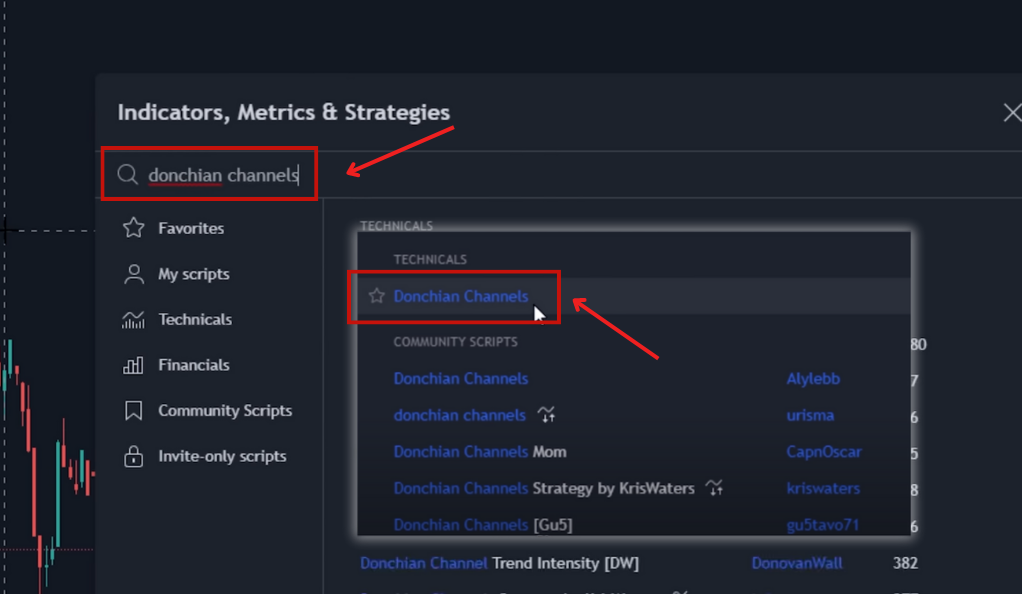

The Foundation: Donchian Channels Indicator

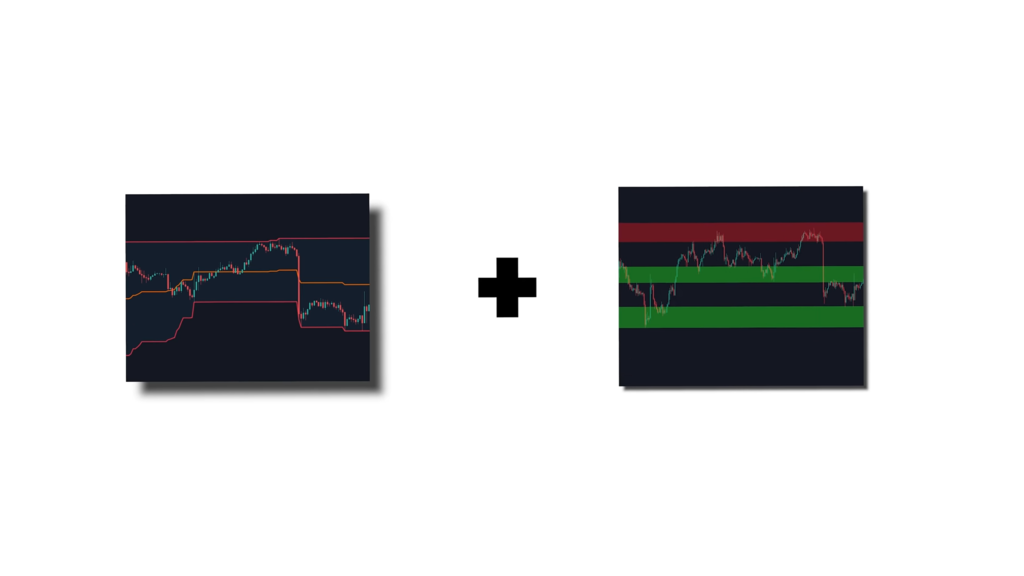

Just as a building requires a strong foundation, the Lw Volatility Breakout Strategy relies on a robust tool known as the Donchian Channels Indicator. Named after its creator, Richard Donchian, this trading tool is designed to identify potential buying and selling points in the market, based on price volatility.

The Donchian Channels Indicator effectively charts the highs and lows of an asset’s price over a set period, providing a visual representation of its volatility. By identifying these channels of volatility, traders can better predict price movements and make more informed trading decisions. Williams utilized this tool to its full potential, leveraging its insights to drive his trading strategy and ensure its success.

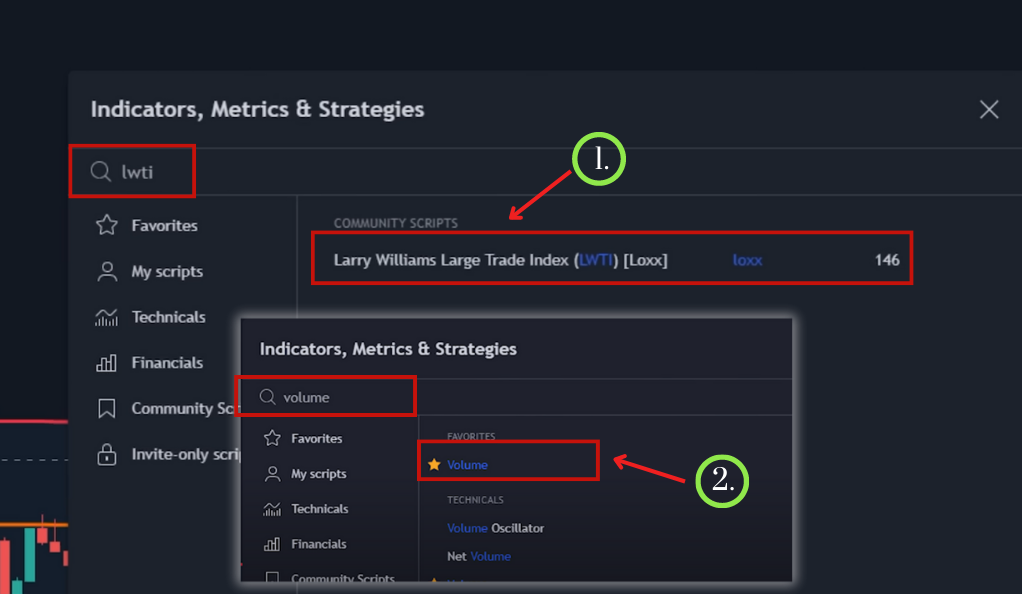

The Extra Advantage: Confirmation Indicators

Williams supplemented the Lw Volatility Breakout Strategy and the Donchian Channels Indicator with two additional confirmation indicators. While it doesn’t specify what these indicators were, it’s clear that they provided further reassurance and validation for his trades.

These confirmation indicators functioned like a system of checks and balances within his trading approach. They offered a second and third layer of verification, ensuring the robustness of the strategy and minimizing potential risks. By integrating these additional indicators into his strategy, Williams added another dimension of complexity and accuracy to his trading, further improving its effectiveness.

The Secret Sauce: A Clever Trading Trick

Every successful recipe has a secret ingredient, that one elusive element that brings all the others together into a perfect blend. In the trading world, Larry Williams had a secret of his own. This “secret trick,” seemed to be the crowning jewel of his trading strategy. Even though the details of this secret trick remain undisclosed, we can make some informed guesses about its nature and impact based on Williams’ overall trading approach and his exceptional success.

What Could the Trick Be?

One may hypothesize that this secret trick could involve a unique method of interpreting the market data, a way to read between the lines of the information provided by the Donchian Channels Indicator and the additional confirmation indicators. It might be a personal rule that Williams adhered to, such as not making trades at certain times or only trading in specific market conditions. Alternatively, it could be a psychological technique, a unique approach to managing the inevitable stress and emotion that comes with the high-stakes world of trading.

Whatever the trick, it likely played a crucial role in differentiating Williams from other traders. Like a chef’s secret ingredient that sets their dish apart, this trick added something unique to Williams’ trading approach that gave him an edge.

The Impact of the Trick

Even though we can’t pinpoint exactly what this secret trick was, we can certainly appreciate its impact. Williams’ journey from $10,000 to $1.1 million in just 12 months is nothing short of extraordinary. It demonstrates the efficacy of his Lw Volatility Breakout Strategy, the utility of the Donchian Channels Indicator, the value of the additional confirmation indicators, and, importantly, the potency of the secret trick.

The combination of these elements contributed to Williams’ success, but it’s likely the secret trick that tied it all together. It served as the unique factor that allowed him to optimize his strategy, making the most of the market volatility and maximizing his profits.

Uncovering Your Own Secret Trick

The fact that Williams had a secret trick suggests that successful trading isn’t just about following a set strategy or using specific tools. It’s also about personalizing your approach, tweaking it to align with your unique insights, perspectives, and strengths.

It’s about exploring beyond the beaten path, challenging conventional wisdom, and daring to do things differently. It’s about continuously learning, experimenting, and refining your methods until you find that special something that sets you apart.

In essence, every successful trader likely needs to find their own secret trick, their own secret sauce. While we may not know the specifics of Williams’ trick, his success serves as an inspiration for every trader to discover and hone their own.

Making Sense of The Strategy

The elements of Williams’ strategy – the Lw Volatility Breakout Strategy, the Donchian Channels Indicator, the two confirmation indicators, and the secret trick – might initially seem complex. But let’s break it down.

Consider this analogy: driving a car. The Lw Volatility Breakout Strategy is the vehicle that gets you from point A to point B. The Donchian Channels Indicator is your GPS, guiding you along the right route. The two confirmation indicators are your co-drivers, ensuring you’re on the right track. And the secret trick? That’s your turbo boost, giving you that extra burst of speed when you need it most.

Mastering The Williams Way

To follow in Williams’ footsteps, one must master his techniques. This involves not only understanding the Lw Volatility Breakout Strategy but also becoming proficient in using the Donchian Channels Indicator. Furthermore, understanding the value and role of the two additional confirmation indicators can help verify the robustness of your trading decisions.

This journey of mastery is not a quick one. It requires patience, determination, and an unyielding commitment to learning and understanding. It’s about delving deep into the mechanisms of the financial markets, dissecting each component of the strategy, and learning to wield these tools with precision and expertise.

The Million Dollar Question: Can You Do It Too?

Given Williams’ phenomenal success, it’s natural to wonder if his strategy can be replicated. Can anyone transform a $10,000 portfolio into a $1.1 million portfolio in a year?

The answer, while complex, is theoretically yes. It’s possible, but it’s not guaranteed. Every trader’s journey is unique, shaped by their knowledge, skills, and the market conditions they encounter. However, understanding and applying the strategies and techniques used by Williams can undoubtedly improve your trading skills and potentially lead to substantial financial gains.

Unlocking Your Trading Potential

Whether you’re a seasoned trader or a beginner, Williams’ approach offers valuable insights. His Lw Volatility Breakout Strategy, when combined with the Donchian Channels Indicator, additional confirmation indicators, and the secret trick, can unlock significant trading potential.

While the specifics of the secret trick remain a mystery, its existence points to the fact that successful trading isn’t just about using the right tools. It’s also about creativity, innovation, and the willingness to think outside the box. These are essential skills for any trader aspiring to reach the heights of success achieved by Williams.

The Verdict: Harnessing The Power Of Volatility

Larry Williams’ journey from $10,000 to $1.1 million is more than just a rags-to-riches tale. It’s a testament to the power of strategic trading and a demonstration of how volatility, often seen as a risk, can be harnessed for substantial financial gains.

While not everyone can replicate Williams’ success, the strategies and techniques he used can be learned and applied. Knowledge is power in the world of trading, and understanding the techniques used by successful traders like Williams can significantly enhance your trading skills.

So, whether you’re just starting your trading journey or looking to improve your skills, take these insights to heart. Learn from Williams’ strategies, apply them to your trades, and who knows? Your trading story could be the next one worth telling.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)