Grayscale Investments’ announcement that it is removing Avalanche from its Large Cap Fund portfolio has caused AVAX’s stock to plummet as of January 2023. The token dropped noticeably by 2% from the beginning of the month, when it was at $12.61, to conclude the month at $12.43. In this analysis, we’ll examine the potential causes of the decline and how volatility might affect the fundamentals of the token.

Effects in the Long Term of Being Removed from Grayscale’s Large Cap Fund

The Grayscale Large Cap Fund will no longer own Avalanche, according to a website announcement made by Grayscale on January 6. Many AVAX holders were taken aback by this news because it marked the first asset removal from the large-cap fund since the asset management juggernaut started it in 2015.

The main worry among AVAX owners is the removal’s potential long-term effects on the fundamentals of the coin. The token’s price is anticipated to decrease significantly in the short term as a result of its departure from the fund, but how much could it decrease in the long run?

Right now, it’s challenging to provide a clear answer to this topic. Grayscale’s move with AVAX, after all, is a declaration of mistrust in the token’s capacity to increase in value in the future, which may have an effect on investor mood in the short- and long-term.

Volatility of AVAX

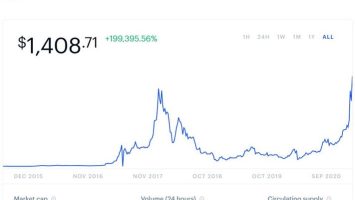

The influence of volatility is another significant issue worth taking into account given the significant price swings of AVAX over the previous several weeks. The token had enormous increases of more than 200% in the fourth quarter of 2020 before beginning to follow a more stable course in Q1 2021.

Most people interpret the token’s removal from Grayscale’s fund as a hint that the bull run is finally coming to an end as the market starts to realize its true potential. As a result, when investing in AVAX, investors should be cautious of large price swings and keep alert to potential hazards.

Conclusion

Grayscale’s decision to remove Avalanche from the Large Cap Fund has caused AVAX to experience a modest decline this month. Although it is now difficult to determine the long-term effects of this occurrence, it is evident that the market’s enthusiasm for AVAX has been subdued, and volatility may be a crucial consideration for investors considering to purchase this token. While a result, as the market continues to respond to the news, investors should be cautious of the dangers associated with investing in AVAX.

FAQs

Positive market sentiment, increasing demand for AVAX tokens, and other market conditions may have contributed to the price gain.

Any cryptocurrency investment includes risk. All investments have risk, and the value of your investment might both increase and decrease. Before investing in any cryptocurrency, you should conduct your own research and consult with a financial professional.

You should take into account the present and anticipated market circumstances, company news and press releases, technical analysis, and any other variables that could affect the price. Additionally, you shoukd be aware of the possibility of price manipulation and other potential hazards connected with trading cryptocurrencies.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)